Information can be a glow in the darkness. Traditional higher education models are losing market share to cheaper education delivery systems. Young people now have the opportunity to learn the very same principles for free that are taught to the people they may eventually hire to run their businesses. I think this free market trend will eventually overtake the traditional post-secondary education models. I wouldn’t be surprised to find a fully-funded college education available, competitive with some of the best traditional colleges, in the not-too-distant future.

I can see a future where the ultimate end-users of that education (private industry), see the benefit to developing accredited curricula, and offering them to current and potential employees, at a greatly reduced cost (maybe for free). I’m not just talking about an MBA from “Mutual of Omaha University“. Think “University of the American Way“, delivering bachelor’s degrees to the masses- graduates might receive checks from the alumni association rather than sending checks to it.

Education via extension isn’t a new idea. This ACC school has been granting degrees, to off-campus students, since the 1940s. Online education is now a pop culture phenomenon. If this educational delivery system grows like I think it will, how can the real estate brokerage or mortgage lending communities profit?

The idea that education can get cheaper (moving towards free) and more readily available will be an irreversible trend. No longer can we hide behind the phrase “proprietary information” or “specialized knowledge”. Consumers may educate themselves about how to get a VA condo complex approved and find that my “specific knowledge”, while helpful, doesn’t permit me to charge a one point premium to my lesser educated competitors. My specific expertise DOES drastically reduce my marketing costs, allowing me to retain more profit than my competitors.

Information can be exported inexpensively. Imagine holding a webinar online, explaining the benefits of owning a Costa Rican vacation property, to German pharmaceutical executives. Then, imagine holding a different webinar, to a group of retired Americans in Costa Rica, about investing in mortgages so that those Germans could borrow their money and buy from those properties. Would that add Read more

Cathleen bought her mother an iPhone just lately. Aloma Collins is 88, and her health is slowly failing. She’s in an awful spot, unable to do much and yet bored to tears.

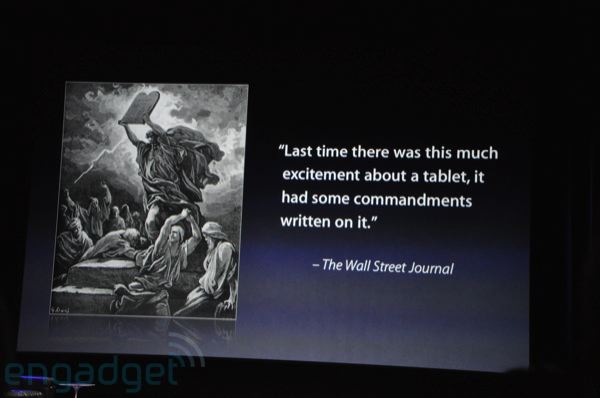

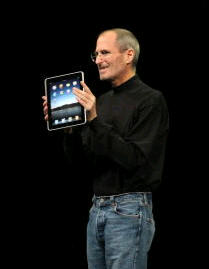

Cathleen bought her mother an iPhone just lately. Aloma Collins is 88, and her health is slowly failing. She’s in an awful spot, unable to do much and yet bored to tears. Here’s the question that will appear in the deep-think mainstream media analyses of the brand new Apple iPad:

Here’s the question that will appear in the deep-think mainstream media analyses of the brand new Apple iPad: