I have SO many posts I need to write and have not taken the time. But I just HAD to get THIS one out. 🙂

There’s always something to howl about.

I have SO many posts I need to write and have not taken the time. But I just HAD to get THIS one out. 🙂

Tanking new homes sells should have real estate flippers and small investors worried. Today KB Homes reported a loss of $149 Million. Additionally, CEO Jeffrey Mezger remarked in the Wall Street Journal, “We can’t predict when market conditions will improve,” essentially ensuring investors conditions will not improve next quarter. Homebuilders have been feeling the pinch for over a year now, but it is finally getting serious.

Surface level analysis of the problems with homebuilders points to signs of a tanking real estate market and excess supply of new homes in some markets. Given the choice between a new home and a “used” home, most consumers will choose the new one. Additionally, homebuilders have the power to offer incentives like upgrades, favorable financing, and lower prices to move their inventory. Investors in hot markets that are cooling will find it hard to compete with institutions like KB Homes, Toll Brothers, Lennar, etc. This will make it tough to move, even the nicest flip.

Furthermore, this situation definitely signals a slowing in the real estate market. Despite what many have been saying on the Realtor/NAR front, investors and agents alike should be preparing for a real estate slow down. KB Homes sites access to capital as one of the mitigating factors affecting home buyers among other factors. This access issue will affect buyers, as well as more aggressive investors, who opted for no money down loans.

The deeper analysis suggests all of the negative news will eventually affect the market sentiment on real estate. Over the past six months the real estate market has seen the collapse of the subprime real estate market, issues with commercial and investment banks, mortgage rates rise, and issues with homebuilders. At some point investor and consumer confidence in real estate has to be affected by all of this news. While this news may not be the tipping point, investors should be asking how much more can the market take?

Investing is part fundamental and part irrational. At times the market seems to go 90/10 one way, and at times those proportions flip. As more negative real estate news emerges Read more

The old adage “the early bird gets the worm” points to the advantage of being first to market. But, has anyone ever thought about the early worm, clearly he was not so lucky. Many of the people who are jumping into the foreclosure market now may be the early worms.

Typically, I am the first one to support jumping into a market that has sustained a significant decline in fundamentals and an increase in the foreclosure rate. The problem with today’s market is the lack of an exit strategy for this type of investment. Take Michigan for example, I luckily got out of this market in 2005 during a downturn. While I made a healthy profit, the investors who bought properties during that time are now the same investors in foreclosure.

The difference between the 2005 market and today is simply access to capital. Many foreclosure markets have two types of buyers. The most common buyers in these markets are low-income families looking to move into their first or second home. In the past these buyers were able to secure subprime or other credit neutral financing. With these vehicles gone or very hard to find, these buyers have been taken out of the market.

The other buyers in these markets are investors. Typically, savvier than families, investors like to get in for a bargain. Unfortunately commercial interest rates have been steadily rising and the prospect of moving these properties has been declining. The commercial interest rate directly affects the value potential of the property. Consider an increase in the commercial multifamily interest rate from 6% to 7.5%. On a $100,000 loan, that is about $100 a month payment increase. With rents holding steady in many markets, the investor will probably have to eat this increase.

Two to five years ago investors could simply rent a property out while waiting for a sale. That option has almost been taken away with the increase in interest rates. Additionally, having a renter in the property opened the buyer pool up further to cash flow investors. Now, the only investors left to turn to are the speculators, looking to Read more

I was running in a local park a few days ago. The road into the park is about a half mile long and barely wide enough for two cars to pass in opposite directions, thus there are “NO PARKING AT ANY TIME” signs on both sides the entire length. As I drove in two mini-vans were parked next to a field, and I waited as two other cars coming the other direction passed. Three women were in the field chatting and setting up cones, perhaps for a relay.

I was running in a local park a few days ago. The road into the park is about a half mile long and barely wide enough for two cars to pass in opposite directions, thus there are “NO PARKING AT ANY TIME” signs on both sides the entire length. As I drove in two mini-vans were parked next to a field, and I waited as two other cars coming the other direction passed. Three women were in the field chatting and setting up cones, perhaps for a relay.

