Via Search Engine Land, trooly stoopid social networking hits the bricks.

Technorati Tags: disintermediation, real estate, real estate marketing

There’s always something to howl about.

Via Search Engine Land, trooly stoopid social networking hits the bricks.

Technorati Tags: disintermediation, real estate, real estate marketing

Think about this: Trulia’s brand is trumping the franchise brand, requiring payments to Trulia, and the franchise brand is trumping the brokers’ and agents’ brands, requiring payments to the franchise. At the same time, the brokers and agents in the field are building the business relationships that form the foundations of the all the brands. They’re doing all the work and they’re having to pay very dearly for lead generation that the web is supposed to be making more efficient. Efficiency for Trulia and Realogy, perhaps, but it doesn’t look very efficient for the brokers and agents.

Check. I think working Realtors need to work without ceasing at developing sources of business that do not require you to give up half of your own deal to cling to the other half. Forget commission relief. There are way too many mouths to be fed upstream.

These business models don’t work in the long run. There’s a fascinating post today on O’Reilly Radar about how Google and others, in their quest to “free” information, need to be careful not to destroy content creation. Here’ a quote from a Google employee, I find highly relevant to MLS today: “”Some think of Google as selling search. Some business types think it sells ads. I think it needs to be in the business of ensuring there’s something to sell ads around.” Yes, exactly. We need to protect content creation, especially the content that’s hard to create, like broad, deep and standard listing information.

Sooner or later, the brokers and agents will figure out that they are paying too much money to Trulia or their franchises for these leads and that they can do it more efficiently through cooperation. This brings me back to the MLS, back to local decisions in the best interest of all competitors. The MLS can and will figure out a way through these challenges. The specific business model for data aggregation and sharing on a broader scale may not exist yet, but the solution exists in a framework of trust allowing MLSs to foster a national non-advertising listing portal controlled by the brokers and Read more

O’Reilly: Is time running out on the Chronicle? Winer: How to reset the clock.

Technorati Tags: blogging, disintermediation, real estate, real estate marketing

Trulia was selected by the Real Estate Board of New York (REBNY), New York City’s largest and most prestigious real estate group, to power the first real estate search engine dedicated exclusively to New York City-based listings.

More:

What does this mean?

For consumers, the new search engine will bring together residential property listings from REBNY-member real estate brokerage firms onto a single public Web site for the first time. For the non-New York readers out there…it’s worth noting that Manhattan’s hugely important real estate market does not have a widely used MLS that would allow access to all listings through any single Web site today.

A few dozen ambiguous fields is not an MLS system, but it’s better than what New Yorkers have now. And, who knows, maybe the horse will learn to sing…

Technorati Tags: disintermediation, real estate, real estate marketing

This is me in today’s Arizona Republic (permanent link):

Realty.bots will make sellers happy

We talked last week about the move by Realogy Inc. to supply millions of real estate listings from its national brokerage chains to upstart Realty.bots Google Base and Trulia.com. This puts the Realty.bots on the map. Who else is affected?

Sellers should be happy. Realty.bots are really not effective real estate search tools, but they are excellent home shopping sites. Listed homes will be exposed to thousands of users who might not have seen them on Realtor.com or local brokers’ Web sites.

Buyers could be happy. Trulia.com can seem like the Disneyland of real estate: Bright colors, interactive maps, even a Google Earth interface.

But buyers might stop to reflect that a Realty.bot listing is not very different from an exclusive listing. My wife and business partner, Cathleen Collins, was out with a buyer who saw an “exclusive” sign and asked what it meant. Her answer was concise and stingingly accurate: “It means they don’t want you to have representation.”

In fact, Realty.bot listings normally are not exclusive listings. They just look like it. When you click through for information, you are contacting the listing agent directly — or the listing brokerage or brokerage chain. If you proceed with the purchase of that home, you will either be unrepresented or you will be represented by the listing broker. You will not have your own buyer’s agent.

Realtors probably should be unhappy with Realogy’s move. Realty.bots tend to cut buyer’s agents out of the transaction altogether. This won’t save the buyer any money. The listing broker will just get paid double.

But listers also have cause to be unhappy, because the listings Realogy is providing to the Realty.bots will click back to Realogy, not to the listing agent or brokerage. My thinking is that their plan is to sell listers the leads their own listings generate.

It’s a brave new world in real estate. It will be fun to see how this plays out.

Technorati Tags: arizona, arizona real estate, disintermediation, phoenix, phoenix real estate, real estate, real estate marketing

What’s half-way between a Zestimate and a real appraisal? Lenders and borrowers are eager to get the benefit of the doubt of a full appraisal without the full-blown doubts incurred with an Automated Valuation Method.

