Ahem: “Today’s young people would be foolish to imitate their parents and view ownership as the cornerstone of personal finance.”

From the Wall Street Journal:

At the risk of heaping more misery on the struggling residential property market, an analysis of home-price and ownership data for the last 30 years in California—the Golden State with notoriously golden property prices—indicates that the average single family house has never been a particularly stellar investment.

In a society increasingly concerned with providing for retirement security and housing affordability, this finding has large implications. It means that we have put excessive emphasis on owner-occupied housing for social objectives, mistakenly relied on homebuilding for economic stimulus, and fostered misconceptions about homeownership and financial independence. We’ve diverted capital from more productive investments and misallocated scarce public resources.

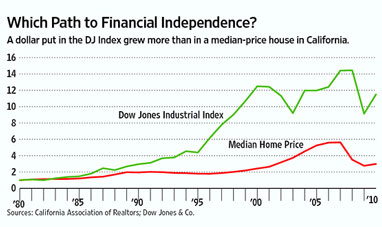

Between 1980 and 2010, the value of a median-price, single-family house in California rose by an average of 3.6% per year—to $296,820 from $99,550, according to data from the California Association of Realtors, Freddie Mac and the U.S. Census. Even if that house was sold at the most recent market peak in 2007, the average annual price growth was just 6.61%.

So a dollar used to purchase a median-price, single-family California home in 1980 would have grown to $5.63 in 2007, and to $2.98 in 2010. The same dollar invested in the Dow Jones Industrial Index would have been worth $14.41 in 2007, and $11.49 in 2010.

No need to pass these facts along to the National Association of Realtors. They already know.

Kim Hannemann says:

And when the WSJ finds someplace you can live for free (as opposed to renting) then you will have those housing dollars you didn’t need, to invest in the DJIA.

Silly comparisons don’t prove squat.

July 12, 2011 — 9:21 am

Greg Swann says:

> And when the WSJ finds someplace you can live for free (as opposed to renting) then you will have those housing dollars you didn’t need, to invest in the DJIA.

In much of California, the monthly cost to rent a home is much lower than the monthly cost to own that same home.

> Silly comparisons don’t prove squat.

That’s a spreadsheetable proposition. The trend line on the chart is pretty dramatic, though. Could be quite a bit worse comparing home ownership with starting your own business.

Moreover, 20% down on a $400,00 shack in Los Angeles is $80,000, plus closing costs. The entry cost to lease that home might be $4,000, rent plus deposits. That leaves $76,000 in investment capital. Do you want to argue that $76,000 invested in a business or in equities will do worse, on average, than that same $76,000 will do “invested” in a house? In a little over three years, the renter will have spent $76,000 in rent, but the homeowner will have made around $150,000 in mortgage payments in that same span of time. Is it your claim that the value of three years of accumulated equity in that home will exceed the ROI of that same money invested in (important words coming up) profit-making ventures?

My take: The NAR has been lying about this forever. Do you dispute that?

July 12, 2011 — 9:33 am

Bruce Hahn says:

We think the author’s math is off. Here’s the online comments we posted to the WSJ article:

Mr. Bridges’ math appears flawed. He used an example of investing a 20% down payment, plus the “the normal homeownership expenses (above the cost of renting) over the years in the Dow Jones Industrial Index”. However rents rise over the years while principle and interest payments on a 30 year fixed rate mortgage do not. After a couple years of rent increases the rent usually surpasses the net (post tax) cost of owning a home. At that point it is the homeowner who would be getting the savings. To make the comparison fair Mr. Bridges should also assume that from that point the homeowner will invest that growing annual net savings in the Dow Jones Industrial Index. The renter could not invest any additional amounts after the first few years because they no longer had any annual savings (over owning) to invest.

Thus the renters investment return would be the return on the original $19,910 down payment, plus an additional few thousand dollars over the next few years as their annual net saving on renting over owning dwindled down and finally disappeared. If that amounted to an equivalent of $25,000 invested in the Dow Jones Industrial Index over 30 years, the value today would be around $287,500, not $1,800,016. By comparison, after 30 years the home would be worth 296,820 and it would be paid off. The homeowner would have also been investing their growing annual savings over renting in the Dow Jones Industrial Index each year over most of those 30 years. With the Dow Jones Industrial Index’s superior rate of return that would no doubt total a very substantial additional amount.

