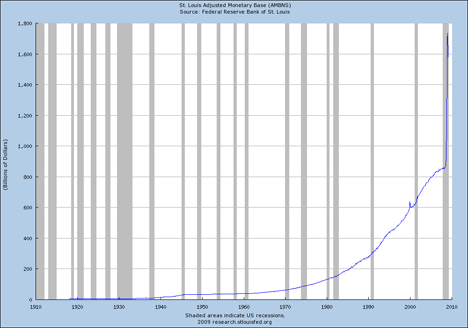

Follow the tiny blue line. That’s the growth of the U.S. money supply. That vertical surge you see there at the right is, essentially, a doubling of the number of dollars in (virtual) circulation since August 2008. Every dollar you own will soon be worth fifty cents. And every dollar you owe will soon be worth two bucks. You do the math…

Doug Quance says:

It’s bad… and I’m not making light of it… but it’s not quite that bad.

The money supply had increased – but not to the extent that our money’s value has been halved:

http://mises.org/markets.asp

March 22, 2009 — 2:16 pm

Greg Swann says:

> The money supply had increased – but not to the extent that our money’s value has been halved:

We don’t need to quibble about numbers.

1. Has the quantity of dollars in circulation increased significantly? Yes.

2. Has the quantity of goods and services increased at the same pace? No.

3. Therefore, are there more dollars chasing goods and services than there were two quarters ago? Yes.

4. Can we therefore expect price inflation? Yes.

5. Does price inflation diminish the value of each spendable dollar held as cash? Yes.

6. Does price inflation over the long run tend to diminish the value of dollar-denominated investments such as mortgages? Yes.

7. Does price inflation over the long run tend to result in dollar-denominated investments such as mortgages being paid with dollars that are worth substantially less when they are paid back than they were when they were lent? Yes.

8. Does this scenario imply that investing in capital goods is more likely to have a happy outcome than investing in dollar-denominated assets? Yes.

9. Is it a reasonable implication that investing in capital goods with as much borrowed money as possible — given current interest rates — is more likely to have a happy outcome than doing so with one’s own money? I say yes.

10. In an inflationary economy, liquidity impoverishes. Debt may not enrich, but it provides better opportunities for obtaining — and retaining — wealth.

Do you disagree with any of this? Real estate is not the only capital asset that will work with this set of premises, but real estate has these advantages in our current state of statism:

A. Investors can leverage real estate at 25% or better.

B. Investors can buy up to ten investment properties with borrowed funds.

So if you had $250,000 in cash in a CD, right now, it could easily drop in value to the 2009 equivalent of $125,000 by 2014. Do you dispute that this is possible?

But you could take that $250,000 and use it to buy 10 rental homes selling for $100,000 each, each of which would rent for $950 a month. (I am deliberately being conservative, but all of this is based on real numbers.)

You now control $1,000,000 in real estate. Each house throws off around $2,700 a year in income after taxes. Even if we make these houses gain nothing in resale value for five years, you still net out a winner on your initial investment — this because of the cash income from the rents. And the rents will have gone up in an inflationary economy, even though we held them flat in this projection. Obviously, if the homes gain in value, you’re ahead by a lot. And what if they lose value? Ask you next-door neighbors. Oh, right. They moved — with no forwarding address.

We’ve lived through all of this before. We know how it works. Am I getting any part of this scenario wildly wrong?

March 22, 2009 — 7:57 pm

Robert Kerr says:

If we experience serious inflation, the higher mortgage rates will drive the median sale price of real estate *downward* and you do *not* want to be sitting on a lot of freshly-purchased property, even at 5%, that’s decreasing in value.

But what do I know? Surely you’re taking your own advice and have begun buying property like crazy, right?

If it’s a smart move for someone who has to pay both sides of the sale, then it’s an even smarter move for a listing agent who only has to pay one side.

So, how many houses have you bought recently? I’m guessing zero.

March 22, 2009 — 6:23 pm

Greg Swann says:

> So, how many houses have you bought recently? I’m guessing zero.