As I ran out ten minutes later, the vans were still there, but now there were five cars stopped in one direction while three others drove by in the other. The women were oblivious, corpulent Paris Hiltons. When I suggested they move their vans to a parking area fifty feet away, one said “Oh, get real. It’s not as if this is a major thoroughfare.” Solipsism at its summary best. Rules are fine unless they’re inconvenient.

…

696.810 Real estate licensee as buyer’s agent; obligations….

(3) A buyer’s agent owes the buyer involved in a real estate transaction the following affirmative duties: …

(c) To be loyal to the buyer by not taking action that is adverse or detrimental to the buyer’s interest in a transaction;

(d) To disclose in a timely manner to the buyer any conflict of interest, existing or contemplated;

Whenever the charge of venality is brought against the real estate profession, out comes the Code of Ethics, here codified into Oregon statute. It’s our Wizard’s Curtain; while most agents I work with — and I suspect most people here — take it very seriously, too many don’t.

The reason high BACs and agent bonuses are used so often as marketing ploys is because they work. I was told recently by one agent who incorporates both in many of his older listings that not only does he immediately get more showings, once under contract the buyer’s agent is much more eager to cooperate to get Read more

New investors rarely stop to address the subject of risk tolerance. People who have never done a single real estate deal see others making a lot of money in real estate and want to jump right in. They never stop to understand the true risks of real estate.

Most investors and books will tell you that real estate is a pretty safe asset class to invest in. This is certainly the case if you are buying core buildings or if you are employing a reasonable buy and hold strategy. Sadly, many investors hear safe investment and assume that opportunistic investing is just as safe.

If an investor is solely a real estate flipper, he/she is taking more risk than investing in the stock market. That might be a surprise to some, but consider the returns. On average the stock market returns 9-13%, while flippers should expect 15-20% returns on their capital investment.

This higher return is certainly accompanied by more risk. First, consider the fact that in the stock market your downside risk is typically capped at 20-30%. Very rarely does the stock market lose more than 10% in a given year. Additionally, a single blue chip stock is not likely to even have that kind of a loss. In contrast, a flipper has a very real chance of losing all of the money invested in a deal. The odds of this are even higher for a novice flipper.

Another aspect of real estate investing is the sweat equity or opportunity cost of the investors time. I can go into my E*Trade account in about two minute, buy a Dow Jones ETF (exchange traded fund), and essentially guarantee myself a 9-13% return on that money for 20 years. However, if I decide to flip property I either have to hire a property manager or I have to act as general contractor, organizing the work to be done. Either way, investors will still spend a tremendous amount of time working on site or dong something with the investment.

Taking Read more

Addressing several people’s concerns about the state of private equity and the possible assertion that private equity could be the next fallout candidate, I thought I would look into this situation a bit more. For those of you who think that this discussion will be outside of the scope of commercial real estate investing, read on and I am sure you will be pleasantly surprised.

At the 8th Annual US Real Estate Opportunity & Private Fund Investing Forum several very important items of note were mentioned. The most significant item is the increase in fundraising efforts, which has moved up from $35 billion in 2005 to $60 billion in 2006. On the heels of that announcement, Morgan Stately Real Estate has just announced it has raised an $8 Billion fund designed to invest in Real Estate in established and emerging markets.

Before I discuss how these numbers will affect the common investor, I want to take a step back and clearly outline what a Private Equity Real Estate Fund or Opportunity Fund does. First, these funds begin by raising investment capital. The larger funds typically bring in money from pension funds, hyper wealthy individuals and governments all over the world. Then, they take these funds and make leveraged investments. An $8 Billion fund will probably invest in about $30 Billion worth of real estate. Investors typically expect returns of 12-20% based on the investment strategy and they expect to exit the fund within the span of 7-10 years.

