Has SellsiusRealEstate.com (“Just like Craigslist, only not free!”) hit the Dead Pool? The weblog rages on, but the main site doesn’t even 404. The “About” page for the weblog has been re-rendered as yet another those-who-can’t-teach pitch, and, of course, Sellsius was a pioneer in the suddenly-popular practice of making net.friends in order to sell them out to advertisers. Perhaps these business models are enough to keep the wolves at bay. Sic transit gloria mundi.

But despair not. Even today, there is something new under the sun. RealtyBaron.com is introducing an idea it calls “risk management for Realtors.” What it is is a hedging strategy — akin to an insurance bet in Blackjack — whereby listing agents pay a premium to insure that listings are profitable whether or not they sell.

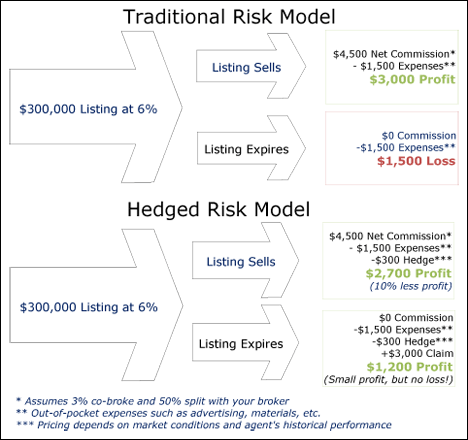

Worth a thousand words:

Oh, wait. That is a thousand words. 😉

This is not quite stoopid, although it shares some genes with stoopid. It’s a Realtor-milking scheme, beyond all doubt. It’s not quite as scurvy as some scams, but it does amount to you betting on your own failure, hardly the food of a good attitude.

I don’t completely hate the idea. But, assuming it takes off in sufficient numbers to matter, it seems to be misaligned to rational market incentives.

As I’ve discussed in the past, we charge a non-refundable retainer to sellers for similar reasons, to cover our front-loaded costs if the rug is pulled out from under us. But the primary reason for the retainer is to impose a meaningful cost on the seller for pulling the rug out from under us. We want for our sellers to have some skin in the game, to make cancellation an unattractive prospect — and to make sure they’re completely committed before we start working. The hedge bet does nothing to assure the commitment of the seller.

Moreover, as above, the entire plan is built around a bet on failure. If you as the lister know your ass is covered both ways, are you as likely to do the whatever-it-takes to get your listing sold? And if you are not, what direction should you expect the hedging premiums to take going forward?

Not my problem. During the beta period, RealtyBaron plans to play its hedging game with play money — which is itself probably a poor idea, since people take risks with play money they would never take with the true gelt. But as a bonus, if you play along in the beta, any “BaronBucks” you earn will convert to ownership in the company at the end of the beta. That’s a fun idea just by itself.

It’s not for me, but at least it’s something different.

Technorati Tags: real estate, real estate marketing

marc says:

Greg, just as in Blackjack, the hedge is not a “bet on failure”, but rather a bet to “soften” failure. The reward for success remains a much better outcome (125% more money).

September 3, 2008 — 8:31 am

Greg Swann says:

> Greg, just as in Blackjack, the hedge is not a “bet on failure”, but rather a bet to “soften” failure.

You don’t control the outcome on an Insurance bet in Blackjack. Whether or nor your listing sells is a direct consequence of the effort you put into selling it. Anything that “softens” that effort is a betrayal of your fiduciary duty to the seller.

However, given that so many Realtors are self-serving and lazy, I think you might have yourself a product. Just not here.

September 3, 2008 — 10:16 am

marc says:

“Soften” the pain of failure…not the effort, Greg. In fact, I feel a hedge strengthens an agent’s effort in two ways:

1) Agents can invest more time and/or money into selling each listing (i.e. risk more) knowing they will earn a return on the investment(s).

2) Agents will be less likely to betray their fiduciary duty at moments when doing the “right thing” may harm the chance of a sale.

September 3, 2008 — 11:02 am

Michael Cook says:

Perhaps its the investor in me, but why I dont I just become an agent and not do any deals? I am making $1200 for every deal I dont do. It sounds like I could do nothing, but find “clients” to allow me the pleasure of listing their home and cash out? To make it even sweeter, I could offer my clients $600 if the house doesnt sell within 30 days. Have a laugh, split the profits and repeat.

If unlike me you have some moral code, you could still use this with those crazy sellers, who wont budge on the price or have some other outrageous demand that will inevitably kill any possible deal. In fact, you might even want to seek them out because they are worth $1200 a head.

This seems like a very, very bad idea and I am not sure what VC would back this foolishness.

September 3, 2008 — 11:07 am

Michael Cook says:

Marc,

I appreciate that you see the good in people, but the reason why insurance agents are so tough is because people will always try to game the system. For every one person that would do as you say, there would be five thinking like me (or worse).