I’m a Realtor, Robert. I’m living right next door to broke. Ask me again at the end of the year. I’ll have to pay cash, but if I had the cash in my hand right now I would be buying as much as I could. Even ignoring the benefit of borrowed money, in an inflationary economy doing anything to convert cash to tangible wealth is a boon.

March 22, 2009 — 6:58 pm

Sean Purcell says:

Am I getting any part of this scenario wildly wrong?

Only the degree… I would lean much closer to hyper-inflation. There is potentially one other problem on the horizon that hasn’t yet been mentioned (and you’re right when you say we’ve lived through all of this before): What finally breaks a highly inflationary period? A RECESSION! The next ten years is beginning to look like a pretty wild roller coaster ride.

March 22, 2009 — 9:10 pm

Greg Swann says:

> The next ten years is beginning to look like a pretty wild roller coaster ride.

It has occurred to me that the best near-term investment vehicles may be beans and bullets.

March 23, 2009 — 6:54 am

Doug Quance says:

Oh I don’t disagree with your premise… and while the market may continue to soften – I would rather pay a little more for a property now than get stuck with higher mortgage interest rates by waiting for the lower price.

Real estate is still a good hedge against inflation… and inflation is coming. Big time.

March 22, 2009 — 10:25 pm

Scott G says:

This is pretty scary. With all of the debt that is being added in stimulus it will be even harder to pay this off in the long run. I pity our children and their children and the mess that we are leaving them with regards to this debt and the enviroment.

March 23, 2009 — 7:02 am

Greg Swann says:

> I pity our children and their children and the mess that we are leaving them with regards to this debt

Post-dated cannibalism by proxy. Who says there’s nothing new under the sun?

March 23, 2009 — 7:10 am

Al Lorenz says:

>It has occurred to me that the best near-term investment vehicles may be beans and bullets.

Those are commodities that the stimulus package has worked well on, at least the bullets half of the statement.

Interest rate will impact property values, or liquidity, but those who can stay in for the long term should come out well. The utility of real estate should be a good inflation hedge long term.

March 23, 2009 — 8:54 am

Jeff Brown says:

Those who have looked back at the systematic demolition of the Carter administration with derision, will soon begin to long for Carter’s ‘moderate’ ideology. 🙂

March 23, 2009 — 10:41 am

Joe Strummer says:

Greg is especially right about real estate right now, given the ability for the average investor to highly leverage his capital. Unless you are in the class of people who can expect the gov’t to give you 97 cents for every dollar of troubled assets you buy, this is the way to be able to do it you’re not among the privileged elite.

But of course, you have to be prepared to ride out the next 5 years at least where property values are going to be hit hard by hikes in interest rates that are coming.

On the upside, if you’re in an industry that pays inflation-adjusted compensation, you will be able to pay off those 2009 mortgages in 2014 dollars in no time flat!

March 23, 2009 — 10:44 am

Thank you says:

I’ve been looking at buying a house, but I didn’t know how the banker takeover and coming hyper inflation would impact my investment…

This will be my first home and I now feel more comfortable going forward.

March 23, 2009 — 11:11 am

Greg Swann says:

> This will be my first home and I now feel more comfortable going forward.

Let us know if you need a referral to a Realtor. We know good people all over the country.

March 23, 2009 — 11:31 am

Tom hall says:

Not only buy a lot of real estate, buy multi-family income property – let others pay your mortgage with their declining valued dollars.

March 23, 2009 — 3:13 pm

Mark Green says:

Greg, I’d love to hear Brian Brady give an update on the non-owner-occupied lending environment.

– Are lenders still going up to 75% LTV N.O.O?

– Assuming they are, what type of rate premium is an investor looking at right now?

– What’s a lender looking for in terms of debt service?

Irregardless, your argument is compelling – certainly worthy of further discussion. I’d just love to see a few numbers crunched.

March 23, 2009 — 3:41 pm

Susan Zanzonico says:

I agree with Tom about buying multi-family or condos that can be easily rented. I have been getting soooo many inquiries regarding rentals..

March 25, 2009 — 8:45 pm