These funds make a variety of investments. First, they typically invest in all major commercial property types (hotel, industrial, office, retail, and apartments) and minor ones as well (storage units, trailer parks, malls, etc.). Additionally, they may purchase Real Estate Investment Trusts, Mortgage Companies, Real Estate Services firms, etc. With $30 Billion to invest, any and all real estate investments are fair game.

Over the past 20 years the private equity industry has grown tremendously. While the major players (Blackstone, KKR, etc.) get all the headlines, many smaller private equity firms operate in lower tier investment categories. If KKR looks for Billion dollar deals, these firms will Read more

I have never been a huge fan of the status quo. While I have some appreciation for the mundane, I would rather blaze my own trail than do things as they have always been done. Interestingly enough, this really comes in handy when approaching investment properties. Doing what makes sense to me may not be the status quo, but it makes me feel comfortable.

Recently, I was looking to close a deal on a 32 unit apartment complex. When asked by my agent how many of the units I wanted to look at, I remarked, “Uh, all of them.” He seemed taken aback by this, and then mentioned that taking a sampling of the units was the status quo. Perhaps looking at five or ten and then extrapolating what the other units look like is a tremendous timesaver. Lucky for me I had all the time in the world.

Interestingly enough all but four units actually looked good, but those four units looked really bad and had a material effect on my offer and the amount of concession I asked for. Looking at all the units would have saved me about $8,000 had I closed this deal. Even as an investment banker, I cant make $8,000 for three hours worth of work.

I will also take this brief interlude to point out the inherent conflict between realtor and investor. That extra two hours actually cost my realtor about $380 (3.5% x $8,000), plus two hours of actual work he could have done securing additional deals. Clearly the status quo worked in his favor. I don’t mean to suggest that is why he mentioned it, but I do mean to suggest that it is harder for him to work in my best interest when our incentives don’t align.

As investors it is important to remember that a deal and all of its components must make sense to you. While the status quo is surely there for a reason, it may not be in your best interest to follow the status quo. Many first time investors or investors who are unsure of themselves fall back on Read more

The long absence is finally over. After a grueling finals week and graduation, a two week vacation, a move to New York City, and a failed real estate deal, I am back with the pack. Based on the great content that I have seen coming from the site, I can assume my absence has gone unnoticed. In order to come back with a bang, I thought I would share a quick life lesson about real estate. The lesson: Real estate is a people business, so it is important to do what you say you will do, and maybe more, but certainly never less.

Here is a quick example. My latest deal to buy two apartment complexes in Greensboro ended in utter failure because one person simply did not do what they said they would do. Before considering this deal, I wanted to be sure there would be enough financing in place to make it happen. While I could have really stretched, begged, and borrowed to get all of the 20% that I needed for the down payment, my trusted mortgage broker recommended I partner with a local investor. He assured me that he could find me a suitable partner within the 30 day due diligence period, so I proceeded with the deal.

To make a long story short, no partner ever materialized and I was forced to bow out of the deal shortly before the end of the due diligence period. Given my upfront nature, I had already informed all parties that this deal hinged on me finding a suitable partner, which over a group dinner my mortgage broker ensured everyone would happen fairly quickly. Fairly quickly, turned into days, then a month and still a partner had yet to emerge.

In the end the mortgage broker’s reputation was trashed after this deal. My agent, who does a lot of great commercial work in the area, has decided not to work with the mortgage broker again. Additionally, the seller’s broker has also black listed this broker, and I think it is obvious that it will be a cold day in a very hot place Read more

It’s been a wonderfully grumpy week. Please indulge me:

When the NY Times came out with its piece on the Madison, WI FSBO market, the NAR typically over-reacted and sent out another set of talking points. Last time they did that — Sixty Minutes — they received some well deserved ridicule; I’m apparently not alone in finding talking points condescending and wholly counter productive. So this time they added: Please do NOT circulate this document.

Yep. That should help.

On a related note, today’s REALTOR&174; Mag email link gives a wonderful illustration on how spin backfires:

Poll: Few Consumers Know What You Do

A new survey by the Washington, D.C.-based Consumer Federation of America reveals that while 84 percent of consumers have a favorable opinion of real estate agents and brokers, many of them lack an understanding of the services that real estate professionals provide.

