What a blessing we have in Senator Charles Schumer (D-NY). Last year he single-handedly protected us from having to spend one more day in a world where IndyMac Bank was a viable institution. Now he’s there for us again. Did you know that traditional values were gone? I didn’t. Here I was walking around and thinking that hard work, honor, respect and responsibility were still in vogue – I could have made a real ass of myself! Thank you Sen. Schumer, once again you’ve taken that bullet for me…

Category: Big Mother (page 13 of 15)

It’s like a motorcycle, but without the pick-up or maneuverability. Or economy. Or range. Or sex-appeal. I want mine with the Vook option!

FT: No more free lunch.

FWIW, while I detest all laws, I think this is a nice example of the law doing more harm than good. These new rules won’t kill the corruption, they’ll just push it underground. Better to have things out in the open, so thoughtful people can make informed judgments.

I’ve been thinking about the disgusting spectacle of millions of Americans presuming to have an opinion about whether or not some AIG employee deserves to be paid a bonus. This was once a country where the idea of minding one’s own business was virtually a sacrament. And then I can’t turn on the television without seeing some grandmother bragging that Medicare makes it possible for her to dine on her own grandchildren. And to top it all off, tonight I’ve been trading depressing emails with Joe Strummer about our progress down the Road to Serfdom.

I know people think they understand what I’m talking about, when I talk about political philosophy, but I’m pretty sure that’s not true. The simple truth is this: I am sovereign in my person — and so are you. I do not have the right or power or privilege or duty to push you around by force, and you do not have that right or power or privilege or duty with respect to me. That’s easy to understand when we’re only talking about we two: If I overstep the boundaries, you will surely help me find my way back to the righteous path. But there’s no difference whether we’re talking about two people or two billion people. Each one of us is free in our person, free as a necessary consequence of being what we are.

Does that mean that other people cannot try to push us around by force? Obviously not. It simply means that failing to respond to human beings as sovereign entities, each one of us a unique end in himself, is wrong — epistemologically incorrect, morally unrighteous, politically criminal.

All of economics is based in collectivist premises, which leads to statements that are true but fundamentally irrelevant. Smith taught us that leaving men free to produce is better for everyone — which does not matter, because each one of us is free regardless of the benefits freedom yields for other people. Hayek among others points out that enslaving us is bad for everyone, which also does not matter. The impact upon the collective is meaningless. Read more

A totally killer run down of the Wall Street mess from — you’ll never guess it — Rolling Stone magazine:

There are plenty of people who have noticed, in recent years, that when they lost their homes to foreclosure or were forced into bankruptcy because of crippling credit-card debt, no one in the government was there to rescue them. But when Goldman Sachs — a company whose average employee still made more than $350,000 last year, even in the midst of a depression — was suddenly faced with the possibility of losing money on the unregulated insurance deals it bought for its insane housing bets, the government was there in an instant to patch the hole. That’s the essence of the bailout: rich bankers bailing out rich bankers, using the taxpayers’ credit card.

The people who have spent their lives cloistered in this Wall Street community aren’t much for sharing information with the great unwashed. Because all of this shit is complicated, because most of us mortals don’t know what the hell LIBOR is or how a REIT works or how to use the word “zero coupon bond” in a sentence without sounding stupid — well, then, the people who do speak this idiotic language cannot under any circumstances be bothered to explain it to us and instead spend a lot of time rolling their eyes and asking us to trust them.

That roll of the eyes is a key part of the psychology of Paulsonism. The state is now being asked not just to call off its regulators or give tax breaks or funnel a few contracts to connected companies; it is intervening directly in the economy, for the sole purpose of preserving the influence of the megafirms. In essence, Paulson used the bailout to transform the government into a giant bureaucracy of entitled assholedom, one that would socialize “toxic” risks but keep both the profits and the management of the bailed-out firms in private hands. Moreover, this whole process would be done in secret, away from the prying eyes of NASCAR dads, broke-ass liberals who read translations of French novels, subprime mortgage Read more

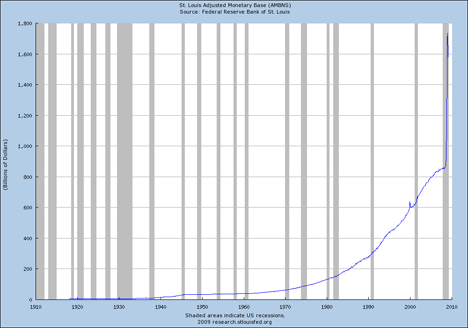

Follow the tiny blue line. That’s the growth of the U.S. money supply. That vertical surge you see there at the right is, essentially, a doubling of the number of dollars in (virtual) circulation since August 2008. Every dollar you own will soon be worth fifty cents. And every dollar you owe will soon be worth two bucks. You do the math…

Victor Davis Hanson, a brilliant old Hellenist, here seeming more old than brilliant, wonders, “Who is John Galt?”