Enter Zaio.com, which is building a nationwide database of drive-by appraisals — really driven-by appraisals. From the San Jose Mercury News:

Zaio started off as a little-known Canadian company founded by Brad Stinson, an appraiser who tinkered with software. Stinson, now vice president of business development for the company, still has an office in Calgary.

Although the company has a low profile, recent hires such as Douglas Vincent, former chief collateral officer with Countrywide Bank, and John Ross, former CEO of the Appraisal Institute, a national organization in Chicago, are making people take notice.

“Our goal is to have information on every home in America,” said Tom Inserra, president and chief executive officer of Zaio from his Scottsdale home. “We already have hundreds of photographers and appraiser trainees and are deploying them around the country quite rapidly.”

The photographers have been sent to 170 cities in the past two months, covering the territory and sending it back to Zaio’s servers. Although the cities of Mesa, Ariz., and Spokane, Wash., are completed, part of the first wave is the Bay Area, and Brentwood seems to be the start of an estimated 80 million homes that will eventually make up Zaio’s database by 2010.

Inserra said that many Web sites have taken aerial photographs of homes, but the system was lacking real-life photos. The information isn’t available to the public but to banks, insurance companies and lenders who will use the service to help determine appraisals objectively, he said.

Zaio’s workers are required to go through a background check, wear company ID and clothing and hand out pamphlets written in both English and Spanish to anxious homeowners. The company also alerts the police department they will be in the area.

“We don’t invade someone’s property or try to sell them anything,” he said. “We’re also the only company we know who will let the homeowners opt out. … If you call Google, they won’t take your Read more

Happiness Is A Warm Gun

I swear I am not trying to pick on Zip Realty but I just couldn’t pass this one up. I saw this on Inman News. From a press release – and I quote:

Real estate brokerage company ZipRealty Inc. today announced a net loss of $20.2 million in fourth-quarter 2006, or 96 cents per share, compared with net income of $17.9 million, or 73 cents per diluted share, in fourth-quarter 2005.

For the year ended Dec. 31, 2006, ZipRealty reported a net loss of $20.6 million, compared with net income of $20.5 million for the full year in 2005.

“We are pleased with our fourth-quarter results, which exceeded expectations in terms of revenue and profitability,” ZipRealty CEO Richard Sommer said in a statement.

They LOST 20 MILLION DOLLARS in last three months of the year and they are pleased with the results. Well, if they’re happy about it, then I’m happy for them.

Should we say goodbye to the half-assed listing? Mike Price:

Today Buyside has announced an ABA, (affiliated business arrangement) whereby any homeowner can list a home in the MLS free of charge. It’s called IggysHouse.Com. Interesting branding, I couldn’t find anything on their site that explained the moniker. Could be they just got tired of searching for decent real estate domains, there aren’t too many left out there.

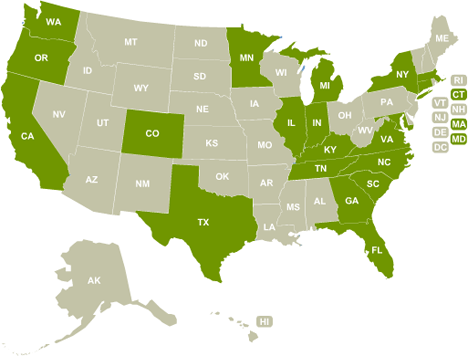

I went and looked for myself. Here is the Iggy coverage area:

Dark green states: Now. Light green states: Soon.

The site sells yard signs, lock boxes and forms, but not at huge premiums. I’m not going to fill out a listing to find out what happens, but my guess is that the end-user is doing every bit of the work for the MLS entry and the supplemental Do-It-Yourself web page with additional photos.

The Iggy people are promising listings on Realtor.com as well. As we have learned, Realtor.com listings do a lot better when they have virtual tours, so Mike might offer to make a video podcast at an extra cost, using PBS-style pan and scan video from the user-supplied photos.

Does this matter? In the age of the $99 listing, probably not so much. I truly don’t understand why there are any FSBOs left in the marketplace. If this doesn’t eat up the few holdouts, I’ll be amazed.

Interestingly, IggysHouse is evidently owned by BuySideRealty.com, which, apparently, hopes that, by giving away 100% of the listing commission it can cling to a whopping 25% of the buyer’s agent’s commission.

Are they daft?! No — they’re lenders. BuySideRealty is a lead-generation scheme that uses the real estate side of the transaction to rope in mortgage borrowers. And how much do lenders make? Just as much as they want to…

This is really quite a bit smarter than Redfin.com. They exploit the de facto “commons” in the traditional commission split, taking the buyer’s agent’s fee without doing the buyer’s agent’s job. BuySide is operating real estate brokerages as a loss-leader, to generate mortgage business.

