No apologies for the topic. As many problems as exist in the real estate industry — many more than the practiced elites would like to acknowledge, many fewer than the bubbleheads need to satisfy their tantrums — Redfin has made itself a prominent example of how not to improve things.

A few days ago in a comment section I wrote that Glenn Kelman’s a phony. It was the heat of the moment and I only wrote it because, well, he is a phony. He has to be.

On the one hand he has to corral capital and customers by feeding the realtor stereotype of the venal do-nothing narcissist, exemplified here in the Sixty Minutes shtick. But on the other he desperately needs the cooperation of the very people he’s trashed if his model has any chance of succeeding, thus the apparent charm exuded at Inman Connect. He creates a crisis of disdain for the full service agent, sets himself up as the champion of the little guy to quell the crisis, then calls on the full service agents to help him do it. Quite a dance, that.

But.

I admit I haven’t spent a lot of time on the Redfin website. It’s not in my market, and I’ve read and seen enough to know it’s a model that’s not likely to succeed. I’ve left the particulars to others and the market to its natural flow.

But I never thought the champion of the little guy would be dumb enough to try to con: the little guy. The following comes from a BHB reader, Leonard Wallace, who…I’ll let him tell it:

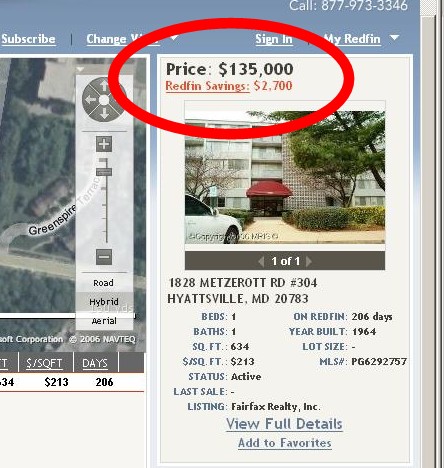

I’m a broker in Maryland where Redfin arrived last month. I’ve read many of your [BHB] posts about Redfin, but I haven’t seen anyone comment on their blatantly false advertising. Here’s a screen shot of a listing in the Washington area:

Leonard goes on to point out:

Redfin’s minimum commission on any buyer transaction is $3000. That never came out in the Sixty Minutes piece or anything else I’ve seen: note here, the first page of the ‘how to buy’ section. That’s why, I suppose, a $500,000 selling price is used as a ‘typical home’. Only when you click through a number of pages to here, does this come up:

Redfin’s minimum commission is $3,000; this is typically only an issue for homes under $300,000 or for-sale-by-owner homes.

Ambiguity at its finest.

Note the Redfin Savings line. First, it’s absent any caveat. It’s not ‘possible Redfin Savings’, it’s not ‘approximate Redfin Savings’, it’s the definitive ‘Redfin Savings’. Second, it’s computed with an algorithm based solely on the, ahem, ‘sacrosanct’ 6% commission, with 3% the arbitrary BAC, multiplied by the listing price and 2/3. Third, and most importantly, it does nothing to compensate for the $3000 minimum Redfin will take for itself.

So in the case above, Leonard found the actual BAC to be 2.5%, and with the $3000 minimum factored in the real Redfin Savings would be: $375. Rebating $2700 for negligible service I suppose is one thing; rebating $375 for negligible service doesn’t quite seem worthy of a champion.

Is this false advertising? Very close. There’s no accessible definition of the ‘Redfin Savings’ line, and the video tutorial even repeats the canard: “Finally, if you look up here next to the listing price, you’ll see that on this home” — this, of course, is on a $6M listing — “you’ll save just under $120k if you buy through Redfin.” Definitive.

Is it bait and switch? Of course. The purpose of bait and switch is to get the phone to ring, and I assume those answering have been schooled in the art of overcoming objections. The ‘We rebate 2/3rd of the buyer’s agent commission!’ is prominent throughout Redfin liturgy, but, with the median price of a US home at around $225k, that accurately applies to fewer than 50% of listings.

Is it important? In and of itself, not terribly. But as a reflection of the Redfin modus operandi, yes, it’s very important.

Most have no problem with a company targeting the high end market for its niche, as Redfin clearly is doing (though I’d question the assumption that someone buying a $6M home would want a GenXer steering the process). Most have absolutely no problem with a company using technology to its advantage, even if it changes the inherent structure of an entire industry. People adapt amazingly well.

What people do have a problem with is a company doing all those things dishonestly. Whether it’s bait and switch, hyper-damning the industry and its agents to advantage, or exaggerating teleagents’ capabilities — eight closed transactions a week? Better negotiators than traditional agents? — Redfin has built its entire model on duplicitous schmooze. The sad irony is Redfin is everything — and then some — that it claims to be trying to fix.