We sense we are trimmers and redistributors, and wouldn’t dare build a new dam a transcontinental railroad, a new 8-lane freeway.

Instead we would sue, file reports, argue, quit, delay—anything other than conceive a majestic idea and finish it, sighing, “It is not perfect, but damn good enough and will do.” Instead, here in California we are simply destroying agriculture by drying up its sources of water-giving life—a once brilliant farming that was the sum total of millions of brave lives from 1880 to 2000 who took a desert and fed the world.

Instead, ensconced in the Berkeley Hills or Woodside, our elites demand of better others to save for them not people, but a smelt, a minnow, or a newt-like creature that must have the entire Kings or San Joaquin River as it dumps its precious cargo out to sea.

So as scare snow melts, it goes out to the ocean, gratifying a lawyer or professor in Palo Alto that rivers flow as they did in the 19th-century, as millions of acres go fallow, hundreds of thousands lose jobs, and we feel so morally superior to those of the past who really were our moral superiors.

It is easy to dismiss our ancestors as illiberal, or with the caveat “Oh, but if we were as poor as they were, we’d have to prove just as tough”, but we still sense they were different in the sense of far better. When I drive up to see those Sierra dams poured in the 1920s, one wonders how they made such things with only primitive machines, and in contrast, are amazed with our sophisticated tools, we do so much less.

This self-congratulatory generation can hardly, as we are learning, build a Bay Bridge again. Yet when we see on the Internet pictures of a new aircraft carrier we are stunned in amazement—we did that? We built such a powerful, sophisticated ship? We—at least someone— can actually still do things on rare occasion like that?

The American people are, to be frank, nauseated Read more

Is this the end of America? Canada’s Financial Post:

Helicopter Ben Bernanke’s Federal Reserve is dropping trillions of fresh paper dollars on the world economy, the President of the United States is cracking jokes on late night comedy shows, his energy minister is threatening a trade war over carbon emissions, his treasury secretary is dithering over a banking reform program amid rising concerns over his competence and a monumentally dysfunctional U.S. Congress is launching another public jihad against corporations and bankers.

As an aghast world — from China to Chicago and Chihuahua — watches, the circus-like U.S. political system seems to be declining into near chaos. Through it all, stock and financial markets are paralyzed. The more the policy regime does, the worse the outlook gets. The multi-ringed spectacle raises a disturbing question in many minds: Is this the end of America?

Probably not, if only because there are good reasons for optimism. The U.S. economy has pulled out of self-destructive political spirals in the past, spurred on by its business class and corporate leaders, the profit-making and market-creating people who rose above the political turmoil to once again lift the world out of financial crisis. It’s happened many times before, except for once, when it took 20 years to rise out of the Great Depression.

Past success, however, is no guarantee of future recovery, especially now when there are daily disasters and new indicators of political breakdown. All developments are not disasters in themselves. The AIG bonus firestorm is a diversion from real issues, but it puts the ghastly political classes who make U.S. law on display for what they are: ageing self-serving demagogues who have spent decades warping the U.S. political system for their own ends. We see the system up close, law-making that is riddled with slapdash, incompetence and gamesmanship.

One test of whether we are witnessing the end of America is how many more times Americans put up with congressional show trials of individual business people and their employees, slandering and vilifying them for their actions and motives. And for how long will they tolerate a President who berates business and corporations Read more

I’ve always enjoyed well written television comedy and I’ve wondered lately why I’m not seeing as much. What happened to the writers? Believe it or not, they all moved to DC and are writing for our Congressmen! Oh sure, there’s a dark edge to the lines they write, but it’s classic television comedy just the same. The congressional outrage reported in this AP story on the AIG bonus debacle is a perfect example.

AIG notified all involved, over a year ago, that these bonuses were contractually due and payable this quarter. Former President Bush knew, current President Obama knew, the various financial players in the administration knew and Congress knew. But that doesn’t prevent Senator Chuck Schumer, D-NY, from issuing this power-drunk one liner: “If you don’t return it on your own, we’ll do it for you.” (If I had written the scene Sen. Schumer would have exited the room directly after delivering this tour de farce but before going through the door he’d stop, turn and say “I’ll be baaaack.”

