On the other hand, do you want to see something cool? No Page Rank. No links to speak of. No history. Just a domain name and relevant headings and content.

Technorati Tags: blogging, real estate, real estate marketing

There’s always something to howl about.

On the other hand, do you want to see something cool? No Page Rank. No links to speak of. No history. Just a domain name and relevant headings and content.

Technorati Tags: blogging, real estate, real estate marketing

…is up at Sadie’s Take on Delaware Ohio.

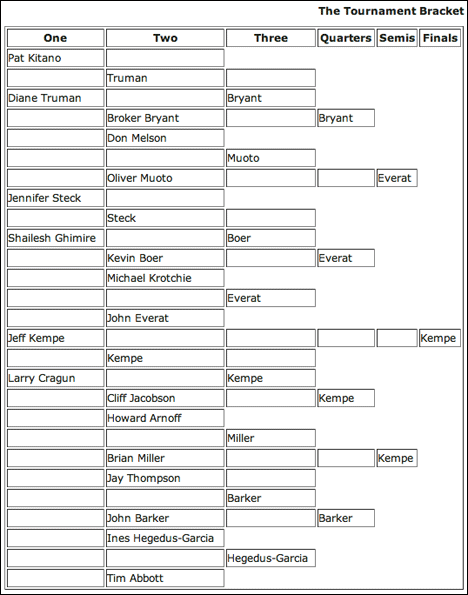

Host Toby Boyce does a truly amazingly phenomenal job as judge — and I’m not just saying that because our own Jeff Kempe won with The Imperative of Divorced Commissions, Part 2: The Inherent Value of Free.

Toby used the idea of a golf tournament as his theme, with the chart above illustrating the competition.

And the competition was fierce, with many first-quality contenders. Wheel you golf cart over to Toby’s place to see what I mean.

Technorati Tags: blogging, real estate, real estate marketing

One of the tenets of financial advisory is the principle of fiduciary responsibility. Today, Wall Street Journal reporter, Jonathan Clements, openly criticizes the strategy Doug Andrew outlines in his best-selling book, Missed Fortune. Mr. Clements’ article, When the “Self” in Self-Interest Isn’t You, attacks the strategy as being completely self-serving for the financial advisers who recommend it.

The author is trapped in the mindset I call “Boomer Economics“: paying down the home and socking away as much as possible in employer-sponsored, qualified retirement plans. The problem with Boomer Economic Thinking is that it is becoming dangerous. The economy dramatically changed on September 12, 2001. We saw a shift of wealth from financial assets to hard assets, hyper-fueled by leverage.

Doug Andrew advises people to redirect monthly contributions for retirement. He advises that they fund a 401-k plan only to reap the benefit of employer matching. He advises that the remaining monthly contribution be earmarked for variable universal life insurance contracts so that the withdrawal from those assets is tax-free. Mr. Clements suggests that this advice comes from “unscrupulous advisers”.

Equity harvesting is another principle promoted in Missed Fortune. It is recommended because home equity fails the litmus test of sound investing. It is illiquid, volatile, and it has absolutely no return. Equity harvesting protects property owners from volatility. Kris Berg describes the challenges experienced Realtors face with panic selling, induced by illiquid property owners and inexperienced sellers’ agents. An equity harvesting strategy, invested in a side bucket to provide liquidity, can mitigate that risk. Mr. Clements directly attacks that principle as being a fee-driven recommendation and misapplies a disclosure offered by the NASD in 2004.

It is a brave new world with extraordinary challenges for the under-60 population. The World War Two generation was able to rely on the paternalistic retirement plans offered by the government and growing corporate America (Social Security and defined benefit pension plans). The Boomer generation presented the government with a distinct threat to those plans. The government answered with a tax-banking Read more

Greg Swann has joined Glen Kelman in the way they both think and talk about the amount of commission, the splits and how it can be divided and allocated.

There isn’t some “set commission amount” for groups and companies to “divide for the public”. This kind of thinking is one of the primary flaws with the Redfin business model. For example, we charge our sellers less commission if we handle the buyer side and are not paying an outside agent. Almost all listing agreements are signed by sellers who are agreeing to pay the listing agent. To suggest that the purchase price the buyer pays for the house has “the buyer really paying it” would

also be saying that the buyer has a right to tell the seller how they should spend any and all of the money they receive from the sale of the house. Why stop with the sales commission?

The idea and concept of the buyer pays the commission is absurd. It is flawed logic. What if some seller (or buyer?) came into my office and started ordering my staff around, explaining that “they paid them”? I pay my staff with MY money. I may have received that money from a commission paid to me by my seller but it is then MINE. The home seller is in the same position. It is their money that they have agreed to pay to an agent. Under the present system, the buyer has

made no such agreement.