From which it’s easy to infer that people love us, even though they aren’t aware of all we do in a given day.

But. Here’s the actual survey. [Note I’m not defending the survey itself since it’s so badly conceived it exists primarily to establish its own conclusion.] The takeaway from the press release:

“Taken as a whole, these survey data suggest that consumers value the services provided by agents and brokers, and have usually had good experiences with these agents and brokers, but that their views are positive in part because of their lack of awareness of specific industry practices that could harm their interests,” said Brobeck.

Juuuuuuust a bit outside.

And the 84%? That’s the percentage of A) The 29% in the survey who’d bought or sold within the last five years; and B) who were rating their own agent. The generic number for all surveyed is 68% favorability, which means a third need a little extra convincing, more than would be required, say, by a set of talking points. One third is a serious number for a profession that begins its appellative with a capital and ends it with a circle R.

Speaking of which: You know the guy you meet at the cocktail party, the one who Read more

This started as a reply to Greg’s post on the Tennessee legislature, which apparently insists going backward is the new going forward. But then I had The Conversation, and it’s developed into a post of its own.

Involved is someone I respect, a friend, a mentor, perhaps the one person more responsible for getting me into real estate than anyone. In the business over twenty years, he knows RE law better than most principal brokers, and has helped me enormously in the first three years I’ve been around.

Oregon is one of the eleven states that has a “Thou shalt not share commission!” law, passed at least fifteen years ago, notwithstanding Glenn Kelman’s Sixty Minutes inference that it was all about him. I wanted to know why it was passed in the first place: Assuming consumer protection against graft or corruption, I couldn’t figure out how that worked. The answer dumbfounded me:

“That protects us, our commissions. I’m glad it’s there.”

Oh, dear. Thank you for the candor. Elaborate?

“Look, I know you’re a free market kind of guy, but there’s nothing wrong with laws protecting us from consumers. People try to hack away at my commission every day on the listing side. This prevents the same kind of hacking on the buying side.”

Wait. Aren’t you worth the commission you charge? “Of course. That’s my point.” Then when someone asks you to cut your commission, what’s wrong with: No. Why do you need a law, especially a law that reinforces the public perception that we’re all self absorbed troglodytes?

“Twenty years ago, before the internet, we didn’t have that reputation. Now 80% of transactions don’t even really need a buyer’s agent.”

Say what?

It went on, defensively and testily. The internet’s the problem, we’re the victims. When I brought up separating buyer commission from listing commission, he said he hoped he was well out of the business before that happened.

It’s occurred to me: his opinion isn’t an anomaly; as I said here the biggest problem we face as an industry is our industry. I can’t begin to get my mind around treating clients as adversaries, Read more

Apropos of pretty much nothing: my two daughters — for whom I live — drove down from Seattle last weekend and threw me a surprise birthday party. The appropriate aphorism: “A good time was had by all.” I just found two party hats in the freezer.

Which provides a seriously imperfect segue into: Nordstrom. Since the time I spent there informs nearly everything I’ve done in business the last thirty years; because what we do as full service agents has been rightfully compared to the Nordstrom model; and because I’ll reference them often, it might be worthwhile to give some background:

I was there when they were just breaking into the California market, before the Department of Labor made them shut down any employee off clock hours — which means a concerned Nordy personally delivering a prom dress to a hormonally anxious deb is considered illegal — and before any organized gangs began using their return policy as a profit center. The employee manual read in its entirety “Use your own best judgment at all times”, twenty five year old buyers were given multi-million dollar budgets with the single instruction “Buy what the customer wants…”, and every employee was given the imprimatur to say only one thing: “Yes.”