Turns out Treasury Secretary Timothy Geithner did meet with AIG CEO Edward Liddy in hopes of discovering ways Mr. Liddy could renegotiate the contracts and all these bonuses, but Mr. Geithner “recognized that you can’t just abrogate contracts willy-nilly” according to President Obama’s chief economic advisor Lawrence Summers. (Apparently, you can only do the old willy-nilly abrogation of contracts on mortgage lenders using BK judges. Don’t you just love this juicy sub-plot on the importance of consistency running throughout the program tonight?)

At this point enters Representative Barney Frank, D-Mass, quite possibly the most culpable legislator in the current mortgage crisis. A less confident person, living in such a LARGE glass house, would probably keep a lower profile but not our crazy Uncle Barney. “The time has come to exercise our ownership rights. We own most of the company.” What?? I thought the administration was taking shares in the companies only to ensure that taxpayers are paid back. Do you mean to tell me they are going to start running these companies too? I’m shocked, shocked to find (this) going on here. Rep. Read more

They’d wake up and catch a clue, that’s what. From the Wall Street Journal:

It is simply wrong for commentators to continue to focus on President Barack Obama’s high levels of popularity, and to conclude that these are indicative of high levels of public confidence in the work of his administration. Indeed, a detailed look at recent survey data shows that the opposite is most likely true. The American people are coming to express increasingly significant doubts about his initiatives, and most likely support a different agenda and different policies from those that the Obama administration has advanced.

Polling data show that Mr. Obama’s approval rating is dropping and is below where George W. Bush was in an analogous period in 2001. Rasmussen Reports data shows that Mr. Obama’s net presidential approval rating — which is calculated by subtracting the number who strongly disapprove from the number who strongly approve — is just six, his lowest rating to date.

Overall, Rasmussen Reports shows a 56%-43% approval, with a third strongly disapproving of the president’s performance. This is a substantial degree of polarization so early in the administration. Mr. Obama has lost virtually all of his Republican support and a good part of his Independent support, and the trend is decidedly negative.

A detailed examination of presidential popularity after 50 days on the job similarly demonstrates a substantial drop in presidential approval relative to other elected presidents in the 20th and 21st centuries. The reason for this decline most likely has to do with doubts about the administration’s policies and their impact on peoples’ lives.

There is also a clear sense in the polling that taxes will increase for all Americans because of the stimulus, notwithstanding what the president has said about taxes going down for 95% of Americans. Close to three-quarters expect that government spending will grow under this administration.

Recent Gallup data echo these concerns. That polling shows that there are deep-seated, underlying economic concerns. Eighty-three percent say they are worried that the steps Mr. Obama is taking to fix the economy may not work and the economy will get worse. Eighty-two percent say they are Read more

This is getting too easy. Financial Times interviewed Bank of America CEO Ken Lewis. His answers reveal why the quasi-government agency that BAC has become is destined to fail. Read the whole article. You’ll swear your reading Orwell’s Animal Farm.

FT: Do you regret your acquisition of Merrill Lynch?

Lewis: I’d be less than honest to say that I haven’t had my moments, but I always try to step back and say don’t judge it by this time and look forward. I still think it’s a compelling, strategic acquisition and we’re going to be awfully happy to have done it over time.

BRADY (commentary): Ken Lewis gleefully overpaid for the world’s largest securities’ firm out of pride and ego. The prospect of commanding the largest mortgage originator and securities firm appealed to Mr. Lewis’ ego. His feckless behavior showed contempt for his shareholders and will be an expense to the people of the United States but why should he care?

FT: Was there a moment when you would have preferred to pull out of the deal?

Lewis: We did in fact think about doing that . . . and consulted with the government about filling the hole [in Merrill’s balance sheet] if we didn’t get out. We were strongly advised that the best thing to do was to go forward with the deal on time. While we made the final decision, we relied heavily on that advice because we respected the opinions of the various agencies.

BRADY: Ken ain’t calling the shots at BofA; he’s an overpaid government employee now. Wanna know how I know? Read the next question.

FT: Have you been surprised by the strings attached to the Tarp money?

Lewis: I’ve been surprised at the reaction of the public for those that have taken the Tarp money when we were doing what we thought was in the best interest of the country.

BRADY: Read the last five words. Ken Lewis’ responsibility is to do what is in the best interest of the BAC shareholders not the country.

The answer is, of course, to break up the banks and stop the government from competing with the healthy banking institutions. Read more

The last time the housing market was this bad, Congress set up the Federal Housing Administration to insure Depression-era mortgages that lenders wouldn’t otherwise make.

