One of the important things that Paulson said in the press conference yesterday was that we (the government) don’t want Fannie and Freddie to stay public and that one of the things that the next administration and Congress has to figure out is “How in the world do we take them private again?”

In light of that, I thought I’d repost what I original wrote on July 22, 2008 about a potential bailout. Not because I think I was right, but because I think we need to start thinking and talking about what happens now. I certainly don’t want the Federal government “mucking around” in the mortgage world for a long time.

What do you think?

Tom Vanderwell

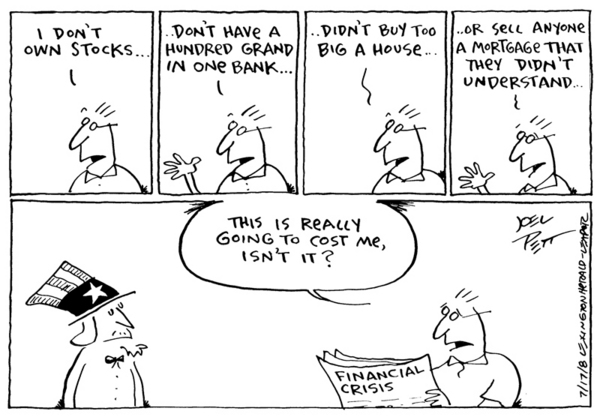

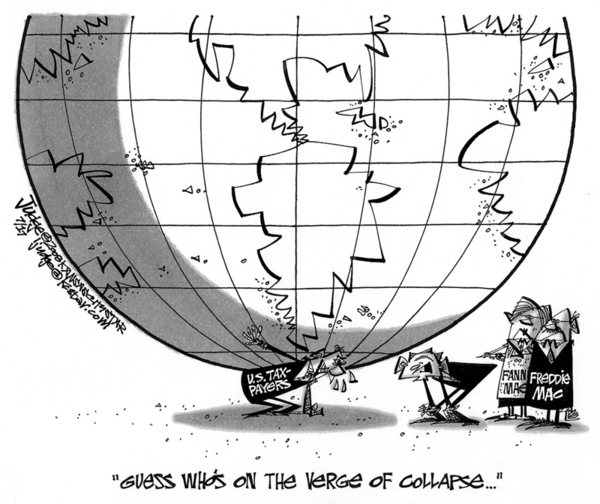

July 22, 2008 Barry Ritholz at The Big Picture had these two comics that brought to the forefront again the issue of moral hazard. Check out the comics and then we’ll talk “on the other side.”

Okay, now some thoughts about moral hazard:

The definition of moral hazard (as taken from that scholarly journal, Wikipedia):

Moral hazard is the prospect that a party insulated from risk may behave differently from the way it would behave if it were fully exposed to the risk. Moral hazard arises because an individual or institution does not bear the full consequences of its actions, and therefore has a tendency to act less carefully than it otherwise would, leaving another party to bear some responsibility for the consequences of those actions.

Let’s break that down and look at it a little more closely in light of the current market environment:

a party insulated from risk may behave differently…. What that means is that, frankly, the people on Wall Street and the bankers on Main St. (including yours truly) might very well have done things differently over the last few years if we had been more fully exposed to the risk. Will Fannie or Freddie buy it? That’s all that most mortgage lenders really cared about when structuring a loan. On Wall Street, the guys (I’m using that term in a gender neutral sense, okay?) who packaged these loans up and sold them as securities didn’t really care how they performed, all they cared about was the great big fat commissions that they made. The rating agencies didn’t care about whether they really told the truth about these mortgage backed securities, all they cared about was getting the big fat commission checks.

And so what do we have now? We have, between Wachovia and Washington Mutual, $10.1 billion in loan loss provisions in the last 12 hours. That’s for a period of 90 days folks. I was going to figure out the cost per day but my calculator doesn’t crunch numbers that big!

Moral hazard arises because an individual or institution does not bear the full consequences of its actions.

But how can we prevent a total meltdown of the housing and mortgage market (what would happen if Fannie and Freddie actually went under) without absolving some of the participants (for this particular discussion, we’ll limit it to Wall St., the Ratings Agencies, the Mortgage Companies, and the Banks who wrote the loans oh, and the mortgage lenders themselves if they did anything criminal or fraudlent) of at least some of their consequences?

Let me offer a few suggestions to start the discussion:

1. If the US Government has to step in to bail out any more financial institutions (aka Bear Stearns Take 2), the shareholders should get virtually no value for their existing shares. Years ago, I bought stock in AutoDie (a local die manufacturing company). It went bankrupt, I lost all $1000 that I put into it. (I know, big time investment). I know what you’re thinking – what about the FDIC and banks that fail? I’m not proposing a change in the way of FDIC, that’s going to continue to work the way it works and I’m all for that. I’m talking about the Bear Stearns, Lehman Brothers, Goldman Sachs type of investment banks.

2. If the US Government has to step in to bail out Fannie and Freddie, I think the only way that should be done would be for a couple of things to happen: 1) Existing shares should be turned into some sort of subordinated debt where the only way the shareholders would get any of their investment back is once Fannie and Freddie are paid back and they are turning a profit and then they would get back a nominal “dividend” until 5 years of profitability has happened. 2) The existing management along with their exorbitant compensation structure need to be shown the door (I could ruin Freddie Mac for a lot less than $20 million per year!) 3. There needs to be a 10 year plan put in place to eventually move Fannie and Freddie from GSE’s (Government sponsored entities) to totally private enterprises. It needs to be done but the market is too fragile to handle it now. That’s why I’m proposing a 10 year plan.

I know that there are companies who indeed are too big to fail, the economic devastation that would be caused by them failing would be significantly worse than stepping in to save them. But I’m getting the very uneasy feeling that the rally in the financial stocks that we’ve seen going on in the last week is being caused/encouraged/related to some sort of an “It’s going to be okay, because Uncle Sam is going to bail out Fannie and Freddie and that will save us from all of our bad investments and the world will be okay.

The world is not without risk, a lot of risk, but when there isn’t the consequences as well as the rewards for the risk, something has gone wrong. According to reports that I’ve read, this bailout could cost all of us $25 billion. We better make sure we do it right or we’ll all be paying for it for it for a long time and we better make sure things are set up so that the same risk without consequence issue doesn’t come back to haunt us again.

What do you think we should do?

Tom Vanderwell

Thomas Johnson says:

These Wall Street bailouts make defending freedom in Iraq seem downright inexpensive.

September 9, 2008 — 10:15 pm