Of the two, BuySide’s is the business model more likely to make a profit, if only because it has Read more

FBS Blog makes the case. I’m still wondering how I might go about shopping for a triplex…

Technorati Tags: disintermediation, real estate, real estate marketing

This is me in today’s Arizona Republic (permanent link):

Databases fall short of needs at realty.bots

Realogy, the giant, publicly traded conglomerate of big-name brokerages, recently announced a deal whereby it will feed all of its listings to realty.bots, Trulia.com and Google Base.

That’s a mouthful. First, what’s a realty.bot?

A realty.bot is an Internet start-up that plans to undertake some part of residential real estate transactions, usually as an adjunct to selling advertising.

Trulia.com, Google Base and PropSmart.com are listings.bots, acquiring listings by scraping Web sites, direct entry and data feeds.

Zillow.com and several others are AVMs, or Automated Valuation Methods, and Zillow is graduating to a direct-entry-only listings.bot.

Redfin.com can seem like a realty.bot, but, as with many other new entrants, it’s really a brokerage with a higher-tech front end.

A better bright-line dividing point might be face-to-face, end-user contact. We may come to the point that a realty.bot is distinguished from other vendors by being untouched by human-hands, a completely automated real estate product offering.

What’s interesting about Realogy’s initiative is that it moves millions of real estate listings onto realty.bots. The natural conclusion to be drawn is that realty.bots are the new MLS.

This is false. Online real estate search tools (their name is legion) are a great place to shop for a home, but they turn out to be a poor place to search for a home.

There are hundreds of searchable data fields in a true MLS database, as compared with a few dozen in a realty.bot’s dataset. Moreover, MLS systems are policed for accuracy and availability, with fines assessed for errors.

I tend to communicate in listings, with both buyers and sellers. In addition to all the other things a professional Realtor can do with the MLS system, it’s the absolute best tool in our arsenal for pricing homes.

Even after we’ve found your perfect home, we’ll be talking back and forth in listings to make sure the price is right, to assess future resale value, to make sure we didn’t miss something better in the neighborhood.

These functions require a full, robust MLS database.

Technorati Tags: arizona, arizona real estate, phoenix, phoenix real estate, real estate, Read more

FBS Blog. It’s brand new, but if you care about tracking MLS tech topics from the vendor side of the table, subscribe to the feed and see what emerges…

Technorati Tags: disintermediation, real estate, real estate marketing

We’re listing Thursday, and it’s been long enough since we’ve done one of these Grand Opera listings that I have a lot of new stuff to invent from scratch. Ideas are easy, it’s execution that’s hard. The sign and the collateral cards are built and being printed. We’re playing with a card that plays off of the sign to emphasize the differences you get by listing with us.

If you’re a glutton for punishment, you can monitor the changes in the web site/weblog named in the sign over the next 48 hours or so. The template is one I’ve been playing with for our brokerage web site (itself to be a weblog), but this version of it will be unique to this house.

I’ve got other balls in the air, too, so I might be thin on the ground for a little while.

James Hsu asked me to define Realty.bot, so here’s an on-stilts explication:

A Realty.bot is an internet start-up that plans to undertake some part of the residential real estate transaction, usually as an adjunct to selling advertising.

Trulia.com and PropSmart.com are listings.bots, acquiring listings by scraping, direct entry and XML feeds.

Zillow.com and several others are AVMs, Automated Valuation Methods, and Zillow is graduating to a direct-entry-only listings.bot, but they don’t like that designation.

Redfin.com can seem like a Realty.bot, but, as with many other new entrants, it’s really a brokerage with a higher-tech front-end.

Arguably, a true Realty.bot is strictly a media/advertising play, but that’s something that could change in time. ShackPrices.com, for example, plans to become a leads vendor, and it is not unreasonable to argue that this may be the ultimate business model for most/all Realty.bots.

A better bright-line dividing point might be face-to-face end-user contact. We may come to a point where a Realty.bot is distinguished from other vendors by being untouched-by-human-hands, a completely automated real estate product offering.

By then I will have made up different words.

Technorati Tags: arizona, arizona real estate, blogging, disintermediation, phoenix, phoenix real estate, real estate, real estate marketing

I’ve been sitting on a post from Jeff Corbett, The X-Broker, for a few days. Jeff Argues that Realty.bots will eliminate buyer’s agents. This actually ties in with recent announcements that major brokerages will be feeding listings to Realty.bots like Trulia.com and Google base. I get the idea Jeff thinks these are good things. I think he’s mistaken.

Start here: Jessica Swesey at InmanBlog asked:

If the DOJ wins and NAR is forced to retract policies, what is the likely chain of events to follow? Who wins and who loses?

My reply:

If the DOJ tries to play pirate with the current system, the big brokerages may go all in-house, which they could easily do already. Then there will be no small brokerages.