September 3, 2008 — 11:10 am

Thomas Johnson says:

I would love to see the NAR promulgated Zip Form disclosure for this one.

If there is no disclosure to the seller, this is for sure a neglect of fiduciary duty, and, I think, a Code of Ethics violation?

Does E&O cover the lawsuit from irate sellers that find out they have an unsold house and their listing broker collected cash for the failure?

Let’s go collect a bunch of 48 hour listings and split the winnings with the seller!

September 3, 2008 — 11:11 am

marc says:

Michael,

Each hedge is underwritten. In your scenario, it’s very unlikely it would be approved for at least the following reasons:

1) You just got your license yesterday which would prove too risky.

2) 30 days is far too short given your local market’s avg DOM is 90 days.

September 3, 2008 — 11:27 am

Greg Swann says:

Marc, I think Michael and Tom have your number memorized by now. Rewarding Realtors for failure is hardly necessary. Ninety-three percent of ’em fail for free already.

This is text I just posted in brag boxes on two of our web pages:

In fact we haven’t done many listings this year. We’ve been turned down twice — always amazing to me, considering how much more value we deliver — but we’ve walked away from a dozen or more. Even with the retainer, we lose money on homes that don’t sell — so we won’t take the listing if we know if cannot sell in this marketplace. This is how we make money, and this is the best favor we can do for an irrational seller.

Taking the listing and then betting against ourselves, the seller and the home is a poor strategy — one that is unlikely to sell many homes but which seems very likely to attract every lazy loser in the NAR to RealtyBaron.

For your sake, I hope we’re all wrong. But I don’t think we are.

September 3, 2008 — 11:44 am

Bob in San Diego says:

I see a whole lot of nothing in the details.

– Nothing about the underwriting process – no mention that its required or how that will be done

– Nothing about the beta period – is that until its an IPO?

– nothing that shows that you ran the baron bucks as equity concept by an attorney

– nothing about the legal way you expect to do this – I’m thinking UCC stuff, but again, nothing as far as details anywhere.

Care to fill in some the blank spots?

September 3, 2008 — 12:33 pm

Michael Cook says:

Note in the example, if you spend nothing with the hedge, you make the same as if you sell the house with the hedge. Sounds like a real estate version of “The Producers.” If this takes off, I will strongly consider getting a real estate license, keeping my investment banking job, putting up a website offering $500 if someone would allow me the pleasure of listing their home, and becoming a very rich man before these fools go out of business.

September 3, 2008 — 12:33 pm

marc says:

Bob,

– The underwriting process is done within 24 hrs of the hedge application. A confirmation email is sent to you explaining this after the hedge application is received.

– Beta period will continue until the system is well tested. Obviously, as soon as possible, but no estimate of when that will happen.

– BaronBucks are not equity nor are they being purchased with real money.

– The design was researched and vetted during the past year which included consideration for legality.

September 3, 2008 — 1:23 pm

Bob says:

Thanks Marc. Care to elaborate on what underwriting is based on?

September 3, 2008 — 1:58 pm

Sean Purcell says:

Michael has pretty well nailed this one. But let’s take a page from the Jeff Brown playbook (i.e. see a bad idea and turn it into something that works). There is always a market for hedging risk (which is quite different from hedging failure).

If you want to hedge risk there is nothing better than options; calls and puts on the home listing. You could use prices for the strike and have various expirations to coincide with time on the market. What makes this interesting is that the homeowners themselves can hedge some of their market time exposure. Neighbors, agents and potential buyers could bid up or down various options signaling the true value of the home. What’s needed: a marketplace. What’s the problem: liquidity. Any ideas?

September 3, 2008 — 2:01 pm

marc says:

Bob,

The underwriting categories include:

– Agent

– Property

– Photos

– Listing

– Market

Each category contains multiple data points which are inspected. Furthermore, each data point has multiple guidelines associated with it. For example, one guideline for photos is: “At least one photo for each bedroom, bathroom, living area, and dining area”

September 3, 2008 — 2:07 pm

Bob says:

The whole thing hinges on the underwriting standards. Commission advance guys do this.

So what are the conditions that must be met for approval?

Can it be a new listing?

What is the listing time frame?

What if the seller cancels the listing prior to the contractual expiration date?

Are disclosures reviewed?

Is the listing price a factor?

September 3, 2008 — 2:11 pm

Bob says:

“At least one photo for each bedroom, bathroom, living area, and dining area”

So you will determine market strategy?

September 3, 2008 — 2:13 pm

marc says:

Bob,

The underwriting doesn’t “determine” strategy. Strategy is left to the agent. Underwriting is used to assess the risk of each hedge.