I’ve commented elsewhere on why divorcing the commissions will never happen anyway – but just didn’t want to let this particular bit of poop sit. Damn, I haven’t posted anything in a while and right now have a plane to catch. This got me out of hibernation, so thank you! LOL.

Jeff, I will mentor you for the same fee I charge everyone else. The amount most buyer agents currently charge buyers. This is the same price I always charge. My goal all along has been to make charging Read more

In a charmingly romantic post this morning, Jonathan Dalton gets bogged down in the all-too-common idea that divorcing the Realtors’ commissions would impose some new financial burden upon buyers, resulting in their loss of representation.

This is false. Although we operate by the fiction that the seller pays the real estate commissions out of the proceeds of the sale, in fact, if the buyer’s lender is not willing to fund the transaction, no sale will occur and no one will get paid. It’s useful in the abstract to envision the transaction as being either all-cash or 100% financed. In both cases, all the money is brought to the closing table by the buyer or the buyer’s lender.

To effect the divorced commission in the overwhelming majority of transactions, all that is necessary is for lenders to change their underwriting guidelines, making corresponding changes in the way they illustrate the flow of funds on the HUD-1 settlement statement.

Right now, many lenders will allow up to 7% in sales commissions, to be charged against the seller’s side of the HUD-1, with up to 3% in closing costs, also charged against the seller’s side of the HUD-1.

If lenders changed their guidelines, such that no more than 3.5% could be charged against the seller for the compensation of the listing agent, with no more than 3.5% charged against the buyer for the compensation of the buyer’s agent, the commissions would be divorced.

So far, this is nothing more than a change in underwriting guidelines and HUD-1 accounting. Absolutely nothing has changed away from the paper-shuffling lender universe. The costs to the buyer and the proceeds to the seller are exactly the same.

Not to rock too many boats at once, but it would also be possible for lenders to make their internal procedures and the HUD-1 bookkeeping more honest, putting a little extra money in the pockets of both buyer and seller.

In the chart shown below, the first column illustrates the current procedure. The middle column shows how commissions can be divorced while retaining the psychotic style of accounting lenders currently deploy. The third column demonstrates how commissions can Read more

By far the most entertaining marketing presentation I’ve ever suffered was in the mid-eighties. I was representing a small shoe manufacturer in Worcester, MA. It was early in the comfort revolution, and the company owner had come up with a way to put a donut in the insole for the heel to rest. He’d asked a local ad agency — his brother-in-law, actually — to come up with a bottom to top marketing plan: name, packaging, hook, advertising.

Cleverly focusing in on the donut, thinking waaaaaaaaay outside the box, this is what was unveiled:

Manistee presents: ZER0&174;s!!

with

ZER0&174; Styling!

ZER0&174; Affordability!

and

ZER0&174; COMFORT!!

We never made it to the packaging.

=====

Here’s Kendra Hogue, editor for the real estate section of the Sunday Oregonian, a couple months ago:

For those of you who haven’t purchased a home before, “hiring” a Realtor to help locate a house costs you nothing.

Well.

No matter how we try to twist statutes or the code of ethics, no matter how much we argue among ourselves as to who actually pays the buyer’s agent, the fact is the debit remains on the seller’s HUD-1 and the perception is that buyers’ agents come free. And the value of ‘free’?

Zero.

No? How many Buyer Presentations have you been on in the last year? Why is it buyers are much more willing to work with the first person they meet — or with Aunt Rose’s pedicurist’s live in girlfriend’s little brother — than a seller might? Why do they often drift, as if one warm body is the equivalent of another?

No matter how much we plead that buyer’s agents are as important to buyers as listing agents are to sellers — and they are — the market price tells buyers a different story, and the argument falls largely unheard. And note importantly that the price isn’t set by the market — the customer — but artificially by the industry. Price-by-fiat is almost always disastrous [Google ‘Nixon price controls’].

The consequences are both obvious and counter intuitive. The fact that buyers don’t scrutinize their hires is a boon to the inexperienced and inept. That keeps the people Kris just Read more

What factors contribute to price declines in a downward trending market? Interest rates, affordability, demand, and consumer confidence to name a few. Today, I have a new one: Crappy agents.

My beef of the week is the confidence crisis I see among agents, at least in my local market, and there are two camps cast in our realty reality version of Fear Factor.

