Wednesday, April 05, 2006

Market-Basket of Homes: Values up 1.97% in March

The month's activity was actually stronger than the raw numbers indicate, with many homes selling at or above list price. A few deeply-discounted properties pulled down the average, but average discounting netted out to only 1.37%, down from 1.42% in February.

A total of 189 Market-Basket homes were sold in March, up from 145 in February. As noted in January and February, the early months of 2006 very strongly resemble the first quarter of 2004. The one significant difference is that overall inventories are substantially higher. For example, there are now 1,209 homes available for sale in the Market-Basket, which would imply an absorption rate of 6.4 months. A six-month absorption rate is considered normal.

"If the Spring selling season is everything it should be," said BloodhoundRealty.com Broker Greg Swann, "then we have no problem. Right now there seem to be a lot more sellers than buyers, and the religious holidays in April could slow things down. But if the market heats up with the weather, we should be fine."

Based on the idea of the Consumer Price Index market-basket of goods and services, the Market-Basket of Homes uses average sales prices for a small subset of all Valley home sales to get a clearer idea of what is happening in the middle of the bell curve. The alternative method, striking a median among all closed transactions, introduces too many extraneous factors to provide a reliable indicator of what is happening to prices for those homes that are most avidly desired by the greatest number of people. To that end, the Market-Basket of Homes looks at sales prices for MLS-listed suburban homes from 1300sf to 1900sf built in 1998 or later, the homes that drive the resale market.

The BloodhoundRealty.com Market-Basket of Homes is updated monthly and is always available at http://www.BloodhoundRealty.com/MarketBasket.pdf

posted by Greg Swann | 8:11 AM | 0 comments | links

Monday, April 03, 2006

Question: How do you see the market now?Fulton also points out that builders were lying in 2004 when they named their reasons, dutifully transcribed by the Republic, for excluding investors from new home subdivisions:

Answer: This is just a small correction that needed to happen. The velocity (of sales), the appreciation of the homes, was not sustainable. Last year was a complete anomaly. It's not normal. You can't compare last year to anything. When people say, "Gee, last February there were 4,600 houses on the MLS (Multiple Listing Service) and this March, there's 36,000," you're just comparing apples and oranges. It's a different marketplace. Completely.

Q: Isn't that how you typically compare, looking at last year?

A: Go to '04. Go to '03. You'll see that there were 30,000-plus in the same time frame.

Q: Why is that? Supposedly, the home builders weeded out all the investors.

A: Not until probably August, September of '05. We started doing it because we saw what happened in Las Vegas in the investor market, which was people closing on their homes and competing with the still-open model home complex and undercutting you by $10,000 and still making tons of money. . . . We were creating our own feeding frenzy. People were standing in line because of the increases. If you slowed down your increases, it slowed down sales. Tell me that isn't scary. . . . The key wasn't so much the overall price as much as the increasing price. . . . Some people thought the price increases would never stop.

posted by Greg Swann | 6:53 AM | 0 comments | links

Sunday, April 02, 2006

Sating the State's OPM addiction...

Answer: Put your hand on your wallet. A brand new campaign of larceny has begun...

Never is heard a discouraging word, it goes without saying. This is propaganda, not news. I could name dozens of reasons why this is a poor idea, but what would be the point? Arizona is by now nothing but an echo chamber. When it comes to the palpable stench of corruption, we hear only from people with no sense of smell...

posted by Greg Swann | 10:12 AM | 0 comments | links

Tuesday, March 21, 2006

Properly belaboring the obvious takes time...

Today, March 21st, Dr. Jay Butler of ASU's Center for the Extended Belaborment of the Obvious, finally arrives at the same conclusion, even though the trend has been obvious since the end of January. Properly belaboring the obvious takes time, after all.

Dr. Butler also released his calcuations on median home values for the month of February, up for the month, surprisingly enough, and a net positive for the year-to-date.

posted by Greg Swann | 2:41 PM | 0 comments | links

Sunday, March 19, 2006

Valley resales figures for February are due out this week. And early analysis from Arizona State University's Real Estate Center shows the median price might have dipped slightly again.Might have dipped? Readers here have known since March 3rd that prices were down in February. As we reported last week, values are up for the month of March so far and for 2006 year-to-date. However: Around half of all residential real estate transactions close in the last ten days of the month. The numbers have been volatile so far, and we still could end the month on a down note. Days on Market is keeping pace with February, so far, at an average of 57 days. A total of 97 transactions have closed so far. This information is current as of 6:45am Sunday, when no one at either ASU or the Republic is working.

In January the median price of all resales was $257,000. They hit a high of $263,000 in September.

It's important to remember that both our analysis and ASU's are trailing indicators. The houses that close in March will have gone under contract in February and before, for the most part. In consequence, while reports of past results offer a general guide to the health of the real estate market, they don't tell us very much about what is happening right now. Of course, the relative lack of utility of the numbers is substantially enhanced by ASU's dilatory habits, but you can always turn to the BloodhoundRealty.com Market-Basket of Homes for a better, much earlier snapshot of the marketplace.

posted by Greg Swann | 6:44 AM | 0 comments | links

Friday, March 03, 2006

"Home values are down for the second month in a row in the February 2006 BloodhoundRealty.com Market-Basket of Homes. Average sales prices dropped by 1.14%, just under $3,000, from $263,638 to $260,645.

The weakness was felt mostly at the higher end of the price range. While a few homes sold for discounts from $10,000 to $30,000, compared to list price, many moderately priced homes sold for above list price. Discounting overall averaged -1.42%.

A total of 145 of the homes Bloodhound tracks were sold in February. This is down from February 2005, when 254 homes sold. But it is up from February 2004, when 137 homes were sold. The homes averaged 58 days on market in February 2006, 17 days in February 2005 and 56 days in February 2004.

Said BloodhoundRealty.com Broker Greg Swann, 'While the media never tire of telling us that 2006 is not like 2005, which is obvious, it turns out that 2006 very strongly resembles the beginning of 2004, which was a completely normal real estate market.'

In the overall Arizona Regional Multiple Listing Service, 6,168 properties sold in February of 2004 in an average of 61 days on market with an average of -2.4% discounting. In February of 2006, 5,868 properties sold in an average of 56 days on market with an average of -2.4% discounting.

'The real test,' Swann said, 'will be March, April and May, the traditional selling season. If those months are healthy, we'll have a great year despite getting off to a slow start.'"

posted by Greg Swann | 9:18 AM | 0 comments | links

Wednesday, March 01, 2006

• 1950: Phoenix covered an area of 17.1 square miles, had a population of 106,000 residents and was the 99th-largest American city.In a word: Wow...

• 2006: Phoenix spans across more than 514 square miles, has a population of more than 1.4 million residents and is the sixth-largest city in the country.

posted by Greg Swann | 7:27 AM | 0 comments | links

Sunday, February 26, 2006

An open letter to the Citizens of Phoenix: Why I oppose the bonds

This little datum actually tells you all you need to know about the bond campaign: In large measure, it is welfare for the rich.

I'm not playing a class-envy card. I despise welfare in all its forms. I can sympathize with the plight of the poor, and I can even volunteer my time and my money to help them. But I think it is vile to use force to steal wealth from honest, innocent producers in order to confer it upon people who have not earned it. But if this is vicious and wrong when done for benefit of the poor, how much worse is it when the recipients are among the wealthiest of the city's residents?

The actual purpose of the bond issue - and of the Trolley and of the recidivist reconstruction of the Civic Center and of all the other so-called 'investments' downtown - is to provide free upscale amenities for the use and enjoyment of rich Phoenicians and their out-of-town visitors. There are miserly little bribes to other constituencies beneath the vast Christmas tree of bond programs, but the overwhelming amount of money will be spent to amuse and enrich people who are already laughing all the way to the bank.

Almost a year ago, I wrote about how these corrupt 'investments' are carefully target-marketed to the most corruptible kind of investors. And this is the first and biggest benefit to the rich of the bond issues: The bonds themselves. They will be underwritten by a politically-connected investment firm, and they will be purchased by politically-wired investors. Even though the city's property tax receipts will surge this year, making it possible to pay for any improvements that are actually needed out of the general budget, we will still issue bonds, paying massive amounts of interest over the years to people who are already very, very wealthy.