This decade’s housing boom rendered the agency irrelevant. Americans raced to aggressive lenders, seduced by easy credit and loans with no upfront costs. But the subprime mortgage market has crashed and borrowers are flocking back to the FHA, which has become the only option for those who lack hefty down payments or stellar credit. The agency’s historic role in backing mortgages is more crucial now than at any time since its founding.

With the surge in new loans, however, comes a new threat. Many borrowers are defaulting as quickly as they take out the loans. In the past year alone, the number of borrowers who failed to make more than a single payment before defaulting on FHA-backed mortgages has nearly tripled, far outpacing the agency’s overall growth in new loans, according to a Washington Post analysis of federal data.

Many industry experts attribute the jump in these instant defaults to factors that include the weak economy, lax scrutiny of prospective borrowers and most notably, foul play among unscrupulous lenders looking to make a quick buck.

If a loan “is going into default immediately, it clearly suggests impropriety and fraudulent activity,” said Kenneth Donohue, the inspector general of the Department of Housing and Urban Development, which includes the FHA.

The spike in quick defaults follows the pattern that preceded the collapse of the subprime market as some of the same flawed lending practices that contributed to the mortgage crisis are now eroding one of the main federal agencies charged with addressing it. During the subprime lending boom, many mortgage brokers and small lenders milked the market for commissions and fees by making as many loans as possible with little regard for whether they could be repaid.

Once again, thousands of borrowers are getting loans they do not stand a chance of repaying. Only now, unlike in the subprime meltdown, Congress would have to bail out the lenders if the FHA cannot make good on guarantees from its existing reserves. And those once-robust reserves Read more

Do you still wonder whether banks will be nationalized? Does the idea of an auto manufacturer declaring bankruptcy scare you even just a little? Tell me you’re not still engaged in any discussions on whether or not the response to our economic crisis has been a step toward “socialism!” Please, come down off your soap box. This discussion of competing ideologies is so 20th century. Disco is dead baby and it’s time you adopted a new framework of thinking. What’s probably confusing you is that the ideology has already been settled. Once you see all of this to be purely matters of terminology, you’ll also gain an insight into what happens next.

For a short while, President Obama’s critics tried to frame the discussion in terms of Socialism. This is a non-starter. I think if you were to poll this president and this congress – a few far-left nuts not withstanding – you’d find each of them expressing a love for this country and not a one expressing a desire to become a Socialist State – even passing polygraphs. You’re using the wrong terminology! Accusing this administration of moving us toward Socialism may have the support of a technical definition, but it drips of ideological connotations where none belong. Think of it this way: the nuns in a convent live in a technically defined communist system (from each according to her ability, to each according to her need). But would you call them communists? Not only is the connotation unjust, the ideology is not accurate. This is what still causes those trepidations mentioned in the opening paragraph.

Listen to me and find some peace. The new ideology has actually been in place and growing for some time. The recent election was only the crowning of its leader. We must move away from Democrats vs. Republicans (too often these days, a distinction without a difference) and understand the new dimension, which is Progressive vs. Self-Reliant. The progressives have been in power in Congress for some time now. The first $350 billion to banks, the AIG bail-out, the “loans” to GM & Chrysler and so Read more

This is my column for this week from the Arizona Republic (permanent link). Since I wrote this on Tuesday, events have overtaken some details, but it remains that few if any borrowers in the Phoenix area will be able to renegotiate or modify their loans under the Obama plan. Everyone who used to have home equity will still get to bear their losses unassisted, however.

The federal government’s housing casino will never play fair as long as there are votes to be bought by cheating

To qualify for a renegotiated mortgage under the plan President Obama announced last week, your new loan can be as much as 105% of your old loan — which sounds to me like curing alcoholism with a good stiff drink.

But the people who are in the worst trouble on their loans bought with 100% financing. Even if there had been no decline in values, they probably could not refinance at 105%, not without bringing cash to cover the closing costs.

But, of course, the typical home in the West Valley is down 50% from its peak value in December of 2005.

Suppose you bought a new home for Christmas 2005, paying $275,000. If you get everything just right, you might be able to sell it today for $135,000. You still owe $275,000, but you can refinance your note at only $141,750 under the Obama plan.

Something’s going to have to give.

But what about the people who were move-up buyers in 2005? They may have put 50% down, which means they’ve lost all their equity, but they probably can’t lay claim on a hardship refinancing. What about the people who paid all-cash? Now we’re talking about people who have actually lost real money — their own money.

Meanwhile, many of the people who end up qualifying for restructuring could easily continue to pay on their notes. We all of us pay on our car loans, even though a car loses half its value when you drive it off the lot.

But we don’t think of our cars, clothing, furniture or appliances as investments. By mucking around in the real estate market, the federal government Read more