That’s why Redfin hasn’t succeeded…and won’t.

People simply hate phonies.

J. Ferris says:

Meh, Redfin bores me now. Kelman went for celebrity status and I see his status going the way of Lindsay Lohan nowadays. Let them handle the sellers/buyers who don’t want traditional or full service assistance and full service agents can go back to working with home buyers and sellers that want to pay for what we have to offer. If Foxtons(they pulled out of my market without telling sellers and fired all of their agents in one shot) is any indication of how discount brokers work I’m not worried about Redfin one bit.

August 18, 2007 — 12:03 pm

Jeff Kempe says:

> Redfin bores me now.

I’ve agreed with that even from the beginning. I wrote right after Sixty Minutes piece that it was never going to work, no need for concern.

Except: The real estate industry has a lot of internal problems both of perception and practice, and fragmented ideas on how best to attack them. One of those ideas holds the Redfin model out as exemplary, the future.

You’re right: more people are seeing the holes in the argument, but there’s no down side to being the one holding the auger.

August 18, 2007 — 12:45 pm

Jeff Brown says:

Jeff – First of all, excellent post.

As soon as Redfin began getting noticed, I told whomever would listen, that the discount brokerages come and go with boom markets. The ones that have demonstrated legs, have corralled a small, but apparently acceptable niche. Good for them.

In normal to down markets, discount brokers simply don’t cut it for most sellers. End of sentence.

August 18, 2007 — 12:55 pm

J. Ferris says:

The Redfin model is held out as exemplary because there is no other “new” model that people can embrace as a new way to do real estate. Redfin’s lukewarm reception by consumers indicates that they DO want an easier way to do real estate but the Redfin hybrid traditional/”web 2.0″ way of doing it isn’t it. There was similar buzz around Zillow.com and Trulia which have settled into their niches very well but they, just like Redfin, lack the Googleish momentum to continue innovating and keep people interested in what they’re doing. Come to think of it, I think there was much more fanfare about how much venture capitalist groups were investing into these companies than what these companies would actually do in their chosen industry. Anyway, the consumers want professional negotiators, market experts and people who will do what they say they will do. It’s really not a tall order! The problem most agents have in fulfilling this order is that they say they fit the bill because they know that’s what consumers want to hear (= sales) but they don’t actually understand the concepts and ideas behind providing this type of service which makes them incapable of doing so.

August 18, 2007 — 1:00 pm

JIm Gatos says:

Those dirty bastards (at Redfin)…

Actually, it’s our fault. Thank you for point out their “minimum” commission. I can’t remember; Was THAT pointed out at 60 Minutes?

We all should spend hours deciphering and de-crypting Redfin’s borderline bait and switch methods!

Jim

August 18, 2007 — 7:18 pm

Russell Shaw says:

I’m with Jeff, “end of sentence”. But I don’t think of Glenn as a phony – I think of him as someone who has done a magnificent job of getting press and getting something going, that never had any real reason to get going at all.

Of course Redfin will fail utterly, that is a given. But if he can accomplish what he has with a plan as flawed as the one he has been working with, imagine how far Glenn Kelman could go with a business idea that did have legs. I predict he will be a fixture in our industry for many many years to come and he will ultimately wind up quite wealthy. Just not from Redfin. 🙂

August 18, 2007 — 10:47 pm

Jonathan Dalton says:

Glenn commented on one of my posts about Redfin, saying the difference was in how they connected with their clients and the level of service they provided. Since it was more than a little vague, I told him he was welcome to expound on his thoughts as much as he liked.

The crickets still are chirping.

Redfin can’t survive except in the higher-priced markets. The numbers don’t work anywhere else.

August 18, 2007 — 11:06 pm

BR says:

Jeff, we’ve said for a long time that their march into the most expensive markets in the country is necessary to survive in smaller markets. The brand is built for market share. Also, I belive that buyside has a $200k limit on their rebate checker. Whether they cannot get the market share they need remains to be seen.

Investor Jeff is correct that they thrive in bubble markets and die in weak markets, but in the past they weren’t being kept a float by vc money. Will it dry up too? We’ll see.

Other Jeff, you’re right, this has never been about the little guy- its about the almighty buck.

My future prediction is “Zillow Realty” when the vc giant swallows up redfin and creates the full service and the do it yourself products… wouldn’t that be a hoot!

August 19, 2007 — 6:17 am

Reuben Moore says:

In regard to Kelman and Redfin, high-integrity people do not hawk low-integrity products. Not knowingly anyway. Is Kelman a “phony”? Well, if he is not a phony, then he is a misguided simpleton. And, I for one just don’t buy that. If nothing else, Mr. Kelman is quite clever and certainly a PR genius.