But Christmas will come twice for prosperous Phoenicians. Take a drive by the Herberger Theater some night. It's a colossal failure as a theatre, but it's an excellent place for rich matrons to show off their thousand-dollar gowns. When you look at your property tax bill - which is probably up 25% or more - take solace that you'll be subsidizing the Herberger to the tune of $16.7 million - plus tens of millions more in interest.

There's money for the Arizona Opera, another outrageous failure, and for the zoo and the art museum and for Phoenix Theatre - because you can't have too many under-attended taxpayer-subsidized theater companies.

Add to this all the money to be blown building downtown campuses for Arizona State University and the University of Arizona. These are completely redundant facilities, of course. What's worse, the state's universities are actually the responsibility of the state government - which is running a billion-dollar surplus. But why should the state pay when the city of Phoenix is willing to milk its own taxpayers in the state's behalf?

But why should the taxpayers of Phoenix strap themselves with $878.5 million in debt, plus as much as $2 billion more in interest over the years, to build these campuses? For the same reason the taxpayers were saddled with the costs of every other 'investment' downtown: In order to provide free upscale amenities for the rich.

It gets better, though: The city hopes that, this time, it will achieve critical mass downtown. It is hoped that by coercing thousands of students to live in downtown Phoenix - won't their parents love that? - the central core of the city will finally come to life, an ungainly, undead Frankenstein stuffed full of tax dollars.

Incidentally, this is why the Trolley runs to ASU. The greatest concentrations of adult bus passengers in the city are in Sunnyslope and South Phoenix. A transit system designed to move the greatest number of passengers would run straight down Central Avenue from Dunlap Road to Baseline Road. But we can't have that. For one thing, that would run the Trolley right past all those gorgeous multi-million-dollar homes, each one sporting a "Support the Bonds" sign. For another, by forcing ASU students to come downtown, then sending them back to Tempe at least once a day for their core-curriculum classes, the Trolley will seem to be working, even though, by Valley Metro's own estimates, it will be yet another colossal failure, with the taxpayers paying huge subsidies for each rider - and even bigger subsidies for each ASU student on the train. But those students will be young, attractive and nice-smelling, which will be very pleasing to all the wealthy residents and their guests, who may ride the Trolley on a lark, but who will never use it for day-to-day transportation.

Incidentally yet again, the Trolley and everything that goes with it are buttressed by a Transit-Oriented Development zoning overlay. Small business-people all along the route of the Trolley are slowly discovering that one of the purposes of Trolley construction is to kill their businesses. As profitable as those businesses might have been, and as popular with their clients, they are not pretty enough to appeal to the sensibilities of Yuppies, the Bohemian Bourgeoisie and the avidly-courted Creative Class. The Trolley's construction will bankrupt the small firms that had done business along its route, and the Transit-Oriented Development zoning overlay will forbid anything similar from replacing them. This is in essence a hidden tax enacted by these so-called 'investments', the deliberate destruction of profit-making businesses - along with an epidemic confiscation of taxable commercial real estate.

And incidentally one more time, downtown Phoenix will never work. It will always be a colossal failure, soaking up tax dollars to subsidize the existing 'investments' and to fund ever-newer boondoggles, each one of which will be promoted as the final answer to all the problems downtown, each one of which will fail in its turn, soaking up tax subsidies forever. The downtowns of the cities we think of as having a downtown - cities like New York or San Francisco, London or Rome - the central cores of those cities developed when transportation was very costly. A city like Phoenix, which developed when transportation was cheap and progressively cheaper, can never have that kind of throbbing, vibrant, population-packed downtown. Never. No matter how much money we throw away on the Trolley or the Civic Center or the chimerical bio-medical bonanza.

Here are some secrets you will never see reported anywhere: Every city in America with a chip on its shoulder is building that paragon of 19th century technology, a Trolley system. Every city with something to prove is building and rebuilding and rebuilding a vast, empty convention center. Every city with an inferiority complex plans to buy its way to greatness by throwing billions of dollars in corporate welfare at the biotech industry - since, as we all know, the most consistently successful venture capitalists are politicians and newspaper columnists. Phoenix is not innovative in any way, not even in its choices of doomed downtown 'investments'.

A self-selected minority of people may long for life in a make-believe-Manhattan, but, in reality, there will never be a dense-enough concentration of them to yield even a chintz-Cincinnati. The closest thing there is in Phoenix to an actual downtown - a walkable concentration of high-commerce, retail and residential skyscrapers - is the area around the Biltmore Fashion Square. The city is doing what it can to destroy this, to protect its futile vision downtown. But even more urban than the Biltmore is downtown Tempe, a pretend-Paris the Phoenix City Council is having a harder time trying to vanquish - although it is trying.

And there's more. All of this, the giveaways to the very wealthy, the redundant college campuses, the destruction of existing businesses, the war on non-taxpayer-subsidized vertical development in other locations - even the improvements to the sewers and fire stations, the true business of city government - all of it will entail the letting of thousands of lucrative contracts to politically-favored developers, vendors, attorneys, consultants - an endless soup-line of mendicants in $900 suits. Where do those folks live? Amazingly enough, they live in the same neighborhoods where you see all the little "Support the Bonds" signs. The neighborhoods where the Trolley will never run. The neighborhoods where the bus-stops - if any - have no overhead shelters.

Bond supporters are ready with talking points for every objection an opponent might raise. No tax increase, 700 participants, the sacred deity that is public education, blah, blah, blah. None of that matters. Every proper function of city government can be more than adequately funded from the impending property tax windfall. The city has no business building colleges or subsidizing the diversions of millionaires. Of course, if the bonds fail, this will be offered as the reason why downtown failed. Take heart: Downtown will fail anyway, and the downtown boondogglers will never admit it. Why should they? It's making them rich.

"Cui bono?," the Roman poet Juvenal asks? Who benefits? As Thoreau reminds us: "That government is best which governs least." The absolute best thing the City Council can do for you and for the city is to get out of your way - and out of your wallet. But who will benefit from this billion-dollar bond boondoggle? If you have to look at your bank balance before you write a check, it isn't you.

I voted by mail, so I've already voted "No" on all seven bond proposals. I encourage you to do the same.

posted by Greg Swann | 10:20 AM | 0 comments | links

Saturday, February 25, 2006

One year of experience eleven times...?

Bad news for the many homeowners trying to sell: It's likely only going to get tougher.The source for this is probably an article by Betty Beard, who is actually a responsible journalist. Witness:

The number of home listings in metro Phoenix is at an all-time high. In January, there were 30,113 houses for sale across the Valley. A year ago, there were 3,402.

The last time the Southeast Valley had listings in the 10,000 range was in late 2002 and early 2003, according to the Arizona Regional Multiple Listing Service Inc.You see, like seemingly no one else at the Republic, Betty Beard is aware that there were years prior to the completely anomalous 2005. Here's more from Ms. Beard:

Robert Rucker, the multiple listing service's chief executive officer, said he couldn't determine that 11,512 is a record because the records are not set up easily to compute that.It may be that Ms. Reagor has a source for her claim that the current inventory is a record, but she doesn't say who it might be. In any case, since a normal inventory prior to the completely anomalous 2005 was around 25,000 homes, and since we've built tens of thousands of new homes since then, it would be very difficult to say what is by now a normal market. The NAR's standard for normal, a six-month absorption rate, is substantially longer than what we're seeing locally.

More from Ms. Reagor:

Some sellers still don't realize the housing market has deflated from last year's peak. Not only are the bidding wars gone but so, too, are many of the buyers. Most of the speculators who sparked multiple offers on homes early last year are long gone, and there aren't as many regular buyers because fewer can afford today's higher home prices. The typical house costs 50 percent more, and the typical income climbed less than 5 percent in the past year.In January 2004, 5,103 MLS-listed properties sold in an average of 67 days on market at 97.7% of the list price, on average. In January 2006, 5,252 properties sold in an average of 50 days on market at 97.7% of the list price, on average. The paragraph is mostly editorializing, but the claims about the market are easily demonstrated to be false to fact.