With this in mind homes are indeed good investments on the road to financial independence. Plus you can live in it and the landlord can’t kick you out at the end of the lease.

Bruce Hahn

President

American Homeowners Grassroots Alliance and

the American Homeowners Foundation

July 12, 2011 — 10:03 am

Mark Brian says:

I find it totally amazing that the Wall Street Journal would publish an article promoting using Wall Street over another way to invest your money. Totally and completely shocked (sorry could not get my sarcasm font to work).

Always consider the source before believing it. Just as you must take anything from NAR regarding real estate with a grain of salt, the same is true about the WSJ and Wall Street.

July 12, 2011 — 11:18 am

Greg Swann says:

> Always consider the source before believing it. Just as you must take anything from NAR regarding real estate with a grain of salt, the same is true about the WSJ and Wall Street.

Really, that’s your take? Dow Jones is composed of ignorant hucksters who get caught in lies again and again?

The math behind that article is pretty simple. If the NAR could do any damage to it, it would. We all know it can’t.

July 12, 2011 — 11:24 am

nick vandekar says:

I think the point many are missing here is that when you own a home you can do with it what you want, never having to ask permission to paint or what color you can use. Everybody is merely focusing on investment. Why? That is a big mistake, look at the other benefits of owning a home of your own, how you contribute to the community and get involved in your neighborhood. Sorry but many landlords put minimum upkeep and maintenance into their properties, whilst a homeowner tends to put more into updating, maintenance and improving the home over time all things that benefit and help the community overall.

July 12, 2011 — 12:14 pm

Jim Klein says:

IMO Bruce has the math right; saved funds don’t return nothing. Plus, there is the possibility that owing to demographic changes, comparing median averages might not be valid. Also, picking 1980 is pretty flaky; move it back 10-15 years and see what happens.

Nick makes a good point too, since it’s all really about value, not dollars. OTOH plenty can be said for renting as well, where things get fixed with a phone call and no expense. To each his own, when it comes to value.

Any investment can be great or lousy, and a home is a ton more than an investment for most people. Besides, if the author’s point is that it’d be wiser to buy the DJIA now than real estate, then he’s out of his mind. The market for stocks isn’t at its (nearly) all-time low; the market for RE is. That’s the end of that story. “Buy low, sell high” MEANS “Be a contrarian,” directly.

July 12, 2011 — 4:15 pm

Greg Swann says:

> IMO Bruce has the math right

Very untrue. The average life of a home loan is five years or fewer. Every move or refi entails new parasitic costs, none of which are accounted for in either Hahn’s math nor in the original article. How do we know a personal residence is a poor investment, compared to profit-making ventures? Ordinary Americans are broke — and they always have been. Calling your clothes or your car or your shoes an “investment” is also an error. As with a residence, these are all durable utilitarian assets which are devoid of value — used up — at the end of their useful life. The only thing mysterious about this discussion is that anyone has to point out these obvious facts. That’s a tribute to the propaganda skills of the NAR.

July 12, 2011 — 5:33 pm

Kim Hannemann says:

>Is it your claim that the value of three years of accumulated equity in that home will exceed the ROI of that same money invested in (important words coming up) profit-making ventures?

>My take: The NAR has been lying about this forever. Do you dispute that?

You bet I do, in both cases. First, because most people wouldn’t be able to identify a venture that would make them a profit if they fell over it, so the “ROI” could easily – and probably would – be negative. Second, you have to live somewhere. If all you are about is financial, go live in the bank lobby.

Second, your continual insistence that the NAR is lying, or a huge consipiracy to defraud the American public, or a drag on the government teat, is getting tiresome. I wonder why you stay in the profession you hate so much.

July 12, 2011 — 4:36 pm

Greg Swann says:

> Second, your continual insistence that the NAR is lying, or a huge consipiracy to defraud the American public, or a drag on the government teat, is getting tiresome.

