HR 3915, The Mortgage Reform and Anti-Predatory Lending Act of 2007, was introduced by Barney Frank, (D-MA). Congressman Frank is also the Chairman of the House Committee on Financial Services. I outlined the key components of the bill with a link to the text here.

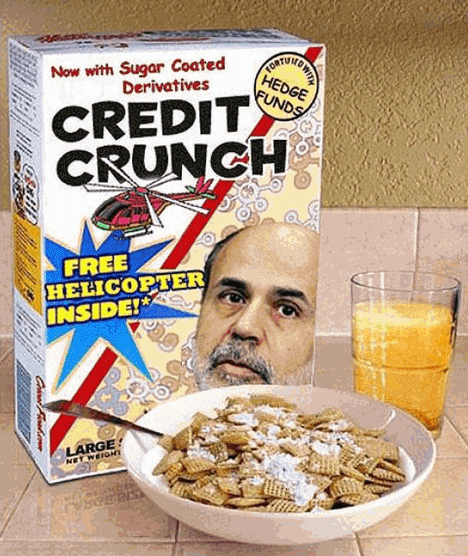

The danger behind this bill is that it doesn’t regulate the proper parties. When you read through the text, you’ll discover that there are two entities that are shouldering the brunt of the blame for the meltdown of the sub-prime mortgage market: originating firms and Wall Street securitizers. The bill stops short of levying any responsibility to the two most interested parties: borrowers and lenders (the individual investors). This bill exonerates them of the responsibility of due diligence.

Experience is the best instructor. An investor needs to lose 10% of his mortgage pool investment and a borrower needs to have his home foreclosed. That experience will instill a sense of personal responsibility in both parties. While loss of investment principal and foreclosure are devastating experiences, the old adage “time heals all wounds” truly is appropriate.

Jane Shaw, discussing Public Choice Theory:

Public choice takes the same principles that economists use to analyze people’s actions in the marketplace and applies them to people’s actions in collective decision making. Economists who study behavior in the private marketplace assume that people are motivated mainly by self-interest.

Ms. Shaw further exposes the dangers of regulation to correct market failure:

In the past many economists have argued that the way to rein in “market failures” such as monopolies is to introduce government action. But public choice economists point out that there also is such a thing as “government failure.” That is, there are reasons why government intervention does not achieve the desired effect.

This bill will provide a false sense of security to the consumer and encourage even more irresponsible behavior. Rather than let the instructional nature of failure naturally correct the market, the regulation would contract the industry so as to dissuade innovation and competition. The scoundrels will fleece the ignorant under the Read more

Do you want to fight a war on poverty? A war on terror? A war on the senseless waste of the sole source of capital, the human mind? Here’s your chance. For two weeks in November, you’ll be able to buy two XO laptops, the One-Laptop-Per-Child computer, with one coming to you and the other going to a hungry young mind overseas.

Do you want to fight a war on poverty? A war on terror? A war on the senseless waste of the sole source of capital, the human mind? Here’s your chance. For two weeks in November, you’ll be able to buy two XO laptops, the One-Laptop-Per-Child computer, with one coming to you and the other going to a hungry young mind overseas.

This is my 30th year in the real estate business. I started with John Hall & Associates early in the year in 1978. Now for the far more important question, has your lot investor suffered a real loss. It depends on how you look at it. Is the “loss” real to her? I think that answer is yes. Is it real to me? Not so much.

This is my 30th year in the real estate business. I started with John Hall & Associates early in the year in 1978. Now for the far more important question, has your lot investor suffered a real loss. It depends on how you look at it. Is the “loss” real to her? I think that answer is yes. Is it real to me? Not so much.