Want a reality check? Go to zillow.com, a new Web site with a program that calculates a home's value for free. It values several Valley homes for tens of thousands less than the price listed on them.If you want to know what your house is worth, do not go to a zillow.com, which delivers completely useless estimates of value for free. Even Net Value Central, a tool used by professionals, lags the market by a month or more. The only way to price a house is to work as rigorously as possible from current and recently-sold listings for extremely similar properties. If you price your house to sell from sources like zillow.com, you will give thousands of dollars away. If you rely on zillow.com to tell you how much to offer on a home, you will see it sold to someone else.

(You can prove all this to your own satisfaction, if you like. Most of Ms. Reagor's mistakes seem to come from falling in love with ideas she doesn't check out. Here she tells us that she ran zillow.com on live listings and found it came in much lower than the listed prices. How did it do against sold listings? She didn't check, but you can. Run zillow.com on the sold homes documented in your local section of the Republic. You'll see that, time after time, zillow.com is substantially under real-life market results. It's a useless toy, which Ms. Reagor might have discovered on her own had she bothered to test it properly.)

It gets better, believe it or not:

Any Valley homeowner with a good crystal ball would have sold last summer and rented until now to be able to take advantage of all the deals out there.It's no kindness to lie to a fool: This is stupid. The average suburban home that you might have sold for $252,000 last July would have cost you more than $263,000 in January, not counting transaction and closing costs and the costs of renting a home and moving twice. The home prices are all rigorously documented, and I've pointed Ms. Reagor to the source data more than once.

I didn't, but I wish I had.It's because she's bad at arithmetic.

Who would have guessed home prices would climb 50 percent in a year?I did. I actually predicted higher and longer, but events haven't borne me out so far.

And who knows where they are headed?In the long run, up. It's not a lead-pipe cinch, but it's a great bet for the Phoenix market. We are an excellent fit for many, many monied demographic segments.

Analyst forecasts run the gamut from prices dipping 10 percent this year to climbing 10 percent.I have not heard a single prediction about values dropping for the year. If Ms. Reagor has a source for this claim, she should name it.

Everything Catherine Reagor said in the matter I quoted is dumb. In the next segment of her column, she wonders why homeowners aren't facing foreclosure. Seemingly, the question "Who would have guessed home prices would climb 50 percent in a year?" doesn't connect in her mind to the idea that even the most financially-troubled of homeowners is sitting on a ton of equity. Because the Republic has become such a cesspit of corruption, it's hard to distinguish stupidity from calculation. With a writer as oily as Jon Talton, the malice is palpable and you know the man is lying in pursuit of propaganda goals. But I don't like to think the worst of people where a more innocent explanation will suffice. In email to me, Ms. Reagor has bragged that she has eleven years' experience "covering real estate in metro [P]hoenix". I'm thinking maybe she's had one year of experience eleven times.

posted by Greg Swann | 11:30 PM | 0 comments | links

Monday, February 20, 2006

posted by Greg Swann | 4:30 PM | 0 comments | links

An open letter to Catherine Reagor and Glen Creno of the Arizona Republic

Second, I would dearly love it if both of you would bring some perspective to your writing. For example, from Catherine's new column:

What this year holds is the multibillion-dollar question. A 10 percent drop in home building or sales would cost the Valley's economy at least $1 billion.There are two important caveats missing from this conjecture. First, we are more likely to gain 10% in value this year than to lose it. Las Vegas had a 50% upswing in 2004, very much like our year last year. Their appreciation in 2005? An incredible 19.2%, four times their normal appreciation.

I doubt Phoenix will do this well, especially since the year has started down, with a serious dearth of buyers. But Catherine's worst-case scenario seems even less likely. But even if we entertain it, what are the consequences?

If I bought a home for $300,000 in January of 2005 (which I actually did do), and if that home is worth $450,000 in January of 2006, and if the market now suffers a "ten percent drop," what happens? My home would then be worth $405,000, $105,000 more than I paid for it. I put 5% down, so my cash-on-cash return after what Catherine seems to regard as a financial cataclysm would be--how much? Jeepers, it's only 700%. A ten percent drop in values would not be good, but after the surge we've had over the last 18 months, it would hardly be tragic, and most people would still be far head of where they were before this boom began.

The "would cost the Valley's economy" argument is also specious except as a bookkeeping analysis. A homeowner's equity isn't actually gained or lost until it is liquidated. If values drop by 10% this year and gain 6% a year for the next three years, none of it matters until the homeowner either sells or refinances. A drop in values might matter to builders' shareholders, and it would matter to homeowners if their notes were to be called by their lenders, but otherwise it's all academic. Without doubt, someone will claim that because his home lost 10% of its value, he now eats oatmeal for every meal, but this will not be true--not the whole truth in any case. A paper loss against paper profits will have few if any measurable real-world consequences, sob stories notwithstanding.

In the same respect, Glen, I've chided you for reacting to the market like Austin Powers with The Mole. Both of you are persistently guilty of this, and I think you are being less than forthcoming in not putting your reports into perspective. Yes, 2006 isn't starting like 2005 did. But if we acknowledge that 2005 was an anomaly--which is what makes the stories newsworthy--then what is actually important is that 2006 seems to be off to a better start than 2004.

Omitting this essential fact is either tendentious or puerile, I can't decide which.

I really can't decide which. The Republic has become such a translucent propaganda organ, it is by now hard to tell when the paper is actively campaigning for some covert purpose of its own, and when it is merely badly informed or poorly thought out.

Your Saturday article was actually funny, and not just because we caught another sighting of The Mole:

The number of existing homes for sale has shot up from a year ago. Home prices are flat or down slightly in most areas. And in January, used-home sales were half of what they were in August, a record month.Again, January 2006 was a much better month than January 2004. And we all can see the mole on The Mole.

As a side note, I'd love to hear how it could be that investors "snatched up three or four new homes at time a year ago" when they were forbidden to buy any new homes. The Republic printed the builders' propaganda line when they trotted it out, and I told you at the time that it was propaganda. I don't believe in proof by isolated anecdote, but can you name even one investor who successfully reserved an unbuilt home last year and has walked away from it now? As R.L. Brown points out to you, the return on investment would be huge--a $2,000 deposit turns into maybe ten or twenty times that in instant equity. Why would an investor leave that kind of money on the table?

But I'm more interested in this remark by the estimable Dr. Jay Butler:

Just look at all the ads.Indeed. Look at the ads, the other white meat in the newspaper.

An incentive is not a fire sale, it's an enticement to induce the buyer to do what he otherwise might not do. In many cases, the incentive is just icing on the cake, since the buyer was already committed. Are builder incentives working? Call and ask. But in fact, incentives are not news. I started hearing about them in September of 2005. This is also when builders resumed courting Realtors--and boosting commissions by double or triple what they had been paying.

Note, however, that investors are still excluded from most new home subdivisions, as least as a matter of stated policy. What this suggests is that the builders themselves do not regard the current market as being as soft as it was in 2004, when the investor policy was all-you-can-eat. In other words, the no-investors rule argues that builders believe they can sell all the inventory they intend to build as high-profit, highly-upgraded owner-occupied housing. They do not need to sell excess to-be-built inventory as low-profit, upgrade-free models to investors.

All of which brings me to my own little bit of news: I had a very busy weekend, which is good for me. But I saw more showing activity among other parties than I've seen so far this year. My joke last year was, if you lingered in a doorway you'd be trampled by the next party of buyers. Saturday was the first day this year when I have seen anything like that. Quite a few Realtors' business cards in newly-listed properties, too, which is also a good sign.

This is nothing more than the kind of isolated anecdote I hate to see reported as real estate news, but it is one data point of actual on-the-ground evidence. If next weekend is just as hot, it will be a strong sign that the drought of buyers is over.

And, all that by the way, I encourage you both to call upon me if you have questions about how real estate works in real life. Someone once told me that I am "rather glaring on the receiving end," which I thought was an exceptionally polite way of putting things, but it remains that I can give you a perspective on what is really going on, short- and long-term, that you are not getting anywhere else. At a minimum, if you let me do your math problems for you, I won't make fun of you for getting them wrong.

Very best,

Greg Swann

posted by Greg Swann | 6:10 AM | 0 comments | links

Wednesday, February 08, 2006

How to make headlines by ignoring the news...

