Russell Shaw’s great post “I want a LOT of money — would you tell me how to get it?” got me thinking about loan officers who constantly ask me about how they can make “a lot of money,” especially in a tough mortgage market. They lament the current market situation, tell me that people are scared to refinance, that underwriting guidelines are more difficult, that property values are falling. They complain that these factors are squeezing their customer base and making it harder to win business. “What can I do? It’s soooo hard out there right now” is a common refrain I hear constantly. I keep looking for a way to disable the “repeat button.” After having this talk ad nauseum I’ve found that I can ask 6 questions to help loan officers refocus on capturing success. Those 6 questions tend to generate between 4 and 5 AHA!s per person. This realization is rather scary to me as many of these loan officers achieved high levels of success during the “boom” years. It makes me want to ask “How much more could you have made back then if you were actually trying?”

Today I’ll cover questions 1 & 2, and then get to the other three in my next post.

The first question is somewhat rhetorical; “How hard are you working; and, how smart is the work you’re doing?” That usually gives the inquiring loan officer pause. They look at me like a deer in the headlights, frozen by the realization that they’ve been working half-speed for as long as they can remember, stammer a bit, and then finally go quiet. Sometimes you see a little light bulb go on over their heads. That light bulb is the first step in an important process. Question one is my warning shot, to let them know that I have no time for their pity parties and that if they want advice they are going to get it — served cold.

I have found that the average loan officer spends too much time placing responsibility for their success on external factors instead of taking the responsibility to Read more

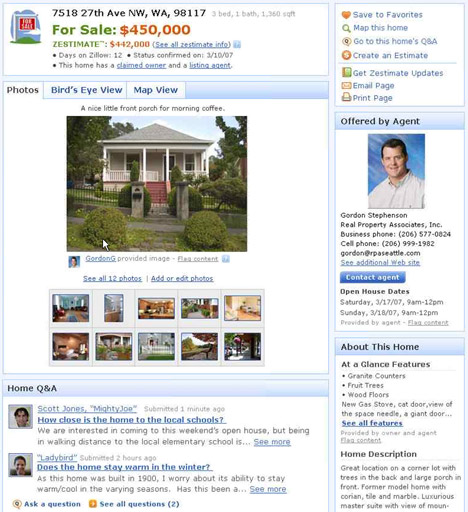

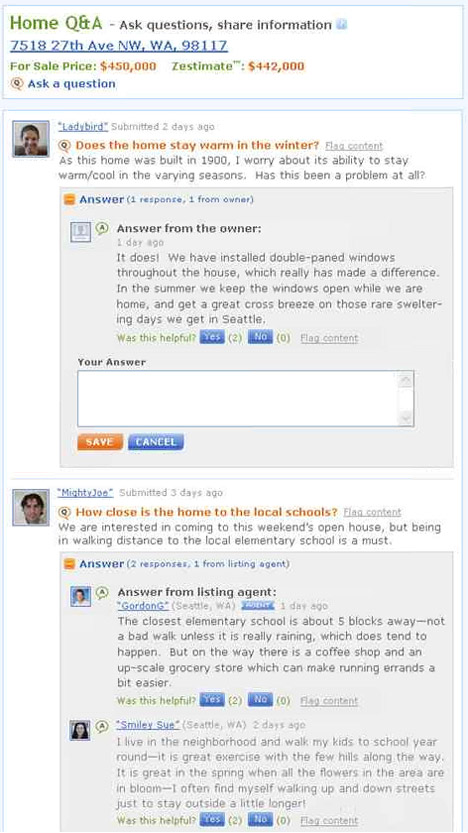

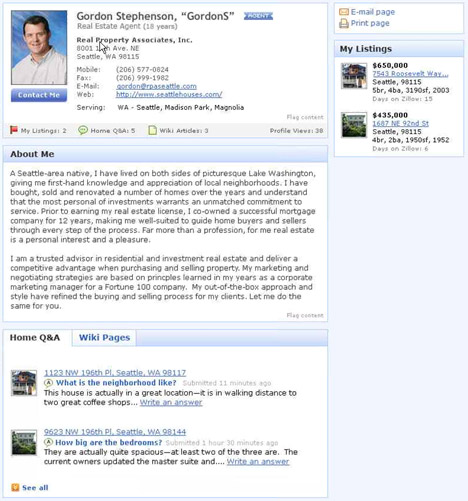

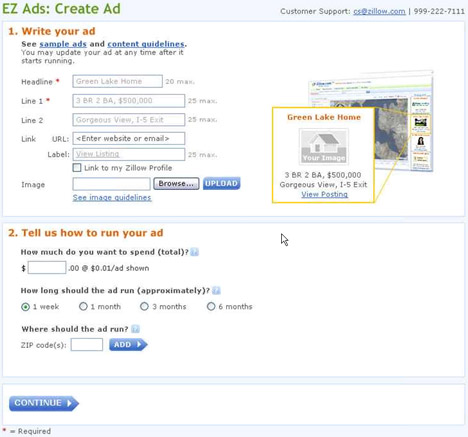

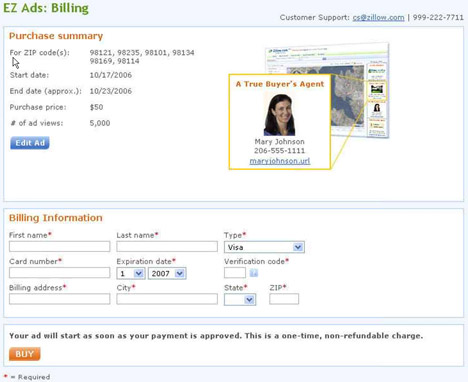

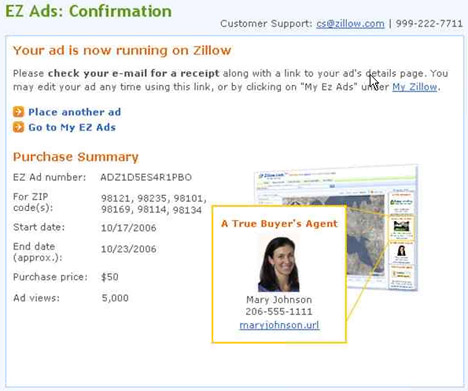

Appended below is an audio podcast with David Gibbons, Director of Community Relations for Zillow.com. In this recording, David talks with me, reflecting upon the details and implications of tonight’s new software release.

Appended below is an audio podcast with David Gibbons, Director of Community Relations for Zillow.com. In this recording, David talks with me, reflecting upon the details and implications of tonight’s new software release.