Jeff objects to this, but it’s not an unreasonable proposition.

Note, for example, the the overwhelming majority of listings in Tucson are held by one brokerage — Long Realty. Who gains more from the cooperative system imposed by the TARMLS system — Long or all the little brokerages competing against it? If Long pulled out of TARMLS, what would happen happen to those smaller players?

In Phoenix, the market is dominated by Realty Executives and by RE/Max, Keller Williams, Coldwell-Banker and Century 21 Franchises. If they pulled out of ARMLS, either in isolation or by forming a new big-boys-only MLS system, brokerages like mine would be wiped out overnight.

Too much of this debate is beside the point. Pundits simultaneously attribute too much and too little importance to the MLS. From a professional’s point of view, Realty.bots are not comparable to MLS systems, and they probably never will be. They are good for window-shopping by consumers, not for searching by professionals. But wresting control of the MLS away from brokers, somehow forcing them to produce content against their own interests, will not change anything that matters in the practice of residential real estate representation. The reason for this is simple: What is wrong in residential real estate representation has nothing to do with the MLS itself.

We’ll come back to that. First: Buyers buy from the selection that is available to them. This is true of everything Read more

Kevin Boer thought he found an error in Redfin’s accounting of its MLS results. What he found turned out to be trivial, which led to another round of war-hooping from the Redfin tribe.

Meanwhile, our new contributor James Hsu has demonstrated that Redfin’s horse runs behind the middle of the pack among big-name Seattle brokerages. In other words, as predicted, experienced traditional agents do out-perform Redfin’s salaried agents.

I finally took a look at Redfin’s spreadsheet today, which they were kind enough to share with me. There are two formulae for calculating the Sales Price to List Price ratio, but I’m not sure that matters. Ten houses sold for less that 65% of list, which I find amazing. More amazing still, nine sold for more than 150% of list. One of them sold for 1,068.526% of list.

One condominium sold for 10% of list price. At that price, I think I might have taken more than one. Condo buyers are smarter, though. Only four of them were willing to pay more than 144%, although a whole bunch sold for more than 110% of list. In Phoenix, they’d be investigating for loan fraud.

Here’s the cute part: Redfin sold 45 condominiums, of which 20 sold for more than its vaunted average performance of 99.340%. Okayfine, fewer than half. For residential listings, however, Redfin kindasorta sucked: Out of 125 sales, 70 homes sold for more than their average.

I named all kinds of reasons for holding Redfin’s claims in doubt. The overarching question — tough agents or tough clients? — is the one Redfin seeks to avoid. Its claims all week have been a textbook example of the Fallacy of Affirming the Consequent: If P then Q, Q therefore P. If Redfin’s agents are tougher than average, then its ratios should beat the market. Redfin’s ratios beat the market (a specious if not actually false claim in any case), therefore Redfin’s agents are tougher than average. The conclusion does not follow, and the raw numbers seem to argue eloquently that the results achieved by Redfin’s clients were caused by Redfin’s clients, not by its agents. The skinflints did Read more

Some readers here may be a bit concerned that some of the writers here on BloodhoundBlog don’t find and report enough negative comments about various discount real estate companies. Relax. There is more.

I received the following email today from Dave Marron. As you will see, he is a former executive for Zip Realty.

__

Hi Russell:

I saw that you posted on bloodhound about zipRealty awhile back. Did you see their earnings release the other day? I’m an ex-zip exec (and ex-KW broker) and I put my thoughts down on paper about the state of their company (see attached). Do you have any use for this? If not, it’s OK. I just thought I’d shoot it over to you in case you thought it was bloggable.

Thanks,

Dave

What’s Wrong with zipRealty?

Last week zipRealty released their “preliminary” fourth quarter results. I’ve been interested in this company since 1999 when I went to  work for them. I

work for them. I

spent over four years at zip performing numerous jobs including VP of Sales. A couple of things popped out at me during their “preliminary” earning release conference call that just don’t make sense. Here are my observations.

One of the initiatives zip’s leaders gave for how they are going to improve in 2007 was an increased effort on training. Stock analyst Wendy Snow asked the team what they intend to do differently in the training arena that will make a difference in 2007. To this, Management answered that their “ideal candidate” would have the qualities of a strong trainer and strong real estate skills. They’ll also consider someone with strong training skills who could be “pick up the real estate craft quickly”. Are they kidding? They would hire a trainer who can “pick up the real estate craft quickly”. Would Pilsbuy, Madison and Sutro hire a legal trainer who could pick up the law craft quickly?

After leaving zipRealty I sold real estate for several years and I’m now an owner in a real estate technology company. The way that I learned the “real estate” craft was by going out and selling lots of homes. It’s not something that you can teach someone to Read more