An example:

The number of houses for sale in metro Phoenix has nearly tripled in the past year, based on December data from the Arizona Regional Multiple Listing Service.This is simply irresponsible. The inventory of available homes last year was abnormally low. There are about 30,000 active listings right now. Two years ago, I would have said that 25,000 listings is a normal market. We've built 120,000 new houses since then, plus we went through last year's boom. I don't know what a normal market is now, and I may not have a clear idea for months. But to say "tripled" without saying anything about "normal" is just sensationalism.

Creno offers some loose conjectural reasons why inventories are up, but he fails to cite the incessant scare-mongering of the Arizona Republic.

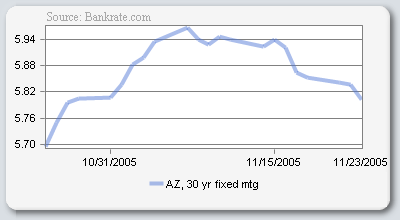

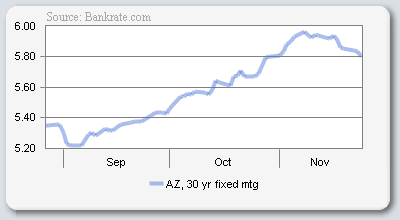

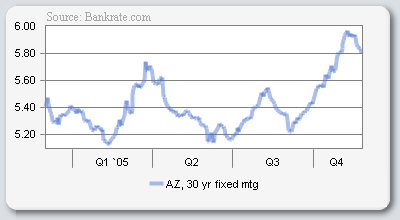

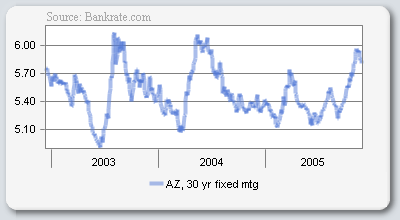

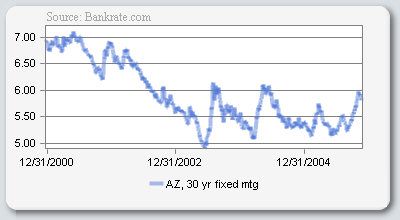

However, "Mortgage rates have nudged higher," he says, another reckless claim the media never tires of making. Every time you read something about rising mortgage rates, click on this link. I wish I had a chart for ten or twenty years instead of just five. Mortgage rates are amazingly low and mortgage lenders make their money by writing loans. They have an incentive to keep new-loan-origination activity high. Other factors influence rates--but not so much, as Alan Greenspan discovered in 13 failed tries to influence them--but it is not unreasonable to expect them to stay low and possibly go even lower. That nothwithstanding, if you saw a chart of mortgage rates over the last 35 years, you'd gape in horror. Even so, people continued to buy and sell houses even when rates were over 20%.

Dr. Jay Butler, who apparently keeps his head where he can best monitor his gut feelings, weighs in with this profound scientific observation: "If prices and rates move up, we're in deep trouble." Oh, my.

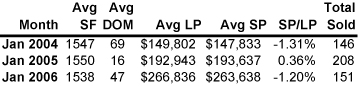

Here's the real truth, which Dr. Butler could have given Creno were he not so devoted to undefended off-the-cuff remarks:

Those are the numbers for the last three Januaries from the BloodhoundRealty.com Market-Basket of Homes. January of 2005 was a banner month, to be sure. But compare January of 2006 to January of 2004. January of 2004 was worse by every measure: Fewer homes sold at a higher rate of discounting with 22 more days on market, on average.

Whether we are really back to normal is a question I'm not prepared to answer until March or April, but our current real estate market is better than it was at a time when the Republic was not running scary stories about how bad everything is.

This is the actual news.

posted by Greg Swann | 7:35 AM | 0 comments | links

Friday, February 03, 2006

Despite not even being among the 10 most populated areas in the country, metropolitan Phoenix led the nation in absolute job gains from December 2004 to December 2005.

The seasonally unadjusted figures from the federal Bureau of Labor Statistics confirm the Valley's status as a growth market not only for new residents but for new jobs as well.

The region added 83,200 jobs to its economy over the year, topping the Washington, D.C., metropolitan area's 81,600 jobs.

Somewhat remarkably, the Census Bureau reported last year that metropolitan Phoenix was only the 14th most populous metropolitan area in 2003, while metropolitan D.C. was the 7th-largest region.

That means the Phoenix region created more new jobs than even such metropolitan goliaths as Los Angeles, New York and Chicago.

"We've actually done incredibly well since the end of the last recession," said Tracy Clark, an economist at Arizona State University. "In percentage terms, we tend to be behind only Las Vegas, but they have a much smaller base."

posted by Greg Swann | 6:24 AM | 0 comments | links

Saturday, January 28, 2006

Surfing a twenty-year wave in the desert

For the next 20 years, some of the weightiest issues for home builders will be figuring out where baby boomers really want to move, when and if they sell their homes, and what type of housing will they desire, be it city-center high-rise condo, beach house, or something in a golf course development.

With more than 70 million boomers heading toward retirement -- the oldest of them turn 60 this year -- these questions were prominent at the National Association of Home Builders' annual conference, which wrapped up on Jan. 14.

Though consumer survey research has shown for decades that homeowners in their 40s and 50s often have no detailed plans to downsize or sell their houses, a new statistical study unveiled at the convention suggests that boomers might have different ideas.

In the study, more than 50 percent of all homeowners ages 45 to 54, and nearly 60 percent of homeowners aged 55 to 64, rated themselves either "likely" or "very likely" to buy a vacation, investment or new primary home sometime in the coming 60 months.

posted by Greg Swann | 7:32 AM | 0 comments | links

Thursday, January 26, 2006

Look who's talking, Part II: Revenge of The Shiny People

The trolley is killing long-established businesses up and down its route, and the green-cheese-heads who inflicted it on us, along with all the other doomed Downtown 'investments,' don't dare admit this and dozens of other obvious truths. They use Soviet-style propaganda to afflict us with Soviet-style 'improvements.'The other shoe dropped today. That same Republic editorial page that warned you all about liars this Sunday just past, today issues the very lies I predicted:

The next step in the game will be to plead with you to go out of your way to 'support' the businesses that are nope-no-way-uh-uh-never not being hurt by trolley construction. And that is propaganda perfection, Soviet-style, to tell two self-contradicting lies in one moondacious exhortation, challenging you--on pain of being declared a counter-revolutionary wrecker--to question anything you are told.

Phoenix can survive Jon Talton, as odious as he is. And we will overcome the stupid mistakes of the moondacious green-cheese-heads Downtown. But I'm not sure that any good thing can thrive in a place where public discourse consists of nothing but lies, and where anyone who dares to whisper the truth is shouted down and, in then end, self-censored.

Businesses along the construction route bear the brunt of a program that will benefit the Valley for decades to come. All of us should appreciate their sacrifice through these challenging times.Their "sacrifice" will be to be destroyed. The actual purpose of all of this massive destruction of wealth is to provide upscale amenities for the people talk-radio host Bob Mohan used to call The Shiny People. The downscale businesses in the path of the Trolley will not survive, nor are they meant to survive.

This is important to understand, because again it's the seen and the unseen. The planned "improvements" around which the Trolley is the lynch-pin will not be nearly as nice as predicted, but they will be very nice, especially from the point of view of The Shiny People. But their cost will be a huge, permanent and on-going destruction of wealth, robbing the Valley of everything that might have been done with the expropriated land and money, of all the opportunity costs occasioned by that expropriation, and of all the leveraged future benefits of profit-making investments, as contrasted with the on-going wealth-destruction of profit-devouring government boondoggles.

What will be seen will be all the fun new places for rich people to play – at taxpayer expense. What will not be seen is all the wealth-producing businesses that were destroyed, nor the wealth-producing investments that might have been built instead, if the City had not robbed it citizens of their money, their land and the future taxable value of that land.

