Holy smokes! I get questions for appraisers, for inspectors, for real estate attorneys, for everyone involved in a real estate transaction except the ding-dong Realtor. Here comes a question for mortgage lenders, who are entreated to chime in with better answers:

Generally speaking, are homeowners personally liable for their mortgage? If yes, is it possible to structure a home loan that doesn’t require a personal guarantee?

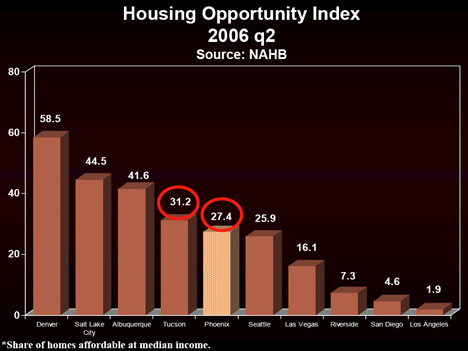

Generally speaking, yes, a mortgage is secured both by the real property and by the borrower’s personal promise to repay the note. If the down payment is 10% or 20%, the personal promise may not be as significant, but if the down payment is very low or if real estate is declining in value (as it is right now in many markets), the lender will depend on the borrower to bring any short-fall to the closing table, should the home sell for less money than is owed on it.

But: There are many types of loans that are not secured by the borrower’s personal promise to repay. The loan will be secured by the real property borrowed against or by other assets, but a foreclosure won’t affect the borrower’s personal credit rating.

Here is an example that can be used for residential loans: The Non-Recourse Loan. The loan is secured by the real property only, with no “recourse” to the borrower on default. Obviously, the lender is going to make sure the amount lent is substantially less than the value of the property, that the property produces income sufficient to pay its own expenses, etc.

This is an investment product, but the interesting thing about non-recourse loan is that they can be used by self-directed retirement accounts, to permit them to own real estate. Your self-directed IRA, as an example, would have to make a hefty down payment on a piece of real property, and there are rules about what your IRA can own and to whose benefit. But by means of the non-recourse loan, your IRA can own (and leverage) real estate to build your retirement nest egg tax free…

Technorati Tags: real estate marketing