This is a Phoenix-local question in its original form, but I intend to answer it from a broader perspective.

What is the forecast for home prices along the light rail route once the route is completed? Boundaries: 7th Ave to 7th St. and Camelback to Thomas.

The most important thing to understand about the forthcoming Trolley in Phoenix is that it’s built on the wrong route. This was deliberate. The greatest concentrations of bus passengers in Phoenix are in Sunnyslope and in South Phoenix, at either end of Central Avenue.

The most important thing to understand about the forthcoming Trolley in Phoenix is that it’s built on the wrong route. This was deliberate. The greatest concentrations of bus passengers in Phoenix are in Sunnyslope and in South Phoenix, at either end of Central Avenue.

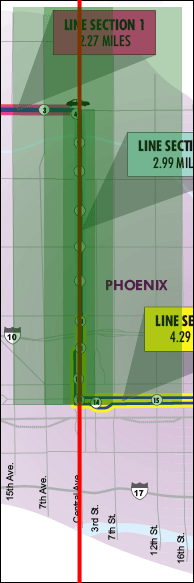

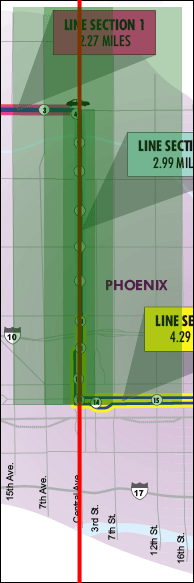

To the right is a Valley Metro map that I have amended. The correct route for the Trolley is shown in bright red, right down Central Avenue. This would move the greatest attainable number of passengers, both from the current Number Zero bus route and from all the transfers from the east/west routes along Central Avenue.

But the purpose of the Trolley is not to move passengers but to move the sympathies of voters, so Valley Metro deliberately picked a route that will serve far fewer passengers but will appease various politically-powerful factions (most especially the millionaires living on Central Avenue between Camelback Road and the Arizona Canal to the north).

But the question before us is: What is the real estate investment value of the Trolley?

The answer? Essentially none.

In the map, the darkest green stripe runs from Camelback south to Washington, from 3rd Avenue to 3rd Street. This region is zoned for high-rise development, subject to Historic Preservation rules and freelance NIMBYism. If any land is likely to be affected by the Trolley, it is this land. But: The people who will make money trading this land will be very experienced land brokers. The people who will lose money trading this land will be punters who think they are getting over on very experienced land brokers.

The middle green band is the land from the Arizona Canal to Washington, from 7th Avenue to 7th Street. This land is ripe, with or without the Trolley. Buy and live, buy and hold, flips, especially tastefully-done historic flips, tear-downs, rezoning for higher-density — there is no limit. People want Read more

determining which city has the best (or worst)

determining which city has the best (or worst)

The most important thing to understand about the forthcoming Trolley in Phoenix is that it’s built on the wrong route. This was deliberate. The greatest concentrations of bus passengers in Phoenix are in Sunnyslope and in South Phoenix, at either end of Central Avenue.

The most important thing to understand about the forthcoming Trolley in Phoenix is that it’s built on the wrong route. This was deliberate. The greatest concentrations of bus passengers in Phoenix are in Sunnyslope and in South Phoenix, at either end of Central Avenue.