That’s not an argument. To the contrary, it would seem to be a tacit concession that you have no argument to make on the subject.

> I wonder why you stay in the profession you hate so much.

I love real estate. That’s why I hate the NAR.

July 12, 2011 — 4:52 pm

Jim Klein says:

“As with a residence, these are all durable utilitarian assets which are devoid of value — used up — at the end of their useful life.”

Well, that’s just false. The land is never used up, and the improvements generally last even longer than my old work boots. In many cases, they last effectively forever.

The math would be exceedingly complex, and I didn’t mean to imply that Bruce covered it all. Just for starters, the single most important value–location–can change enormously over time. Using 1965-2005, I could show you people who did twice as well with homes as the DJIA and you could show me people who did half as well.

Plus, I wouldn’t want to distract from your entirely valid position about the NAR. Kim’s comment really struck me, particularly her ironic view about how foolish everyone else is.

July 12, 2011 — 7:12 pm

Greg Swann says:

> The land is never used up

I said “residence.”

> and the improvements generally last even longer than my old work boots. In many cases, they last effectively forever.

Houses wear out. This is not worth quibbling about.

> Using 1965-2005, I could show you people who did twice as well with homes as the DJIA and you could show me people who did half as well.

Keep in mind that the real estate markets in the United States have been under the sway of Rotarian Socialists for at least 100 years. In a free market, we would all understand that one’s own residence is only very rarely a profit-producing investment, but, instead, is virtually always exactly what I said it was:

> Plus, I wouldn’t want to distract from your entirely valid position about the NAR.

For this I thank you.

> Kim’s comment really struck me, particularly her ironic view about how foolish everyone else is.

Kim’s a man.

Bottom line: The NAR has pitched the idea that homeownership is a foundational necessity in creating a retirement plan. Realtors are not alone in this: Insurance salesmen pump this idea a lot, as do financial planners — and, obviously, mortgage lenders. Owning a home is a wonderful thing, but, just like owning a car or $70 jeans or a pair of kick-ass boots, it is a luxury — not an investment. If you want a place of your own, beloved over all, I want to sell it to you. But if your goal is to make money, there are better, more reliable and less looterish ways of doing this — most notably income-producing real estate.

July 12, 2011 — 8:39 pm

Thomas Johnson says:

>if your goal is to make money, there are better, more reliable and less looterish ways of doing this — most notably income-producing real estate.<

This is it! Why NAR hasn't glommed on to this fact is a testament to something not admirable. Postive cash flow indexed to inflation, properly selected residential real estate will triumph over the renternation buffoons propagandizing the value of their paper ponzi souffle. Ask any fifty something white collar worker how his 401K has done over the past ten-fifteen years as his ever higher salary withholdings have poured into the bankster's black hole.

July 12, 2011 — 9:42 pm

Mark Brian says:

Greg, I never said the Dow Jones is full of ignorant hucksters. Rather I implied the WSJ is PR/Hype for Wall Street.

July 13, 2011 — 12:39 pm

Michael Cook says:

Sorry I am late to the game on this, but the article is flawed on many levels. First, volatility of investments must be considered. Residential homes on average are far less volatile than residential real estate, so they should offer a higher return. Clearly not rocket science. Long-term/retirement investments make sense when you have an expectation that the value of that investment wont decline 10% or more in a very short time period. On the whole residential real estate is a far better candidate than the DJIA. Thats the reason they recommend people move out of the stock market as they get closer to retirement. That simple logic would suggest that volatility matters.

Obviously this is all local. Perhaps if you live in Las Vegas, you didnt have the same luck as someone in Chicago or New York City. A major issue with the argument for real estate. A person can very easily invest in a ETF that would reflect the DJIA returns. Much harder to invest in the “average” US real estate home.

We have had this discussion numerous times before here. I dont agree that you can simply compare returns without considering risk. That is investing 101. And Greg, until you can whip up a CAPM (Capital Asset Pricing Model) or Beta for the median housing market, your arguments make no sense. You are comparing apples and oranges.

Looking at it from a non-financial point of view, I do think it makes more sense more middle America to invest in their homes, as oppose to the stock market. Middle America has no idea what makes the stock market tick. They dont know when to get in and out. They simply rely on advisors more motivated by fees than their long term well being. These are the main “investors” likely to get into the market at its peak and panic and exit at the trough.