“We fear things in proportion to our ignorance of them”. Titus Livius

First, there are the newer agents who haven’t experienced anything but a flying-off-the-shelf listing environment. Their training and mentoring has been focused entirely on getting the listing, the listing being the Holy Grail of real estate. Listings are King, they are told, and once that listing is secured, the check is in the bank. And the future checks are just around the corner. Use the listing to populate your marketing copy, snag those sign calls, and spawn new listings. Keep the car warmed up, because off to the bank you will again be – very, very soon.

“The greatest mistake you can make in life is to be continually fearing that you will make one”. Elbert Hubbard

Even veteran agents have seemingly forgotten that markets change, and with that, our approaches to the business need to adapt. Speedy-quick contracts, contracts proferred and negotiated without breaking a sweat, contracts which are all but guaranteed to make their way to the County Recorder’s office in 30 days with narry a hiccup, are a thing of the past. Unlike the new agent, they once lived a time when the hard part wasn’t “winning the listing”, but when the real work ensued once the contract was inked. Many seem to have forgotten.

Listings are becoming a dime a dozen, and it’s what you do with the listing and the trust the client has placed in you that now separates the men from the boys, the “salesmen” from the “professionals”. What does it take for an agent to successfully represent a seller today? Hard work, time (a lot), money (a boatload), and patience.

“Time is money”. Benjamin Franklin

I often tell sellers that I don’t make the market; Read more

This is me in yesterday’s Arizona Republic (permanent link):

Not all neighborhoods feeling a downturn

There are neighborhoods in the Phoenix area where the housing downturn is barely discernible.

How can that be? News reports are full of doom and gloom stories. Defaults, foreclosures and interest rates are up, with mortgages resetting seemingly at whim. If the news is always bad, how can it be good at the same time?

In fact, in some parts of the Valley prices have not fallen, with some neighborhoods actually experiencing continued appreciation. Inventories are up all over, but, so far, we haven’t seen much in the way of desperation selling.

We track a slice of Valley real estate as an indicator of where the market might be headed. We look at newer mid-sized homes in freeway-accessible suburbs. These were the homes that led the market on the way up, and they’ve suffered more than others on the way down.

So how bad is it out there? The homes we track are down 13.41% from the peak in December of 2005. That’s not insignificant. If you bought (or refinanced) a home like this any time after May of 2005, you’ve probably lost money. On the other hand, if you bought your home in January of 2004, you’re still up by around 58%. If you put 20% down, that’s a 290% cash-on-cash return. Better yet, as bad as things have been, there is only about seven months of inventory on the market, suggesting that prices may not fall much farther.

On the other hand, MLS Area 323 in the West Valley runs from Northern to the I-10, from 43rd Avenue west to 115th Avenue, a large and very diverse housing stock. Available inventory is huge, more than a twelve months’ supply. But, interestingly, prices in that region have only dropped by about 2.75% since December of 2005.

Don’t run down the street in celebration. Interest rates are flighty, and sub-prime or even low-down-payment conforming mortgages may be a thing of the past. But, even so, acknowledging that things may get worse before they get better, they haven’t been that bad so far.

From email from Teri Lussier:

By the way, I’ve changed brokerages. Another agent and I have teamed up — he found me through TBR. He asked me yesterday if I subscribed to a blogging service for content feeds. “No, I write it myself.” I’m adding content he never considered. He’s a former IT guy, and he teaches the brokerage’s tech class. I know more about blogging than he does, so yesterday he tapped me to teach the blogging portion of the next tech class. REWL101 bookmarks for everyone! And I’m thinking of offering to hire myself out to guest blog — to plug in regular content for any agent who would like. Great fun.

I seem to remember there being some kind of weblogging competition, but I cannot for the life of me imagine how it’s being judged…

Furthermore: The girl is nothing but class…

Technorati Tags: blogging, real estate, real estate marketing

The Center for Realtor Technology Web Log (there’s a mouthful) has a Realtor-oriented review of the iPhone:

On the real estate side of things, though, there were a few disappointments. I went to Trulia, Zillow, and Realtor.com. All three had some rendering issues from a missing MAP to elements on web pages covering each other (making filling out a search impossible.) One issue is that one of the sites has their map via Flash, which isn’t yet supported on the iPhone. I visited some of the sites on Safari and Mac and Windows and didn’t have the same rendering issues, but did still have the same missing non-flash map elements. The rendering issue I saw on the iPhone could be a bug in that version that will hopefully be corrected soon. Don’t get me wrong, they were still mostly usable, but it wasn’t as clean an experience as most of the non-real estate sites I’ve visited. It could just be luck on my choices either way.

