Just think about my disappointment when I entered a prominent San Francisco eatery seeking the most coveted food stuff, only to find it was neither a specialty nor an item on the menu!

Yet again, I was bamboozled.

What ever happened to truth in advertising?

Perhaps my San Francisco mishap taught me to be perhaps a bit less gullible. When I see a claim, even a statement of fact, I figure it might be important to do some more digging.

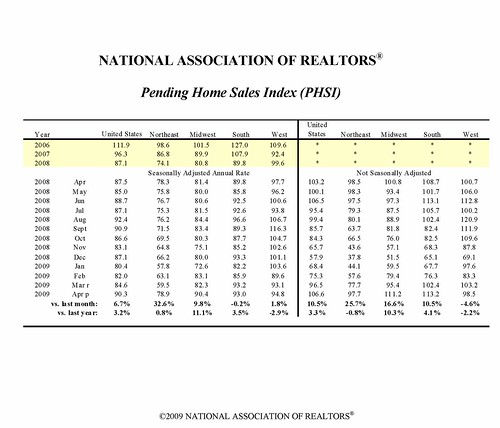

Let’s take NAR’s recent press release regarding Pending Home sales, up 6.7% from a year ago last year. Sounds encouraging – and let’s face it, we all could use encouraging news. But what does the increase really mean?

Let’s take a look at the data behind the aggregated index of 6.7% that NAR published:

NAR Pending Home Sales Index

While 6.7% sounded encouraging, I am not necessarily convinced that it means we are anywhere near out of the woods. Why? Because if you look at the seasonally adjusted for the West and South, areas that have the highest concentrations of inventory and loss of value, the numbers don’t seem to be telling the same encouraging news.

Here’s why. Take Las Vegas for example:

Single Family Home Inventory in Las Vegas per Altos Research

There are about 15,661 properties on the market in LAS VEGAS as of June 07, 2009.

How about Phoenix:

Single Family Home Inventory in Pheonix per Altos Research

There are about 7,816 properties on the market in PHOENIX as of June 07, 2009. Definitely making progress, but still a fairly long way to go.

What about Miami?

Single Family Home Inventory in Miami per Altos Research

There are about 8,450 properties on the market in MIAMI as of June 07, 2009. Again, inventory has significantly dropped, but the statistics do not suggest that the reduction in inventory is due to actual sales.

Let’s take a quick look at Boston:

Single Family Home Inventory in Boston per Altos Research

There are about 187 properties on the market in BOSTON as of June 07, 2009. Only 187 homes in a city of roughly 700,000? Still average market time is roughly 145 days. Even with essentially little inventory, market time is unusually long.

Where was NAR’s tag line “Real Estate is local, consult with a Realtor” in the recent Pending Home Sales Index press release?

Sorry guys – I think we still have a long way to go.

Russell Shaw says:

There are currently more homes being sold in the greater Phoenix area than at any time in history. Business here isn’t “up”, it is WAY up. But that doesn’t mean that things are good for everybody. WHAT is selling is another story (about 65% lender owned). We have two markets here: above 350k and below 350k (max FHA loan here is $346,250).

The median price is at a historical low and inventory in the upper price ranges is bloated beyond belief – but in the lower price ranges there is an actual *shortage* of inventory. How is business? Well I guess it depends on who you are asking. 🙂

http://www.allphoenixareahomes.com/?p=47

http://www.allphoenixareahomes.com/?p=43

June 7, 2009 — 11:50 am

Thomas Hall says:

Russell – great info and thanks for weighing in. You have better articulated why one index does little to really communicate just what’s going on. While things are WAY up in the lower price range, the higher price ranges are stagnant.

My feeling is at least things seem to be moving in the right direction.

June 7, 2009 — 1:39 pm

ShortWoman says:

I can’t speak for other markets. But I can tell you what’s going on in Vegas. We’ve got 12,000 pending/contingents and 17,000 sold since the first of the year. REOs are half what they were 3 months ago (if there were really “phantom inventory” I would think it would start to trickle out in the next 30-60 days). Short sales are slowly moving. This isn’t because of withdrawn and expired listings, it’s because right-priced homes are moving fast, often with multiple offers. There is some teeny bit of evidence that prices have become stable and perhaps are starting to rise a little. My concern is that we may have a mini-bubble of first time buyers.

But my opinions are only my own.

June 7, 2009 — 9:39 pm

Robert Kerr says:

Very interesting site and data, Russell. Thanks.

Do you think the data on %age of sales to investors is correct:

I ask because 5% seems very low given what I witnessed and I know of quite a few cases where Phoenix-area investors misrepresented themselves as resident-buyers on their applications – and that would invalidate the 5% number.

June 7, 2009 — 10:50 pm

Robert Kerr says:

The price per square foot charts are surprising: $70/sq-ft?!

Great site, nice collection of data, I’ve bookmarked it!

Is there any way that visitors to your site can generate their own custom charts?

June 7, 2009 — 10:55 pm

Russell Shaw says:

>Do you think the data on %age of sales to investors is correct

I understand your point and agree – many investors here have made false statements on the affidavit claiming they were owner occupants to get the lower tax rate. But I also believe that if the 5% number is too low, so is the 20% now. Although I will add that the data being used isn’t completely “raw” but is scrubbed about as well as it can be. Mike Orr (the creator of the Cromford Report) is the most impressive evaluator of Phoenix area market stats I’ve ever seen. Here is a link to a talk he did for a mastermind group I attend every month – and it is totally worth the hour you will spend watching it. http://www.number1homeagent.com/index.php/2009/05/22/mike-orr-and-the-cromford-report/

June 8, 2009 — 2:01 am

Ki says:

I have seen this as well in a few markets. Basically inventory dropped but sales did not seem to pick up. I have not looked at stats for May but I would expect to see more sales since rates were pretty low. In fact since rates went up I saw a few panicked buyers trying to buy before they went up too much more. But I don’t expect that influx of panicked buyers to last too long.

June 8, 2009 — 2:39 am