Middle America definitely understands housing though. Most of the time they live in the same area their entire life. They know what their neighbors house sold for, they know what their other neighbor spent on their new bathroom, and their vested ownership in their home gives them even more incentive to keep the neighborhood thriving. Saving for a house presents a more concrete saving goal than retirement. Who knows how much you will need to retire on? But, its very easy to understand that you need to save $40,000 for a down payment on a 2 bedroom home. Over 20 years, assuming no foolishing refinancing (not an option in a 401k), they would have a reasonable retirement egg.

July 13, 2011 — 2:23 pm

Sean Purcell says:

Like Michael, I’m late to this party and all the really good points have already been made. But that’s never stopped me before…

When I read this article, my first reaction was an intuitive sense that these numbers are all wrong. I think Messrs. Hahn and Klein have covered that well. Mr. Cook, however, lands closer to my take: volatility, understood as risk in the securities market and a lack of security in one’s abode, is a bright line factor in decision making.

This does not appear, at least to me, to contradict what I’ve understood Mr. Swann to be saying for some time now: an owner-occupied home is NOT an investment. Never has been and never should be; it’s a secure place to live and integrate with a community in which one feels kinship. So long as it has a mortgage, it’s not even an asset; it’s a liability. Whether it’s better to rent or own one’s personal abode is best based on location, long term plans and so forth.

It seems like parts of this discussion stem from a growing problem: we are entering an era of baby boomers retiring who are “home rich” and “money poor”. This bodes very well for the real estate industry, but shouldn’t underpin any arguments on the “home ownership vs capital markets” argument. Like almost everything the baby boomers have done during their dubious reign, their current retirement assets problem stems from an almost surreal selfishness; shortsightedness and a desire for immediate gratification without consequence are the boomers downfall, not whether they chose buying a home vs investing in the stock market for their retirement needs.

I argue that home ownership is still the American Dream, not because it provides any kind of retirement benefit or worthy investment return, but like Mr. Cook, because it provides peace of mind, a sense of roots and a connection to a larger community. Moreover, the equities market, as currently constructed and personified by the NYSE, would be low on my list of places to invest. Few outside the market understand it, or why to get in or out of an investment. It’s a rigged game, for the most part, and becoming more and more irrelavent to the average person in America. That politicians still base decisions on “how it might affect the market” is laughable, but grist for a another post.

July 14, 2011 — 8:11 am

Jim Klein says:

Good points all. Another thing throwing this off is the implicit axiom that wealth is money. This dubious assertion is becoming more dubious by the day, literally.

As we will all come to learn, there is really nothing extant except value. Market-wise, an investment is that which will return value in the future. Wealth is a store of non-consumed value, in whatever form it takes. We are all guilty of making the assumption that the standing currency is the best way to track this value, but neither logic nor history support that assumption.

July 14, 2011 — 8:54 am

Vin says:

I remember a study done by a blogger showing average gains of the value of a home vs. the value of an investment portfolio over a 30 year period. The portfolio won in a few different categories.

If you can find an inexpensive rental that suits your needs, why not rent and invest the excess if it will benefit you in the long run?

July 14, 2011 — 9:19 am

Greg Swann says:

> If you can find an inexpensive rental that suits your needs, why not rent and invest the excess if it will benefit you in the long run?

Bingo! Makes the most sense when you’re young, when you’re establishing your retirement plan. We saddle young people with mortgages and huge life and health insurance policies — not to mention outrageous taxes — then we wonder why they can’t manage to save any money. When the real estate market turns, half the people in the country lose every penny of financial cushion they might have had. This is stoopid, and it is entirely an artifact of lies told by the NAR.

July 14, 2011 — 9:26 am

Michael Cook says:

Vin and Greg,

You both need to address the volatility point and the education point. Suggesting a factory worker, who knows nothing about the workings of the stock market base their future on “7%” returns seems incredibily short-sighted. Most people cant even name the stocks that make up the DJIA, let alone explain to me what current economic factors might do to their returns.