An honest newspaper would at least report both sides of this story. But as the Republic itself admits:

[O]nce truth becomes malleable, once lies become facts and facts become lies, then we make ourselves suckers for every con man, every flimflam artist, every propagandist whose schemes may range from petty theft to the takeover of an entire body politic.When we finally think to ask, "Who crashed the Phoenix?," the best answer will be: The Arizona Republic.

posted by Greg Swann | 9:37 AM | 0 comments | links

Wednesday, January 25, 2006

City officials are negotiating with a St. Louis-based company that wants to build a $22 million parking garage on the eastern edge of downtown.What it says, reading between the lines, is this: Free land for a profit-making parking structure.

The six-level structure would be on city-owned land on the Phoenix Biomedical Campus, near Fifth and Van Buren streets.

But wait. There more.

The garage would contain about 860 parking spaces, including two levels below ground, plus 18,400 square feet of medical office space and about 5,600 square feet of retail space.It turns out it's free land for a profit-making parking structure plus 24,000sf of profit-making commercial real estate.

The land will be untaxed, of course. It's City-owned.

But here's the cutest part of all:

The Transit Oriented Development zoning overlay would forbid this if it were being done on private land with private money.

The full triumph of corruption comes when uncorrupted commerce becomes impossible...

posted by Greg Swann | 7:40 AM | 0 comments | links

Funny thing about "knowledge workers": They don't like to drive.This is so cute. The taxpayer subsidy on the Trolley will be $10 per trip, possibly much more. So the subsidy per "knowledge worker" – these would be the same "knowledge workers" who buy all the insanely expensive sports cars? – will be something like $20 per work day, $100 per work week, $5,000 per year.

That's one of the reasons Thomas Gorny decided on a site along the future light-rail line when he relocated his Web-hosting business to Phoenix from Santa Monica, Calif., late last year.

"I found that a lot of developers and IT people don't like to drive," said Gorny, chief executive officer of iPowerWeb Inc.

He hasn't plumbed his employees' psyches to understand why, but he estimates 20 percent of his 120 workers carpool, take the bus or bike to work, anything to avoid the car commute.

When rail opens in late 2008, Gorny figures he'll be perfectly positioned at 919 E. Jefferson St. to use the rail as a perk for his transit-loving staff.

Why wouldn't Gorny be glad? He's getting up to $5,000 per employee in benefits, paid for by the gullible taxpayers of Phoenix.

The City is destroying an immense amount of wealth. It's not just the billions in tax dollars that will be thrown away building and operating this paragon of 19th Century technology. Vast tracts of land Downtown have been expropriated, as has the entire south side of Camelback Road from 19th Avenue to Central Avenue. This was all taxable commercial real estate, and its taxable value is now gone forever. Still worse, its value as space where profits are produced by production, not destroyed by taxation, is gone forever. Profit-seeking small businesses are perishing all along the route of the Trolley as construction makes them inaccessible.

But all we get from the local media – and not just the Republic – is propaganda. If we had just one actual newspaper in this town, we might have been spared the slow-motion train wreck the Trolley and its attendant boondoggles will cause.

posted by Greg Swann | 7:15 AM | 0 comments | links

The AAA travel and financial services club will locate up to 1,100 new jobs over the next three years in Glendale as it creates a regional customer service and information technology center in the West Valley.Sounds like good news, doesn't it? Not quite...

Roughly 500 of the jobs are considered "high-wage" positions, paying more than $75,000 a year, said Barry Broome, chief executive of Greater Phoenix Economic Council, which helped broker the deal. Up to half of the jobs would be call-center positions that would pay less than Maricopa County's median household income of $46,111.

When fully staffed, the facility will employ up to 1,400, according to AAA, and will be one of the city's largest employers.

City Council members will hold a special meeting Thursday to discuss, and likely accept, the 10-year incentive package the city is offering AAA. Glendale is offering to:That $1,200 subsidy per job doesn't sound like much, but about 700 of the jobs will qualify for it. That's $840,000 of the taxpayers' money to buy these jobs. Given that it's a "10-year incentive package", I'm wondering if it's $840,000 per year. Throw in another three-quarters of a million for redecorating and some miscellaneous regulatory relief, and the owners of AAA – a profit-making enterprise – brought home quite a score.

• Give AAA $1,200 for every job the company creates that pays more than $50,000.

• Reimburse the company up to $750,000 for facility rehabilitation and waive permit fees up to $49,700.

"But, but, but!," the City of Glendale and the Greater Phoenix Economic Council will exposulate:

The project is expected to pump $42 million into Glendale's economy over 10 years.As always, it's the seen and the unseen. Whether the total price tag is $1.6 million or $9.1 million, it remains that the City of Glendale is going out of pocket to buy jobs. Certainly those jobs have an economic benefit, but we can never know what economic benefits are lost by robbing a profit-producing Peter to pay corporate welfare to a profit-devouring Paul. All we can know is that what might have happened will not.

Here's a simple lens for distinguishing one from the other, though:

The businesses that do best for everyone – their clients, their employees and their investors – are the ones that are so busy making money that they don't have time to wrangle deals to rob the taxpayers.

posted by Greg Swann | 6:54 AM | 0 comments

Sunday, January 22, 2006

Because once truth becomes malleable, once lies become facts and facts become lies, then we make ourselves suckers for every con man, every flimflam artist, every propagandist whose schemes may range from petty theft to the takeover of an entire body politic.You see, if we're not careful, we could end up with a newspaper that actively campaigns for insane boondoggles, that puts an openly lying socialist on its business and editorial pages, that distorts the positions of anyone daring to oppose it.

This is a free country - for now. The Republic has every right to campaign for every possible form of idiotic, liberty-devouring 19th century social planning. It has every right to be the cesspit of tendentious corruption it has become. The press is free, so it even has the right to pretend to a virtue it has long since forsaken by decrying in others the persitent deception it has long since habituated - most especially on its editorial pages.

But it has no right to expect anyone to take it seriously...

posted by Greg Swann | 6:25 AM | 0 comments | links

Sunday, January 15, 2006

How to profit by bad examples...

Witness:

Kurt Nishimura is taking a calculated ride on Arizona's real estate wave. He sold his home in the Willo neighborhood, believing its value has topped out, and is renting an apartment in the Arcadia area for a year, hoping to buy something after the wave has crested.The Willo is the most popular of the historic districts downtown. Well-restored Willo homes are avidly sought. People cruise the streets slowly, watching for real estate signs to be posted so they can get their bids in first. I am not making this up.

The rate of appreciation in the Willo consistently eclipses the baseline appreciation rate for the Valley. It's not hard to understand why: The supply is fixed and finite and the demand is unlimited. The rest of Mr. Nishimura strategy is also daft, but selling a home in the Willo because he expects its value to go down is particularly addle-pated.

But how about Tom Connelly, "president and chief investment officer for Versant Capital Management"? He "recently sold his house near a mountain preserve in Paradise Valley and is renting an apartment near 24th Street and Camelback Road." What was he thinking? This again is a house that will consistently beat the market. Connelly has a strategy, though. Unfortunately, it's based on securities trading, rather than real estate: "I think that in 12 to 36 months things will go down, way down."

Wanna bet?

Gene Cohen wanted to make the same dumb mistake, but in the end he was just too complacent. He's hanging onto his Willo home for all the wrong reasons. In due course, he will celebrate his inertia.

There is another article in today's Republic asserting that 20% of Americans think the only way they could save $200,000 is to win the lottery, so I suppose we shouldn't be surprised that Ms. Nichols was able to find three seemingly well-heeled gentlemen who are so clueless about basic economics.

For example, Mr. Nishimura wants to wait until interest rates go up before he buys another house. His expectation is that houses will be much cheaper. This will not be the case, but his monthly payments could easily be 25% higher.

This is all very simple calculator math. Any of these men should be able to do it, as should Ms. Nichols. On the one hand, they're going to give up at least 10% a year appreciation on their homes, probably much more, along with the mortgage interest deduction and all the other benefits of owning versus renting--most notably the future leverage value of that accrued appreciation. And on the other hand, they're going to pay a lot more for a lot less when they finally realize that real estate does not work like the stock market.

But if all that is true, what are we to make of these three stooges? Are they really that dumb, or are they concealing other motives?

