This is me in today’s Arizona Republic (permanent link):

MLS ‘ad’ crackdown a waste of time, expert says

Here’s an interesting conundrum: MLS rules forbid one broker from advertising another’s listings without permission. The question is this: What is advertising?

At first blush, you might say that advertising is paid space or time in a publication or on a broadcasting outlet and that the rule is devised to prevent Broker Paul from advertising Broker Peter’s listings as if they were his own.

Surely it would be sleazy of Broker Paul to do that, but the rule itself is not without stain. Why wouldn’t Broker Peter want free advertising for his listings?

Because he wants to maximize his chances for representing both the seller and the buyer, taking commissions from both.

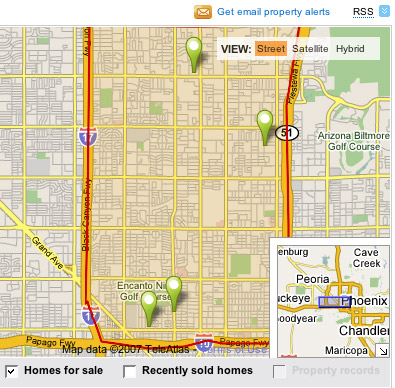

With the advent of the Internet, though, things are getting more complicated. Zillow.com, the Seattle-based real estate portal, will permit anyone, including Realtors, to announce that a particular home is for sale. Is this advertising another broker’s listings?

Seattle’s Redfin.com, a discount brokerage, built weblogs devoted to reviews of listed homes. The Northwest Multiple Listing Service has ordered the company to shut these sites down, assessing a $50,000 fine, claiming that the property reviews are advertising.

Two points to consider: First, nothing prevents ordinary people from saying whatever they choose, subject to libel laws, about a property. The only people to be restrained from speaking are MLS members, who presumably have the most information to share.

Secondly, these conversations will go on.

The Internet massively reduces the cost of sharing and acquiring information. The natural course of events for net-savvy consumers is to obtain as much information as possible before buying or selling anything.

Truly, resistance to this indefatigable quest for information is futile. So, smart vendors embrace it.

When you shop for a book on Amazon.com, at the bottom of the page you will find reviews by ordinary people, some positive, some negative — and the reviews themselves are rated by other users.

If Realtors, through the MLS, elect to exclude themselves from Net-based conversations about particular properties for sale, they will hurt no one but themselves.

Technorati Tags: disintermediation, real estate, Read more

Bruce has a background as a lobbyist and has written several books. These days he seems to spend most of his time letting various government divisions (with loads of emphasis on the federal government) know “what is good for consumers”. He has a big heart, he just wants to help. He is quite secretive on who pays him. But he has come right out and said it is NOT Bank of America – so my guess on that is obviously wrong. I really don’t expect him to be forthcoming now – whoever does pay him doesn’t want anyone to know who they are.

Bruce has a background as a lobbyist and has written several books. These days he seems to spend most of his time letting various government divisions (with loads of emphasis on the federal government) know “what is good for consumers”. He has a big heart, he just wants to help. He is quite secretive on who pays him. But he has come right out and said it is NOT Bank of America – so my guess on that is obviously wrong. I really don’t expect him to be forthcoming now – whoever does pay him doesn’t want anyone to know who they are.