In the early seventies one billboard on I-5 leading out of Seattle read “Will the last person leaving please turn out the lights?”, but leading in to the city was another billboard that read simply “We understand there’s a recession. We’ve elected not to participate.” and signed Bruce Nordstrom. When the same Bruce Nordstrom — “Mr. Bruce” in the vernacular — was asked in a meeting why it was necessary to give money back to people who didn’t seem to deserve it, after an eternal icy silence he said: “That’s my money. You’ll give it back until I tell you differently.”

Everyone has probably heard the (true) anecdote of the radial tires returned for a full refund at the first San Francisco store. What everyone doesn’t know is that, while most department stores at the time funded their advertising at 4% of sales, we budgeted 2%. Read more

So I’ve spent the last hour trying to navigate Word Press — I’m going to bet it’s much easier than I’m making it — have written a terribly serious post on the allegorical link between Nordstrom and real estate, and decided that’s a really inelegant way to introduce myself.

Yes, thirteen years with Nordstrom in the late sixties and seventies, the perfect business education. Twenty five years as a manufacturer’s rep, until getting on planes and traveling salesman jokes simply got to be overwhelmingly dull. I got my real estate license nearly three years ago, and immediately wished that I’d done it years before.

Which means most here probably know more about real estate than I do. The reason I came to Bloodhound Blog in the first place was to learn.

What I do know is people. Why they buy, their motivations and reactions. I know that the Arizona Board of Appraisal is thoroughly nuts for thinking it can shut down Zillow, or even trying. I have a pretty good notion Redfin will be out of business in two years. Sixty Minutes is an anachronism.

And I’m certain the real estate business is changing. Much of the status quo is antithetical to anything I learned at Nordstrom: the industry gets much of its incentive from what’s best for the industry, not what’s best for the people we serve. I’ll never understand the first seminar I went to after I was licensed, where the instructor said good agents spend 90% of their time prospecting for new clients. 90%. If I spend that much time selling myself, what, exactly, am I selling?

Phil Knight said: “Nike is a marketing company, but our product is our number one marketing tool.” What I do for buyers and sellers is my product, and my interest is in being as good at that as I can be.

That’s why I’m here; I really, really look forward to it.

Thanks, Greg; I’m honored!

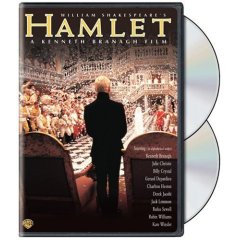

How long is The Long Tail? Long enough, even, for Kenneth Branagh’s Hamlet, ten long years after its theatrical release. I despair for the state of staged drama, and not just in the chip-on-its-shoulder burgs, but this, in Horace’s phrasing, is “a monument more lasting than bronze.”

How long is The Long Tail? Long enough, even, for Kenneth Branagh’s Hamlet, ten long years after its theatrical release. I despair for the state of staged drama, and not just in the chip-on-its-shoulder burgs, but this, in Horace’s phrasing, is “a monument more lasting than bronze.”

The news: Kenneth Branagh’s Hamlet is to be released on DVD, at last.

We’ve been on the waiting list at Amazon.com for years, and I’d like to hope that this is a vindication of the waiting list idea, a social tug-of-war to stretch The Long Tail.

I’ve written a lot about this film, huge surprise. The introduction below was written in November of 1997. The Cameron you meet there would have just turned six years old. The review comes from February of 1997, at the time of Hamlet‘s theatrical release.

Hamlet past his bedtime

I rented Branagh’s Hamlet last night. I had seen it this spring at a big-screen theater in Phoenix, an unforgettable experience. Sadly, the videotape is not letterboxed, so much of the wide screen impact is lost. Nevertheless it is quite fine and very worth renting — or buying.

My six-year-old son Cameron came out of his bedroom and tried to pretend that he just had to see the film, a staying-up-late ploy that never works and that he never stops trying. Surprise of all surprises, last night I let him stay up, and he surprised me by becoming engrossed. I had to synopsize for him now and then (though Hamlet in synopsis is very brief), but he figured out from the synopsis that Hamlet and The Lion King are the same story. Not even Cameron can stay up as late as Kenneth Branagh, but he made it to the slaying of Polonius, nearly two hours.