We’re not ready to make the leap yet, but it seem clear that this device — or a near-term competitor — is inches and hours away from shipping my laptop off to the Museum of Computer History.

Technorati Tags: real estate, real estate marketing

I’m not being morbid. I just don’t have the wide-eyed naivete necessary to write for SeekingAlpha.

Technorati Tags: disintermediation, real estate, real estate marketing, Zillow.com

Here is a sampling of mortgage offerings on Bankrate.com. (for July 11, 2007)

I chose a $252,000 loan for a $315,000 purchase price in Phoenix. Income and assets need to be verified. Credit score of at least 620. I assume a 1% origination fee and about $1200 in APR loan costs. I would have priced that loan on July 11, 2007 at 6.5% with an annual percentage rate of 6.679%.

Take a look at the variances on Bankrate.com . Can you see the stupid mortgage banker tricks that can be played? The lower rate offerings are stacked with APR fees. In reality, those “fees” are truly discount points but the advertisers know that the consumer eschews the term “points”.

Bank of America and Countrywide have been advertising “No Closing Cost” loans on television. So, why does B of A reference their no closing costs loan but quote a rate with .537 discount point and $1155 in APR fees? It’s the rate, stupid! Mortgage shoppers won’t call if they published the rate of over 7% for their “no closing cost” loan.

Confused? Bankrate.com would be better serve a consumer if they isolated a rate for a specific loan offering and insisted that the advertisers compete on fees. Then, rank those advertisers from lowest fees to highest fees.

That’s assuming that mortgages are a commodity. Even Bankrate.com knows that just ain’t true.

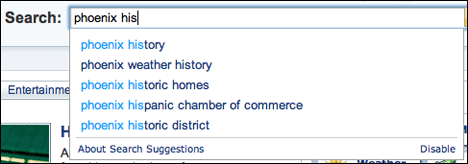

Simply brilliant. Anyone for a betting pool on when this shows up on Google? And pause to think about what this does for very popular search terms…

Technorati Tags: real estate, real estate marketing

We live and work right on the Arizona Canal in North Central Phoenix. North Central is a nebulous geographical region. Properly speaking, it runs from Seventh Street to Seventh Avenue, Missouri Street to the Canal. Within those boundaries, you will find some of the most prosperous and powerful people in the city — two categories from which we are more than amply excluded.

People living as far east as 16th Street and as far west as 19th Avenue might claim to live in North Central, and it would be considered churlish to contradict them. But this courtesy would not be extended to anyone living north of the Arizona Canal. North of the Canal is Sunnyslope, one of the worst neighborhoods in Phoenix.

What’s the difference? About $150,000 right now. In other words, the house you could buy just north of the Canal for $250,000 would cost you at least $400,000 if you were to buy it just south of the Canal. Location, location, location.

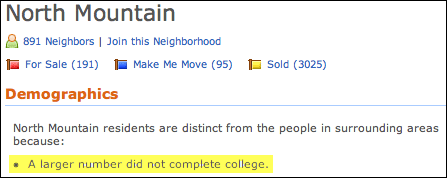

Now suppose you have joyfully paid that price premium to own, use, enjoy and profit from a home in North Central. If you went to your neighborhood page on Zillow.com, what might you not want to see?

I added the highlighting, just to put a finer point on the slur. In fact, this is just the kind of ham-handed stupidity you would expect from a robo-bartender, which, if you think about it, is one of the bogus roles a social network can take on.

Full disclosure: I am a social networking skeptic. The youthful fetish clubs are immensely popular with people who are determined to stay forever young. The commerce-oriented sites are full of self-promoters, every bit as interesting as the Friday morning business card exchange at the Denny’s over by the freeway. It could be there is something else I’m missing, but I’m not predisposed to care.

The truth is, I’m an introvert, as are many smart, technically-oriented people. My skin doesn’t actually crawl when I’m around other people, but my social interactions are always project-focused, and I’ve never been to a party that I didn’t want to leave before I got Read more

From John Cook’s Venture Blog:

As an investor and board member at Avvo, I asked [Zillow.com’s Rich Barton] when Zillow might roll out an online rating system for real estate agents. That idea is in the works, with Barton saying that the company also is trying to develop ways for consumers to search for agents based on specific criteria. Stay tuned…

First we’ll milk ’em for free content as the only persistent members of our “community.” Then we’ll sell ’em astoundingly low-yield advertising. Then we’ll get anonymous misanthropes to write poison-pen letters about them. That sounds like a plan…

Am I missing something, or is this evidence of an unbounded cluelessness?

Technorati Tags: disintermediation, real estate, real estate marketing, Zillow.com