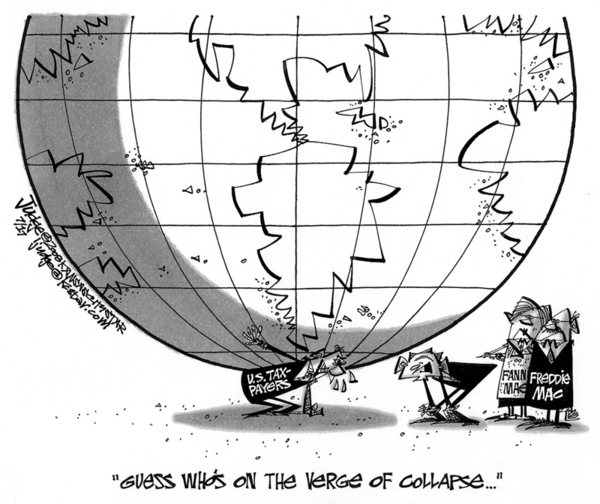

If you’ve been reading this for a while, you’d know that it’s been getting harder to get a mortgage. Well, today we have proof of it for all to see. This chart is courtesy of the Federal Reserve (by way of the Big Picture). Some commentary after the chart:

Now for some thoughts:

1. See the line that represents prime mortgages? Yep, it’s gone continuously up since this started a year ago.

2. See the line for “non traditional?” Remember back late winter where things sort of “eased off” in terms of credit? Yep, that’s when those loosened up again. Well, that’s changed again.

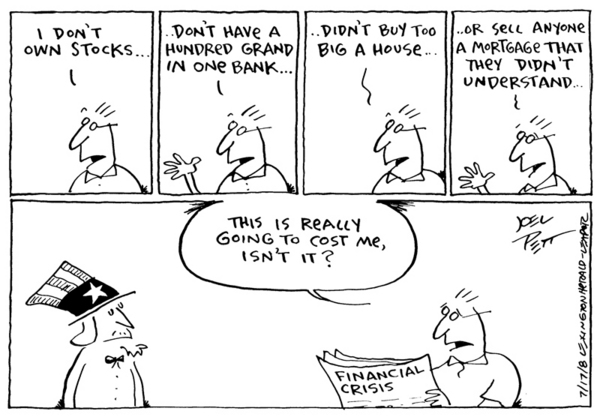

3. Subprime – well, let’s just say that subprime is going the way it should – up so that only those with large downpayments can get them and they end up paying more for them.

So what should you take away from a chart like this? A couple of suggestions:

1. If you are planning on buying a house or building a house, you better plan on being able to document your income and your assets completely.

2. If you have something “marginal” about your financial profile (income isn’t quite enough, documentation is challenging, credit is spotty) you can expect to have to come up with more of a downpayment and work through more details. You also might want to consider moving your timeline up and trying to do it now rather than next spring – it’s looking like it’s going to be harder then…..

3. If you are looking to buy a house for the first time, you might have to rent a little longer and save up a little more of a downpayment than you would have.

All is not lost, the mortgage world is not dead, just a bit harder than it used to be. Call me if you’d like to chat about it.