Could it be that Mr. Nishimura really didn't like the hassles of being a homeowner, so he sold his home and justified it with a bogus economic argument? Could it be that Mr. Cohen is embarrassed that he loves being a homeowner so much? Given that Mr. Connelly telecommutes to Minnesota, is it plausible that he might have wanted a zero-maintenance residence?

We'll never know, because Ms. Nichols didn't drill down to the underlying emotional reasons for selling, for which the purportedly 'logical' reasons may simply be a cover.

On the other hand, it could be they really are as clueless as they come off.

Either way, they have reaffirmed my already strong belief in the long-term value of investing in rental housing.

Who says there's nothing to be gained from reading the newspaper?

posted by Greg Swann | 6:42 AM | 0 comments | links

Tempe puts the fork in the Thunderbird...

But as cities compete for overnight stays, the numbers could work in Tempe's favor:It is needful to point out that these are not to be taxpayer-subsidized hotel rooms. They are being built by actual entrepreneurial businesses risking their investors' capital. Amazing...

• Business travelers' stays increased last fiscal year at almost twice the rate in Tempe as the average rate in Phoenix, Chandler, Mesa and Scottsdale, according to TravelCLICK, a company that tracks tourism figures.

• Sporting events are drawing even bigger crowds. Last year, 2,425 overnight Tempe stays were attributed to the P.F. Chang's Rock 'n' Roll Arizona Marathon & 1/2 Marathon. This year, that number jumped by about 1,000, according to the Tempe Convention & Visitors Bureau.

Yet the vast menu of events at Arizona State University and in Tempe's downtown can overwhelm Tempe's 5,000 or so hotel rooms, city leaders say. Consider the Fiesta Bowl. Many of the cash-carrying fans, along with the Ohio State and Notre Dame football teams, left Tempe to spend their nights in Scottsdale and Phoenix.

That's why plans for expansions at two of the city's most prominent hotels are hailed as big news. Tempe Mission Palms may add up to 200 guest rooms and 20,000 square feet of meeting space, according to Chris Kenney, the hotel's director of marketing. The Fiesta Inn Resort's new ownership is injecting $5 million worth of renovations in the form of landscaping and adding conference space, General Manager Sherry Henry said.

Plus, a new upscale hotel will likely go into Tempe's newest lakeshore project. Starwood Capital Group, the brawn behind the Westin, Sheraton, "W" brands and other hotel chains around the world, has expressed "enthusiastic" interest in putting a luxury hotel on the Tempe Town Lake site, said Chris Salamone, Tempe's development manager.

"Building new hotels to fulfill the needs of all the tourists our events bring in, for a city that's landlocked it's the key to our financial solvency," he said.

posted by Greg Swann | 6:17 AM | 0 comments | links

Thursday, January 12, 2006

Sprawl in Connecticut is advanced almost every time somebody pulls a zoning permit. Good intentions about sprawl become academic when someone goes in for a permit. It is far too late for lofty thoughts. All that matters is how well you've met the zoning code.

Zoning is, in effect, the codification of a town's desires for itself - its self-image. Developers, architects and engineers are smart enough to know they must conform, or they will suffer. Zoning appeals are no fun; they are expensive and unbelievably time-consuming. Most developers would like to avoid appeals. And even once you reach the Board of Zoning Appeals level, staff and board members do not welcome blue-sky discussions about alternative ways of doing things.

Sprawl may not be what The Courant wants, and it's not what a growing segment of the population wants, but it is what our zoning codes demand, so it is what we have and what we will continue to have until we change our codes.

On the whole, our zoning codes are nonsensical. In my town of Essex, as in most Connecticut towns, it would be impossible to use the town's zoning code to build anew the very hometown Essex citizens love. Few aspects of urban density that make Essex village special are allowed by the town's zoning code. In a new Essex, buildings would be too far apart, and they would be placed too far from the sidewalk. There would be too much space around each building. Houses would be too far back from the water. The streets would be too wide, and houses wouldn't be tall enough to have the elegant proportions of those built in the 18th, and especially the 19th centuries.

The village would be too spread out and suburban in feel. You could have the best architects in the country working on a new Essex, but if they're following the Essex zoning code, they'll arrive at something very different from our town. And this disconnect is not unique to Essex; it's typical of most Connecticut towns.

posted by Greg Swann | 8:24 AM | 0 comments | links

Wednesday, January 11, 2006

A: Because the State government has $850 million in surplus funds.

Not funny, but true. Here's an even better puzzler: Why is no one else asking this question?

posted by Greg Swann | 7:05 AM | 0 comments | links

Even when the news is good, it's bad

Construction expert: Home building to slowThe body of the story:

The Census Bureau last month reported from July 2004 to July 2005 population grew 3.5 percent in Arizona. That's four times the national growth and puts you just a hair behind Nevada. Two hundred thousand people moved into Arizona during that time and they all want a place to live.

posted by Greg Swann | 7:05 AM | 0 comments | links

Monday, January 09, 2006

Why the sky doesn't fall, despite the constant warnings

If present trends continue, the price of gasoline may someday hit $50 a gallon. The average worker could spend as much as 36 hours of his 40-hour work week to buy a tank of gas.If you stipulate the premise, "if present trends continue," the rest follows logically enough. The trouble is, present trends will not continue. The free market is dynamic, and no commodity is valuable irrespective of its relative cost. If we anticipate a steady increase in transportation costs (and the experience of history is all the other way, despite the nonsense you read in the newspapers), then we should also anticipate a decrease in the amount of transportation. This is already happening, not because of gasoline prices but because of time lost to commuting and convenience gained by working from home. From the Las Vegas Review-Journal:

As attendees at last week's Consumer Electronics Show perused gadgets that could enhance their leisure time, their bosses were plotting to get them out of the office for good.The point applies to any economic good - most especially real estate - provided it is not monopolized by government. If people are free to choose among alternatives, and if vendors are free to provide those alternatives, buyers and sellers will arrive on their own at a mutually-satisfactory meeting-of-the-minds. This only happens millions of times a day, so it's perfectly understandable that Chicken Little would fail to notice...

Members of a panel that delved into the world of technologies for home use said businesses are increasingly eyeing products that will enable employees to telecommute, or work from home.

"We're seeing a huge trend in the business world to move consumers away from commutes," said Alexander Ramia, director of product development for Innofone, an Internet consulting company in Santa Monica, Calif. "The person working at home doesn't know when to quit, so companies get more work out of them, and time spent in cars commuting is lost productivity."

posted by Greg Swann | 7:09 AM | 0 comments | links

Thursday, January 05, 2006

December 2005 BloodhoundRealty.com Market-Basket of Homes: Values up 1.73%

posted by Greg Swann | 12:47 PM | 0 comments | links

Tuesday, January 03, 2006

Setting the record straight...

The Valley ranks as the second-safest major metropolitan area in which to conduct business and avoid major natural disasters and terrorism.So says the Business Journal of Phoenix, citing a survey by Risk & Insurance magazine.

Second-safest? Who's number one?

Sacramento, California, believe it or not.

Surely this is a mistake. Note these important Sacramento defects:

- It freezes in Sacramento, several times a year

- It rains 18 inches a year, three times more than anyone should have to abide

- It's only 17 feet above sea level, which can't be good

- The population of the city is only 400,000--a little more than Mesa

- Worst of all: It's in California!

I designed this billboard for New Orleans a few months ago:

Perhaps we need to post it in Sacramento as well...

posted by Greg Swann | 4:41 PM | 0 comments | links

Sunday, January 01, 2006

An open letter to Ken Western, Editor of the Editorial Pages of the Arizona Republic

Regarding your New Year's Resolution to improve the opinion pages of the Republic, is it possible to petition for a more balanced coverage of the forthcoming City of Phoenix bond issue?

From my point of view--and you probably disagree--the Republic is a tireless cheerleader for all of the--to me--insane boondoggles being effected Downtown. For example, nation-wide, all public transportation schemes are colossal failures from a cost-recovery standpoint, but the Republic publishes nothing but puff-pieces about the ValleyMetro Trolley--which stands an excellent chance of being the biggest failure of all. As far as I'm concerned, this is not news, not opinion, not even public relations. It is active, knowing mendacity, deliberately concealing facts, uncontested but largely undisclosed, for purposes of propaganda.

