This is a first strike at a taxonomy of real estate weblogs. Taxonomy is the science of categorizing things. Of course, not everything can be neatly categorized, but the elucidation of categories can focus the mind, helping us to understand where certain weblogs might fit, which are hybrids of two or more categories, and which can only be described by the creation of new categories.

Again: This is a first strike. I may not have created enough categories, or I may have created some in error. I may have certain weblogs — offered here as examples — miscatalogued. If you think I’ve got something wrong, say so. If we can whip this into a decent shape, I may built it as a separate page, something we can lay by for an enterprising newspaper reporter — or the nonesuch, whichever comes along first.

In any case, here’s my first swing at the ball:

- Real Estate Industry, real estate industry focus for professionals, BloodhoundBlog

- National Interest, real estate focus for consumers, The Real Estate Webloggers, About Home Buying & Selling Real Estate

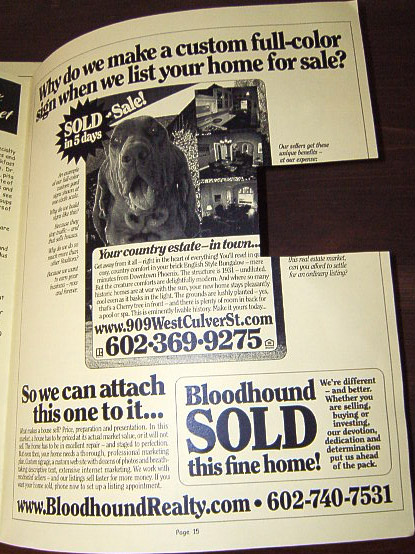

- Local Interest, local real estate focus for consumers, The San Diego Home Blog, Brokers First Realty, The Phoenix Real Estate Guy

- Hyperlocal Interest, hyperlocal real estate focus for consumers, McCormick Ranch Real Estate & Homes

- Neighborhood, hyperlocal focus, not real estate oriented, RealCrozetVA

- Architecture/Decor, elaboration of design for consumers

- Real Estate Aficionado, homes, decor and construction for consumers, SocketSite.com

- Home Remodeling/Refurbishing/Restoration, homes improvement how-to for consumers

- Staging, home staging for consumers or professionals, Home Staging Rants & Ravings

- Appraisal, home appraisals for other appraisers, Appraisal Scoop

- Title, title and escrow for professionals

- Home Inspection, home inspection for consumers or professionals, Homewerx Home Inspection Blog

- Vendor, vendors appealing to professionals, Ubertor Real Estate Blog

- Weblogging Vendor, weblogging vendors appealing to professionals, The Real Estate Tomato

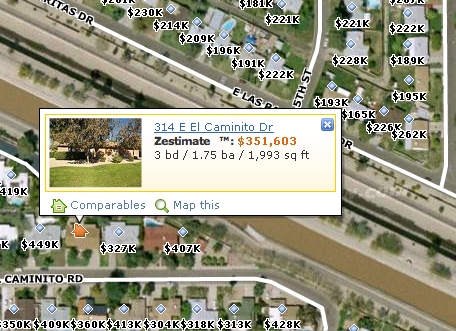

- Corporate, corporate PR for consumers and professionals, ShackBlog, Zillow Blog

- Investor, real estate investing advice and discussion, BawldGuy Talking, Real Estate Investing for Real Blog

- Loan Officer, mortgage lenders appealing to consumers, America’s Most Opinionated Mortgage Broker, The Mortgage Reports Blog, Blown Mortgage

- Mortgage Industry, mortgage industry news for consumers or professionals, Mortgage Matters

- Technology, real estate technology news for professionals, The Future of Real Estate Marketing

- Marketing, real Read more

of houses and never have a problem. And there are some people you can’t make happy – no matter what you do.

of houses and never have a problem. And there are some people you can’t make happy – no matter what you do.