This reminds me of a quote: There is no such thing as a contradiction. If you find one, check your premises. You will find that one of them is wrong.

August 19, 2007 — 8:53 am

Jeff Brown says:

Ah, an Ayn Rand fan. 🙂 Me too.

August 19, 2007 — 9:55 am

Reuben Moore says:

Jeff – Yeah, I am almost certain that Glenn Kelman’s middle name is “Peter Keating”….

August 20, 2007 — 6:31 am

Glenn Kelman says:

Hello,

This is an excellent point. We will be more clear about our commission refund in cases where it seems likely to apply.

Already, we clearly explain how we calculate the commission refund in a page that is one of the most popular on our site. We also explicitly warn clients about the minimum fee before they submit an offer using our Offer Wizard. Once an offer is submitted, our agents immediately query the MLS to determine the actual commission being paid for the property in question, and then notify the client of what refund, if any, he or she should expect to receive. All of this happens before the client signs a purchase & sale agreement, and most of it happens before the client even attempts to make an offer through the Redfin site.

We have tried to display in advance the actual commission paid for each property, and thus the refund that a client can expect to receive, but MLS rules forbid this disclosure via the web. For our first year in business, our average commission refund was 1.96% of the property value, so it has seemed fair to use 2% as an approximation of the commission refund a client can hope to get.

But we should still warn clients buying less-expensive homes that our minimum fee will limit their refund. This is a feature that slipped the last update to our website, but which we are putting into a new version of the site scheduled to be released at the end of this week.

The reason that we didn’t address this issue before was sloppiness rather than any nefarious attempt to make the telephone ring (we prefer that clients first approach us online, not by telephone, anyway); we instituted the minimum fee without taking the time to update the site in all the places we should have. It hasn’t been an issue with our clients so far because they tend to buy expensive homes, and those who don’t seemed well aware of the minimum from the warning displayed in the Offer Wizard.

All the same, you make a good point, and we hope to address the issue later this week.

Regards,

Glenn

August 20, 2007 — 4:35 pm

Joshua Ferris says:

Glenn,

Thanks for addressing the point in a concise way. I applaud your quick efforts in addressing the issue at hand but do realize that being in the spotlight will force your company to be held to a higher standard and thus all mistakes you make will be noticed more than the average company’s would. Your offer wizard is an interesting concept. I do have one question for you though… What if the total commission amount offered to the buyer’s agency is less than $3,000? Does the buyer have to kick in the difference?

August 20, 2007 — 5:12 pm

Jeff Kempe says:

I appreciate your response as well, Glenn. I don’t buy it, but it’s appreciated nonetheless.

If I were an investor, the only thing that would worry me more than your deliberately deceiving your customers is your deceiving them due to … sloppiness.

It’s axiomatic: Under promise, over deliver. That goes triple for a startup. Transparency – honesty – generates confidence; if honesty means you’re not going to get the $250k buyer this time, perhaps he’ll come back when trading up.

But a buyer contacting Redfin expecting, due to a search engine promise, a $2700 rebate and finding instead the rebate will be $375, not only isn’t going to buy through you, but isn’t going to go to the next cocktail party singing your praises.

That isn’t Peter Drucker esoterica, it’s common sense, and should be a top priority, not an afterthought.

Best.

August 20, 2007 — 6:52 pm

Leonard Wallace says:

…we hope to address the issue later this week. – Glen – 8/20.

Well, it’s September 9 and Redfin still is operating the ‘bait and switch’. Their website states the amount of savings in BOLD RED letters, but the true savings is a fraction on many listings. NO asterisk, NO fine print, just a false number (although they did lower it, it is still nearly 3 TIMES their actual savings.)

Here’s the latest on the same listing:

Price: $135,000

Redfin Savings: $1,050

1 of 1

1828 METZEROTT RD #304

HYATTSVILLE, MD 20783

Beds: 1 On Redfin: 230 days

Baths: 1 Year Built: 1964

SQ.FT.: 634 Lot Size: –

$/SQ.FT.: $213 MLS#: PG6292757

So now, instead of $2,700 it is $1,050. but it should be $375!

Whatever your feelings on the Redfin business model, there is no way to support the blantant misrepresentation that Redfin uses to get their phone to ring and their mailbox to fill. Redfin was put on notice, but they refuse to correct their mistakes.

Check it out for yourself! Click on the redfin website and enter PG6292757 as an MLS number. In this area, there are literally hundreds more with the same error.

September 9, 2007 — 2:31 pm