That notwithstanding, the tax-payers of Phoenix are about to be strapped with nearly a billion dollars of new debt, much of which--in my opinion--will be entirely wasted. It seems only reasonable to me that we have something resembling a debate on the issue. As much as PNI as a corporation or the Republic as a newspaper might favor the bonds and their proposed uses, it remains that the newspaper is the only remaining medium in which such a debate could take place.

Institutional criticism is usually futile. From a customer-oriented point-of-view, criticism is a great gift. It may tell you how to do better, but, at a minimum, it tells you how to stop doing badly. But the denizens of most institutions, when criticized, will instead circle the wagons, insisting on the rightness of their positions and the risible nature of anyone who would dare to challenge their expertise, experience and endless estimable qualities. Certainly this has been the case with the mainstream media, which never tires of ridiculing the alternative media and its audiences, bidding good riddance to every former cash customer. The auctioneer has a cure for this syndrome, but what does he know, anyway?

A couple of weeks ago, I had thought to write to you to offer to elucidate my objections to the Downtown boondoggles, and the course of municipal government in general in the Valley. My working title was "10 ways to crash a Phoenix," reflecting the ten weeks until the bond issue comes to a vote. At the time, I reconsidered, first because I felt it was a waste of my time even to offer to do the work, and second because I have very little confidence that the Republic or any other medium in Phoenix will ever utter a discouraging word about the Creative Class Cargo Cult and its grand designs.

But in light of your article today, I am re-reconsidering my position.

Here is my offer: I will produce op-eds arguing against the bond issue and everything it portends, to be run in the Viewpoints section over the next ten Sundays. I'll write whatever I want and you can edit for length, if you'll promise not to eviscerate the content. You'll pay me nothing, which is already my arrangement with the Republic.

Obviously I can write. You can see me on topic here. You didn't run this when I submitted it in May, but I didn't expect you to.

Please understand that doing this is not good for me. It will be bad for my business, both because it will take time away from profitable work and because it will alienate some potential clients (although it may endear me to others). Even so, I care enough about the future of the Valley that I am willing to act contrary to my own interests in order to see this issue debated in the full context of all the facts.

The fact is, the bond issue will probably pass. As the Republic accidentally reported last week, the deck is already stacked against opponents. But when the Trolley and the Civic Center and the hotel--decorated by genuine bureaucrats!--all fail, along with all these other stupid stunts, it would be nice if somewhere in the public fora there had been a discussion of why they must fail. And--who knows?--maybe the tax-payers still have time to catch on to what it being done to them, if they are given the opportunity to exercise an informed discretion.

My expectation is that you'll refuse this offer--probably without even the courtesy of a reply--but I'm open to the possibility of a surprise. In fact, it is in the long-term best-interest of the Republic to be an honest broker of information in the Valley. I don't think it has honored this obligation with respect to these Downtown boondoggles, but, as you note, New Year's is our big chance to resolve to do better.

So: I'm game if you are.

Best,

Greg Swann, GRI, CBR, Realtor

Designated Broker

BloodhoundRealty.com

Vox: 602-740-7531 | Fax: 602-504-1353

posted by Greg Swann | 2:34 PM | 0 comments | links

Get a grip on the growing tyranny of politically adept neighborhood groups.

The flip side of all those aggrieved neighbors who opposed building the so-called Trump high-rise (it was neither The Donald's own project nor a "high-rise" in any serious sense of the term) is that there were plenty of others in the neighborhood who supported the project. I've met with them. Talked with them. Looked at the bullying, browbeating lawyer letters that the anti-Trump activists had sent to them.

I could gripe about all the undeserved nobility assigned to the opponents of development in the East Camelback area, but, really, they acted no different from countless other neighborhood groups that have come before them. Their power is in opposing. And in their growing effectiveness, they are giving us all a textbook lesson in the perils of direct democracy.

Phoenix is in a precarious position. The outlying cities are growing, including their commercial centers. If Phoenix is to keep pace at all, much less thrive, it must tend its commercial gardens. By placating activist "neighbors," many of whom don't even live in the affected 26th Street subdivision, the Phoenix council is putting at risk one of its most vibrant commercial cores.

Absolutist-minded neighborhood activism is probably the purest example I can imagine of Arizona's rejection of the power structure that once existed here.

posted by Greg Swann | 10:41 AM | 0 comments | links

Friday, December 30, 2005

Housing is is more affordable despite contrary opinions

Despite a widespread sense that real estate has never been more expensive, families in the vast majority of the country can still buy a house for a smaller share of their income than they could have a generation ago.Actually, it would be interesting to compare square-footage-per-occupant with the percentage of income needed to pay for a home. Homes are a lot larger than they used to be, with fewer full time residents. Anyone who pays attention to reality and not the news media knows that virtually everything is better and cheaper--expressed in work-effort-expended-to-obtain--than it was twenty years ago, and there is no reason I can think of that housing should be any different.

A sharp fall in mortgage rates since the early 1980's, a decline in mortgage fees and a rise in incomes have more than made up for rising house prices in almost every place outside of New York, Washington, Miami and along the coast in California. These often-overlooked changes are a major reason that most economists do not expect a broad drop in prices in 2006, even though many once-booming markets on the coasts have started weakening.

The long-term decline in housing costs also helps explain why the homeownership rate remains near a record of almost 69 percent, up from 65 percent a decade ago.

But-but-but!--the "affordable housing" campaigners will exclaim--home-ownership in the Phoenix-area is below the national average! This is true. The national average is 69%, where the Valley of the Sun trundles along at a lowly--wait for it--68%. If you subtract our incompletely-documented residents, we are well above the national average.

But-but-but! People in Phoenix pay more than the national average for housing, expressed as a percentage of their income! This is also a case where subtracting the hard-working folks who live under the radar yields radically different results.

"Affordable housing" is a scam. There is no one with a decent income, good credit and well-managed debt who cannot purchase a home in the Valley. We prove this thousands of times a month. Creating a vast new government program to give the illusion of ownership to people who do not qualify for home-ownership will do no good, but it will do a lot of harm:

- People who do have good financial habits will be penalized; some or all of the homes they might otherwise have purchased will be expropriated

- People who have bad financial habits will receive unearned rewards in the form of housing they do not deserve and very probably will not respect or maintain; the experience of HUD housing subsidies makes this very plain

- The "owners" of so-called "affordable housing" will not be able to sell their homes at market value, realizing the appreciation, since, if this were permitted, the inventory of "affordable housing" would vanish in short order

- Since they will not have the right of unfettered disposal, the "owners" of so-called "affordable housing" will be, essentially, tenants-at-sufferance, further contributing to their indifference to their "property"

Home-ownership is the badge of the Middle Class, the backbone of America. But it is not a Cargo Cult. Behaving wisely leads to home-ownership, but "owning" a government-subsidized "affordable" home will not cause people to behave wisely. A thoughtful people could reasonably expect the contrary--informed by past experience if not by cold reason.

posted by Greg Swann | 8:16 AM | 0 comments | links

Monday, December 26, 2005

While it remains unclear who will emerge as winners or losers when neighborhood leaders and developers begin hashing out future building heights in the Camelback Corridor, one thing is certain: supporters of Phoenix's upcoming bond election are breathing a sigh of relief.In other words, the City wants to limit votes on the referendum to people who stand to prosper from it, with everyone else getting bilked. Everything that was ever done for any of the Downtown cargo cults was done this way. It's just rare for anyone to admit it.

When Phoenix City Council members decided last week to overturn their decision to allow more high-rises in the corridor to avoid a referendum, they managed to keep the issue off the March 14 ballot, the election in which voters will decide whether the city can sell almost $880 million in bonds for citywide capital improvements.

"Keeping the referendum off the same ballot is one less reason you have for people to vote no," said Jason Rose, a Valley political consultant. "Elections are highly uncertain events to begin with, and with the Trump dynamic, it created more uncertainty, more doubt. And at the end of the day, people didn't want to risk downtown getting trumped just like 24th Street and Camelback did."

posted by Greg Swann | 7:10 AM | 0 comments | links

Friday, December 23, 2005

Interest rates are down, Gas prices are down, housing starts nationwide are up, and home prices in the Valley are up, so you know what that means. Yup, the sky is falling yet again.

