I won’t be able to rely on the numbers for another few days, but March will turn out to have been a very busy month. Volume of sales will be up substantially over February, and April promises to be even stronger.

The bad news? Prices were down again in March, and I’ll bet April will also be a down month.

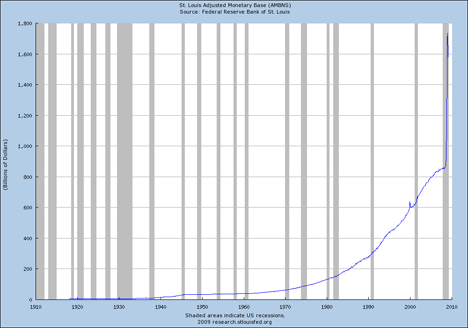

The good news? Mortgage interest rates are at historic lows.

The worse news? The foreclosure pipeline is still very full, and 10,000 more homes are being lined up at the entry point.

And that’s the trade-off confronting owner-occupant home-buyers. We’re looking at two more years of foreclosures, which argues that prices will continue to decline, at least for a while. But it’s hard to imagine interest rates going much lower — or staying this low.

About half of those newly-foreclosed properties will end up as lender-owned resale homes, hitting the market in 60-90 days. FannieMae and FreddieMac had a moratorium on foreclosures in the fourth quarter of 2008, so some of these new foreclosures will reflect that delay. Even so, there are plenty of other troubled mortgages still to hit the pipeline.

I see two issues that matter:

- Will new foreclosures come onto the market more quickly or more slowly than they are coming off? Right now, overall inventories are declining, which argues that sometime soon prices will stabilize or even increase.

- But do we have enough heads for the bedrooms? We’re overbuilt, and if we don’t have enough people to put into these homes, we could see an echo bust as inventory newly absorbed by investors sits vacant.

We know in the long run we will recover, but we don’t know where the long run is. The question for owner-occupant buyers is the one addressed above: Will you save more by paying a higher purchase price now, at a lower interest rate? Or are you better off waiting for better prices, even if you end up paying a higher interest rate?

Is it possible that the home of your dreams could be selling for $10,000 less three months from now? Yes. Is it also possible that, three months from now, interest rates will be high enough that you won’t be able to qualify for that home, even at the lower price? Sadly, yes.

These are all questions for a lender, so let me know if you want me to put you in touch with one.