For example, Michael Cook applied for a hedge under a fake name. Fake Michael requested a hedging period of 30 days. It will be rejected because 30 days is far too short. As the system matures, the guidelines may allow 30 days at a certain price point, but not now.

September 3, 2008 — 3:20 pm

Paul says:

“— akin to an insurance bet in Blackjack — ”

Interesting analogy Greg.

From somebody who was a Blackjack Dealer and took casino classes at UNLV that involved quite a bit of statistics — that’s one of (if not) the biggest sucker bets there is for the player in traditional blackjack.

“***Pricing Depends on Market Conditions and Agent’s Historical Performance.”

Hmmm… Something tells me that the price for “the hedge” is going to certainly benefit the house. If the Hedge is even approved in the first place. Which… correct me If I’m wrong, goes through underwriting after the listing is taken. Priced, photos taken, etc..etc..

This has nothing to do with rewarding bad behavior. Any significant real estate experience and you can look at the marketing and the price of a home to get a pretty good idea if it’s going to sell… or not.

Like Greg mentions… we’ve walked away from potential listings because–

“— so we won’t take the listing if we know if cannot sell in this marketplace. This is how we make money, and this is the best favor we can do for an irrational seller.”

I can specifically think of two that we did not take and other agents did — ($50,000 and $85,000 overpriced in our opinion)– which on the last check, were still available for sale. I certainly would not approve any hedge on those :).

However, I would certainly take the $300 hedge bet from a couple of well known bank owned listing agents that I know — who just so happen to price the homes really, really good. (And yes.. they actually clean up the homes for the bank and actually take more then one picture.)

As Marc from RealtyBaron points out in the comments — not anybody can get this “hedge” and something tells me that the people who can get it… won’t need it.

Nobody said they would take/accept every hedge request.

Certainly a very interesting concept to say the least — if you are the house.

September 4, 2008 — 3:11 am

Greg Swann says:

> that’s one of (if not) the biggest sucker bets there is for the player in traditional blackjack

Yeah, I know, but I didn’t want to get too deeply invested in what is in important ways a specious analogy.

The rest of your comment is fascinating. I’ll be interested to see how this plays out.

September 4, 2008 — 7:00 am

Michael Cook says:

Would this have to be disclosed to a client? I would be interested to hear how that conversation goes. As an investor, I cannot imagine that I would be excited (or in business) with someone that is hedging their bets.

September 4, 2008 — 8:19 am

marc says:

The business model is not a Vegas casino, i.e. slanted odds. RealtyBaron will earn an underwriting fee (i.e. $10-20) and will price the hedges so that premiums equal payouts over time.

September 4, 2008 — 8:36 am

marc says:

There are dozens of guidelines, but getting approved is not difficult. However, if a hedge is rejected, the agent is notified with reasons and has the opportunity to re-submit.

Absolutely.

Anything but absurdity. 45 days? Very likely. 48 hrs? Not a chance.

Yes, but currently the payout is prorated.

No.

Yes, but again, anything but absurdity.

September 4, 2008 — 9:06 am

Doug Quance says:

Interesting topic for conversation – but I don’t see this working in the real world.

The mortgage industry, too, thought they could hedge their bets… and we see what that got them.

September 4, 2008 — 10:36 am

Josh says:

What about agents not purchasing the hedge for listings that will easily sell. If they tend to only purchase the hedge for listings that are sketchy, the result will be an excessive amount of claims and payouts in relation to premiums paid.

I know that group health insurance companies deal with a similar tendency where employees who are healthy opt-out of the health plan or purchase individual health plans for less cost. The result is that the group plan provider gets stuck with a disproportianate number of unhealthy people who require more care. They fight this by setting minimum employee opt-in percentage requirements.

Does REALTY-BARON have any plan to require agents to “opt-in” on at least a certain percentage of their listings?

September 4, 2008 — 10:51 am

marc says:

No minimum requirements. However, the scenario you describe is considered. For example, if Joe Realtor sells only 1/5 of his hedged listings, Joe is one of two things: an under performing agent or hedging his most risky listings. Either way, Joe’s cost of hedging increases.

September 4, 2008 — 11:46 am

laurie mindnich says:

I got as far as the “retainer” for expenses (from a seller who is overpriced), and thought, Suckaaahs!”- pay for an overpriced listing. Or did I misunderstand something of greater value? Waaaay outside of the thought process that simply suggests: “If it’s overpriced, let it go.”

The sellers don’t need an additional expense; they need a reality check, however they find it, and a sold sign.

Absent that, no outside expenses neccessary. It’s hard enough.

September 5, 2008 — 5:54 pm

Greg Swann says:

> I got as far as the “retainer” for expenses (from a seller who is overpriced)

Go back and re-read. We don’t take overpriced listings.

September 5, 2008 — 6:34 pm