Branagh’s Shakespeare is vigorous, to say the absolute least, but this can’t be a vice when we are so used to thinking of these plays as dry and dull, the fitting penance of a schoolhardy youth. In the theater I thought the ghost was too much, but it was just enough on the television screen, and it was the ghost who hooked Read more

We saw a performance piece called “Love, Janis” last week. It wouldn’t do to call it a play. It was more of a fictionalized chronicle of Pearl cavorting with her inner child while blasting through her greatest hits at top volume. The music was beyond excellent, and the interstitial crap was no worse than Ray or Walk The Line or The Doors — no act of evil or self-destruction is ever your fault if your records chart well. Creepy and dopey (no pun intended), maudlin and mopey, but ultimately nothing. If they had cut all that and doubled up on the music, it would have been a knock-out tribute show.

Here’s the beef: Was this raucous rock ‘n’ roll encomium performed at an Indian casino, alternating with the Tina Turner and Michael Jackson impersonators? No, alas. Was it the 8 and 10 o’clock headliner act at an off-Strip locals resort in Las Vegas? Guess again. No, “Love, Janis” is part of this season’s “drama” from The Arizona Theatre Company, one of eight “plays” to be presented this season to audiences of rich white people, whose seats will be graciously subsidized by poor black and brown people.

This is “theauhtuh, dahling,” an allegedly high-brow undertaking undertaken in that high-brow “performance centre” downtown — itself graciously subsidized by people who only make it downtown when they are dispossessed by fate and taxes. And although I am speaking of Phoenix, particularly, everything I’m saying goes for every chip-on-its-shoulder burg in America. “We can’t be a true city without theauhtuh, dahling,” even if that “theauhtuh, dahling” turns out to be a complete joke.

What’s the real point of this ugly charade? Wealth is waste, but how can one justify the indulgence of a thousand-dollar gown if there is no “theauhtuh, dahling?” No symphony? No opera? No ballet? None of these boondoggles is profitable, and that by itself is an excellent argument for doing away with them. Mozart can’t make money, but neither can “pops” music conducted by TV’s Doc Severinsen. Cage fighting turns a buck, as do rodeo and tractor pulls, but how can one wear a designer Read more

In no particular order:

Who has the most irritating driving habits, men or women? I don’t think this question has an answer but found the comments section funny.

__

The other Russell Shaw. Actually, there are several. This one I’ve been in touch with several times over the past few years, as people sometimes send him an  email in an attempt to reach me. Russell always forwards them to me. He is (in addition to being a very nice and very bright

email in an attempt to reach me. Russell always forwards them to me. He is (in addition to being a very nice and very bright

guy) a VERY prolific blogger. And until now he had not been blogging about real estate. He is now. As much as I might like to take credit for some of the insightful things he writes, I don’t want to risk getting caught – so I wanted to point out that I am not “that Russell Shaw”. In the past it was Russell the blogger and Russell the Realtor. The line became blurred once I joined BloodhoundBlog and now the distinction of “the one who blogs about real estate” just went away too.

He damn sure better not move from Portland to Phoenix and go into the residential real estate sales business – because then we are going to have trouble. 🙂

__

Years ago I read a book (now out of print) called the Robert Half Way To Get Hired in Today’s Job Market. Robert Half had and has one of the largest employment agencies in the world. As I’ve always considered the process of me “getting a listing” me applying for a job – I got a lot out of it. About two years ago I happened to run across this website and was very impressed. His name is Nick Corcodilos. He has a free weekly email newsletter where he responds to letters from people looking for jobs. Lots of smart employers and business people read it regularly. There isn’t something I can use in every issue but there is often enough to make it worth my time.

__

I received the following email from Kerry J. Grinkmeyer:

—– Original Message —–

From: Kerry J. Grinkmeyer

To: Number1Expert@nohasslelisting.com

Sent: Wednesday, April 25, 2007 2:47 PM

Subject: Your Recognition Plaque

Russell Shaw

Congratulations on Read more