In a worse case scenario, its always better to own hard assets. Renting and then owning an investment property might make little sense in many markets, where owning would get you a better return. Clearly, given my profession I am biased towards real estate, but to be clear, I have a very good understanding of how the stock market works. I would rather my 70 year old parents put their hard earned money into their home than into the stock market. Investment or not, I know they will always have their own place to live.

Lastly, I am having trouble understanding how to differeniate between and investment property and a primary home. In theory, your primary residences gets a mortgage tax deduction that your investment property does not. Depending on your area, owning might be more or less expensive than renting. I am in New York, so owning is at least twice as expensive. However, in those markets, as you would expect, price appreciation (and volatility) are much higher. So help me understand why paying $2,000 in rent a month is different than paying a $1500 mortgage plus $500 in general maintenance? The only thing I see is that I get a 35% tax rebate on my mortgage interest. What am I missing?

July 14, 2011 — 1:11 pm

Michael Cook says:

“and the improvements generally last even longer than my old work boots. In many cases, they last effectively forever.”

“Houses wear out. This is not worth quibbling about.”

I think this point is worth quibbling about actually. When considering the time value of money, if I have to spend dollars today to replace something, like a roof, its a dollar or dollar comparison. However, if my roof last for 25 years, it turns out to be a much smaller cost to me. Even if, as expected, the price of roofing materials increases with inflation, I should still be much better off, having invested my money at even 2% above inflation.

“As with a residence, these are all durable utilitarian assets which are devoid of value — used up — at the end of their useful life.”

This statement is only partially true given the key facts above. First, you give no credit to land value, which can never be used up as was already mention. Second, you give no credit to the time value of money. If I buy a house today and it lasts me for 25 years with only basic repairs and then in 25 years it is obsolete and must be completed gutted and replaced, I am still way ahead. One, I own the land and two, I still have useful materials. Living in New York City, I can tell you that there are many pre-War (i.e. pre-1930s) buildings that are still around and commanding huge premium because of the quality of their construction.

Lastly, the land issue is paramount because at the end of the day, even if my entire home crumbles to the ground 50 years from now, the land underneath will be more valuable. And this may be a shocker, but land prices tend to appreciate (more volatile) faster than inflation in some areas. And unless the human race stops multiplying or finds another planet some time soon, there will continue to be more people looking for a fixed amount of land. Perhaps this is more obvious to me because the land value of my condo building here is New York City is actually a fairly large percentage of the value of my condo.

July 14, 2011 — 1:27 pm

Michael Cook says:

“> If you can find an inexpensive rental that suits your needs, why not rent and invest the excess if it will benefit you in the long run?

Bingo! Makes the most sense when you’re young, when you’re establishing your retirement plan. We saddle young people with mortgages and huge life and health insurance policies — not to mention outrageous taxes — then we wonder why they can’t manage to save any money. When the real estate market turns, half the people in the country lose every penny of financial cushion they might have had. This is stoopid, and it is entirely an artifact of lies told by the NAR.”

Not sure how your rental property scenario is any better than this? You believe if the housing market takes a turn for the worse, rentals will be that much more resilent? Has this ever proven true? As someone that works with foreclosures in the commercial space, let me be the first to tell you that commercial multifamily owners were not spared during the housing crisis. If those same people that lost money in their homes had put that same money in rental property, they would have lost their shirts. Oh wait, many of them did. See Las Vegas, Florida, California, etc. Was the stock market better? Nope. Unless you were in gold or cash, you lost your shirt. I dont have any cool latin phrase to describe your error in analysis here, but perhaps someone else can help me out here.

July 14, 2011 — 1:35 pm

Carmen says:

Did anyone really need the Wall Street Journal to figure that out?

July 14, 2011 — 3:40 pm

Beverly Mors says:

The investor had to have all the money in cash to invest in the stock market not be able get a loan the majority of the money and then reap the appreciation on the barrowed money. The $3,000 to $20,000 down payment turned into nearly $300,000 over that time period. So an increase of over 33% per year on every dollar actually invested. No need to tell the Wall Street Journal as they already know this.

July 21, 2011 — 8:00 pm