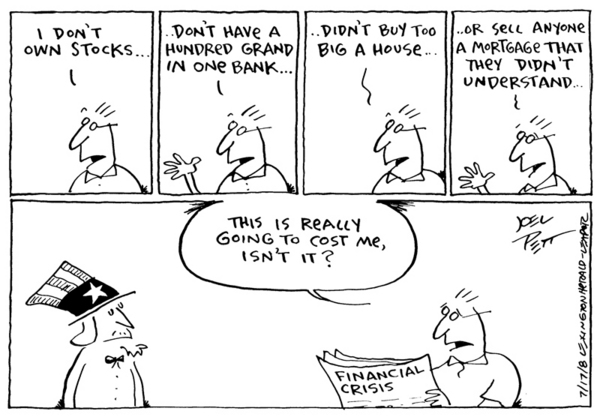

Things fall apart: Kevin Hassett at Bloomberg.com is getting death threats over this news analysis:

The financial crisis of the past year has provided a number of surprising twists and turns, and from Bear Stearns Cos. to American International Group Inc., ambiguity has been a big part of the story.

Why did Bear Stearns fail, and how does that relate to AIG? It all seems so complex.

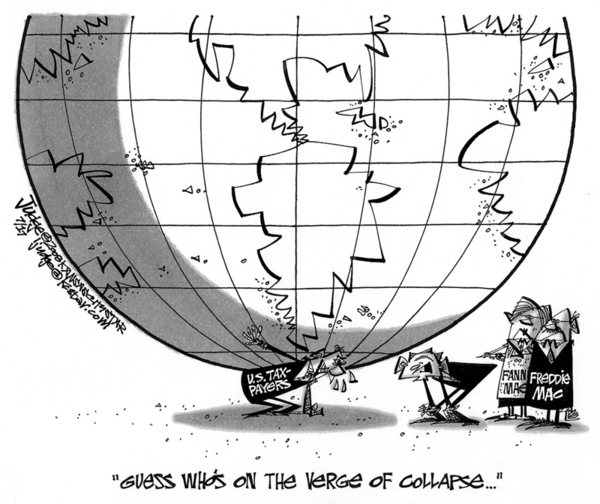

But really, it isn’t. Enough cards on this table have been turned over that the story is now clear. The economic history books will describe this episode in simple and understandable terms: Fannie Mae and Freddie Mac exploded, and many bystanders were injured in the blast, some fatally.

Fannie and Freddie did this by becoming a key enabler of the mortgage crisis. They fueled Wall Street’s efforts to securitize subprime loans by becoming the primary customer of all AAA-rated subprime-mortgage pools. In addition, they held an enormous portfolio of mortgages themselves.

In the times that Fannie and Freddie couldn’t make the market, they became the market. Over the years, it added up to an enormous obligation. As of last June, Fannie alone owned or guaranteed more than $388 billion in high-risk mortgage investments. Their large presence created an environment within which even mortgage-backed securities assembled by others could find a ready home.

The problem was that the trillions of dollars in play were only low-risk investments if real estate prices continued to rise. Once they began to fall, the entire house of cards came down with them.

Take away Fannie and Freddie, or regulate them more wisely, and it’s hard to imagine how these highly liquid markets would ever have emerged. This whole mess would never have happened.

Technorati Tags: investment, real estate, real estate marketing