Affordable homes are vanishing. Vanishing! It must be the Grinch, slinking around with a bottomless bag full of affordable homes. And all the poor Whos down in Whoville--er, Phoenix--are rapidly becoming impoverished by their incredible real estate wealth.

Truly, these are Trying Times...

Here, by way of a metaphor, is a way of understanding real estate reporting as it is practiced in the Valley of the Sun:

The rains in Phoenix are torrential! When a big storm is coming, the clouds will gather all afternoon, piling up hundreds of feet high. You'll look off to the southeast, and it looks like the entire island of Manhattan is about to crash land onto the Valley. But first comes the dust, a thick carpet of brown grit propelled by sixty-mile-an-hour winds. And the first hint of precipitation may not even be rain: Golf-ball size hail is a common precursor. By now the winds will be entirely untamed, ripping away branches and uprooting whole trees, blasting picture windows right out of their frames, even tearing the roofs off of older homes. When the rain finally comes, it drenches, dumping inches of rainfall in a few short minutes. Flood retention ponds overflow. Sewers back up. The washes and floodways rush like rivers gone mad. If you are foolish enough to get caught in the path of the water, your car may be pushed hundreds of yards downstream--or totally submerged. A storm in Phoenix is like a storm nowhere else.Every bit of that is true, and none of it is relevant. We have three or four storms like that every year, almost always in the late Summer. They're over in a couple of hours and life goes on. Rain is interesting in Phoenix, but one of the things that makes it interesting is that it is extremely rare.

So: Is it possible that a homeowner could live through a 60% run-up in the value of his home and still have financial problems? You bet. Is it likely? Not so much. It is common? Not at all. If you want to insist that, say, 5% of homeowners are in trouble irrespective of all the gifts that wise men bring, we'll go along with that. But the other 95% are a lot richer than they were this time last Christmas--and most of them aren't even doing anything about it.

The same metaphor applies to the argument for so-called 'affordable housing'--which is not news but a political campaign. In fact, thrifty school-teachers and firefighters--the usual designated pity-objects--are buying homes every day. In general, thriftless people are not buying homes--not because the homes are 'unaffordable' but because they have no savings, their credit is bad, and their debt-to-income ratios are too high. How boring the news is when you drill down to the facts.

We should concoct a Grinch-be-gone spray, because these pitiful sob stories never go away. In March of 2005 and again in May, we were entreated to weep along with the Mahlerweins:

Just ask Rebecca Mahlerwein. She teaches in Tempe but can't afford a house in the same city as her kindergarten pupils. The starting salary for the typical elementary school teacher in the Valley is about $30,000. Mahlerwein's husband is also a teacher.Who doesn't commute? But that's beside the point, because we have to look at this situation like Realtors, not newspaper reporters.

The couple found a house they could afford in the southwest Valley suburb of Laveen, but now Rebecca has a 40-minute drive to her classroom every day.

"I carpool with another teacher so that helps, but it would be so nice to live in Tempe," she said.

First, the Mahlerweins have a combined Adjusted Gross Income of at least $60,000 a year--they're both teachers. With good credit and low debt, they were a slam dunk for a nice house in Tempe. Stipulating that they couldn't get a nice home in Tempe, what does that tell us? Yup, you guessed it.

What they did buy, on July 9, 2004, was a brand-new 1,943sf home with a pool in Laveen, a bucolic near-in suburb with sweet views of South Mountain. They bought the home in Rebecca's name only--this per the tax records--which suggests that the lender for whatever reason didn't want husband Randy on the loan application. In other words, what made Tempe 'unaffordable' wasn't that anything was actually beyond their reach, but that they bought their home with only half their income. Brand-new. 1,943sf. With a pool. Qualifying with only half their income. The poor babies!

Now here's the Grinch-getter for both sets of sob stories, the vanishing affordable homes and those poor, poor house-rich Phoenicians:

The Mahlerweins paid $161,739 for their home. It's now worth $300,000 at least. They put $8,931 down, so their cash-on-cash return is 1,548% in less than 18 months, an amazing rate of return. What's more, if they sell their home, they're sitting on around $135,000 in equity, after closing costs, which is 20% down on a $675,000 home in Tempe. The highest-priced home currently offered in Warner Ranch, a very nice place to live, is $599,900--for 2,813sf with a pool. If they want to, the Mahlerweins can hopscotch from a nice home in Laveen to an even nicer home in Tempe in only one hop. Everywhere but in the newspaper, that would be very good news.

The points are these:

1. Affordable homes are not vanishing, but under-qualified buyers cannot and should not buy homes.

2. Valley homeowners are not poor. They are really, really rich all of a sudden. They should put their newly-acquired equity to work getting even richer.

3. Don't believe everything you read in the newspapers.

4. Don't expect the Grinch to change his ways on Christmas morning. That's just in the storybooks.

posted by Greg Swann | 7:24 AM | 0 comments | links

Thursday, December 22, 2005

Splitting time between two homes

A new market segment of homeowners called "splitters," people who split time between two homes, are helping to fuel not only the home-building industry, but other industries as well, a survey from Florida-based WCI Communities found.

Splitters evolved from post-World War II migratory trends in the United States. How many places have they lived since birth? How many of their extended family still live in the same town?

These are among the 35 questions that were asked of 12,000 people in the survey, which required respondents to live east of the Mississippi River and be a homeowner. Of the 1,743 respondents, 408 qualified as splitters.

About 70 percent of splitters own a second home and 20 percent, identified as "super splitters," own three homes.

"Americans no longer expect to experience birth, life and death in the same city or town where they grew up, or even where their families currently live," WCI spokesman Kyle Reinson said.

He said the survey was commissioned to develop a better understanding of emerging American cultural and economic trends of second-home ownership.

A recent study from the National Association of Realtors projects a twofold increase in second homes by 2009, which would account for nearly 12 million homes by the end of the decade.

posted by Greg Swann | 8:02 AM | 0 comments | links

Lilliputians win: Downtown Phoenix to be erected in Downtown Tempe

The Phoenix City Council yielded to pressure from residents Wednesday and decided to reverse its decision to allow more high-rises in the upscale Camelback Corridor.This is the last, best hope for Phoenix to have something like a Downtown--a Central Business District, composed mostly of actual free-market businesses--within the borders of Phoenix.

The action effectively kills several projects, most notably the $200 million condominium/hotel development proposed by Donald Trump and development partner Bayrock Group near 26th Street and Camelback Road and sends them all back to the drawing board.

Of course, the City Council will continue to push for its dream of a fake Downtown--composed almost entirely of tax-payer funded structures--further south. This was the reason for their voting against the planned towers after they had already voted for them: The alternative was to have the issue as a ballot question at the same time Phoenix voters will be asked to saddle themselves with nearly a billion dollars of new debt to build a redundant campus for ASU and a redundant medical school for UA in the all-new fake Downtown. If you're wondering why the City's tax-payers should pay for State universities, the City Council doesn't want you to vote--no matter where you stand on the Biltmore towers.

In any case, the real action will move east, to Downtown Tempe. This is already as close as The Valley of the Sun gets to a Downtown out-of-towners can understand. Tempe has been land-locked for years, so its politicians, marginally less venal, understand that the only way the city can grow is up.

It still won't be a Central Business District--the Biltmore site was the only hope for that--but it will be alive and vibrant and dynamic, where Downtown Phoenix will always be just one Grand Tax-payer Boondoggle after another--all of them failures, all of them declaimed as great successes, the hails of elaborate praise echoing through the canyons of perpetually empty streets.

posted by Greg Swann | 7:45 AM | 0 comments | links

Sunday, December 18, 2005

"How would you like it if you owned a house or a business and the state came to you and said, 'You know what, we're not going to buy this piece of land ... and in the meantime, you can't do anything with your land?' " said Cochran of Calabrea Development. "It's just wrong. It's totally against property rights and what this country is built on. You can't control someone's land without owning it."This idea evidently hasn't made it to City Hall...

posted by Greg Swann | 6:27 AM | 0 comments | links

Thursday, December 15, 2005

Is that Starfleet Headquarters?