Q: Is there room in the Realty.bot business for a third major player?

A: What business?

Joel Burslem came to Phoenix last week, and I had a chance to spend a few hours with him before he flew back to Portland. Because I live and breathe real estate and because I’m casually cruel in a thoughtless kind of way, I punished him with real estate tour — major commercial developments with side trips into residential neighborhoods. Joel’s observation: “There sure are a lot of ranch houses.”

It’s one of my life’s goals to be a kinder, more thoughtful person, but dramatic differences may require a reincarnation or two. Even so, I didn’t just make Joel look at houses. We had plenty of opportunities to talk as we meandered. One of the topics I wanted to discuss was the profit potential for Realty.bots like Zillow.com and Trulia.com. Zillow has firmly embraced the Google.com business model of delivering advertising based on targeted search. Trulia had just moved to a business model pioneered by Realtor.com — milk the listers.

My question is this: Taking account that I myself am impervious to advertising, how is any of this going to play out in the long run? People will pay for clicks for a while, but sooner or later they’re going to try to account for those clicks in converted sales. If the impact of advertising is not demonstrably cost-efficient, then why do it? I’m not saying this will happen, but as media consumers become more and more like me, it seems to me to be more and more likely.

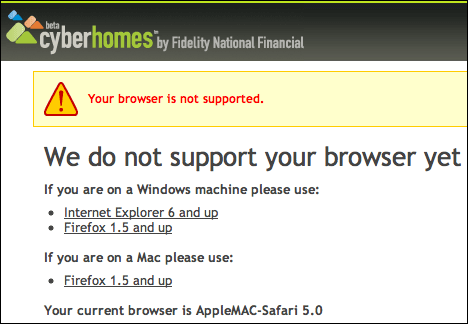

Into that steaming cow-pie steps CyberHomes, about to emerge from a year-long beta period:

That’s not auspicious, but who know what tomorrow will bring.

But, more importantly: Who cares?

For now, CyberHomes is Yet Another Map-Based Automated Valuation Model. Punch in your address and you get a wild-eyed pricing guess based on tax records and statistics and having no material connection to the actual house, which, as I have demonstrated in the past, may not actually even be there. So far: Big yawn.

CyberHomes hopes to dominate the hugely unprofitable free-AVM market by having access to the vast title farms of Fidelity National Finance. Will better information on recent comparable sales make for better estimates of value? It would in the hands of a skilled real estate professional. In software? Probably not so much. Pricing a house is an art that requires a vast amount of data that will never be found in databases.

But who cares about that anyway? CyberHomes isn’t competing with appraisers or Realtors. It’s competing with Zillow. I haven’t seen the new release, but what I’ve seen so far is Zillow in the Spring of 2006 with heat maps from Trulia that came along in the Summer of 2006. If there is anything on the site beyond the AVM, I’m not seeing it.

Here’s another interesting idea I had last week, although I don’t remember talking about this with Joel. If a Rich Barton really wanted to disintermediate a branch of the real estate industry — a few highly-paid flak-catchers, a few very-low-paid drones, a whole lot of computing power and much lower costs — the arm of real estate that is both most-ripe for disintermediation and most-profitable by far is the title and escrow business. Title companies make their money by issuing insurance policies they almost never have to redeem. With improved data processing, their track record will only improve. This is the branch of our business that is most like stock brokerage or travel agency, and it is the one that could most easily and most profitably be supplanted by better information technology.

So why is Marty Frame building an also-ran AVM with Fidelity’s money and information? You tell me…

Technorati Tags: disintermediation, real estate, real estate marketing, technology, Zillow.com

Michael Wurzer says:

Exactly.

November 12, 2007 — 9:33 am

Diane Cipa says:

http://radicaltitletalk.blogspot.com/2007/11/dont-underestimate-ability-of-fidelity.html

Michael……it’s spread well beyond that. They’ve got real estate sales in their cross hairs and these guys are a damn good shot.

November 13, 2007 — 6:52 am