The Arizona Republic is positively ripe with real estate stories today.

The Arizona Republic is positively ripe with real estate stories today.

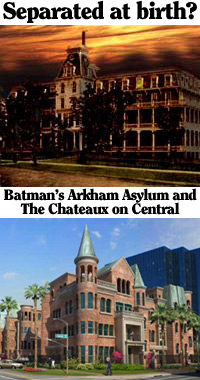

First up, the amazingly ugly Chateaux on Central condominium development is being forced into bankruptcy. The homes were to sell for $2- to $4-million for apartments as many as six-stories tall — not a misprint. Freddy Krueger and Damien from The Omen took a pass on choice units, thus exhausting the entire market for this giant gargoyle of a structure.

In that same column, ace real estate reporter Catherine Reagor suggests that there might be a connection between lower interest rates and increased buyer activity. Jeepers! Who’d ‘a thunk it?!

Economist Elliott Pollack says nice things about the Valley’s growth prospects, so he must be making it all up. Cliff’s Notes: Fundamentals strong, new housing over-built, possibly still as long as two years to shake out.

One of the things I love about this place is that people are audacious. We all know about the giant fake lake in Tempe, but did you know that we have not one but two airstrip-based subdivisions? Garage in front, hangar in back with accessways leading to a private airstrip. In Gilbert, there is a boat-racing subdivision — a long, skinny lake surrounded by houses with docks. They run nationally-televised boat races there. Comes news today that we are about to get our own micro-winery. Modeled on the idea of a micro-brewery, a vintner plans to set up business in Downtown Tempe.

Finally, there is a fun story on the development problems posed by hundreds of old military bombing sites in Pinal County. The explosive charges used in the practice bombs were very small — but still plenty enough to burn down a house. The interesting thing is that we’re talking about Pinal County — too much, too soon, too often declared DOA in the housing downturn. It could be there are people in the real estate business who have heard there really was a day before yesterday, and there may, in fact, truly be a day beyond tomorrow…

Technorati Tags: arizona, arizona real estate, phoenix, phoenix real estate, real estate marketing

Michael says:

You seem like an overly self-centered person. On the one hand, it’s a shame you have a forum. On the other, it’s good in the long run that people can read and judge for themselves.

Seeing views like yours is what ultimately makes democracy (and good sense) function.

November 26, 2006 — 3:16 pm

Buzz Saw says:

The Arizona Republic is positively ripe with real estate stories today.

Um, I think you might mean “rife”. Could be wrong, this whole blog is ripe, I mean dang! What’s that smell?

November 26, 2006 — 5:30 pm

bubbleguy says:

Go find yourself a real job and stop screwing honest people.

November 26, 2006 — 6:36 pm

Greg Swann says:

> Go find yourself a real job and stop screwing honest people.

I sold a house this afternoon. The commission was absurdly high, almost $23,000. I screwed the buyers by donating almost $18,000 to their down payment and closing costs. It was a blood bath. I screw people like that all the time. I can’t figure out why they keep coming back — and sending me all their friends and relatives. They must be masochists…

November 26, 2006 — 6:46 pm

james says:

Hey Dude,

I’m watching this real estate market melt down. Its going much like the bloggers had mentioned years ago. No one seems to have a real good time line though.

If you have something to really respond with then how about answering how the capital gains exemption increased the value of real estate or perhaps tax structure changes cause real estate to be more valuable.

Otherwise housing values are out of whack and financial stress is at too high a level to be maintained.

I think the CH Smiths web site had some good info.

Otherwise the real estate industry seems to be full of people selling sunshine to everyone. It all seems chocked full of vultures of one kind of or the other.

James

November 26, 2006 — 10:26 pm

Joe says:

>I sold a house this afternoon.

Just curious, Greg (and I can understand if you don’t want to share this information):

* How much did they buyer put down, percentage wise?

* Did they opt for a fixed or an ARM?

* Are they spending less than 30% of their income on the loan?

* Was the loan amount less than 3.5 times their annual income?

November 26, 2006 — 10:43 pm

Joe says:

Hello? Greg?

November 28, 2006 — 5:07 pm

Joe says:

I guess Greg is too busy out selling houses to answer. Because, gosh, I can’t think of any other reason that he wouldn’t want to answer those questions. 🙂

November 29, 2006 — 2:27 pm