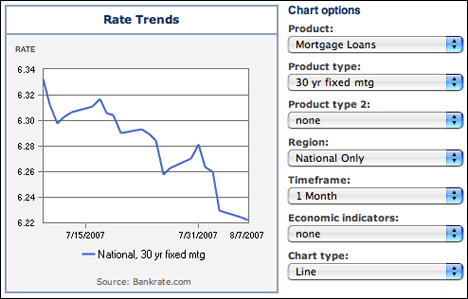

Source: Bankrate.com. The rain it raineth every day, but it’s not the same rain everywhere.

Technorati Tags: real estate, real estate marketing

There’s always something to howl about.

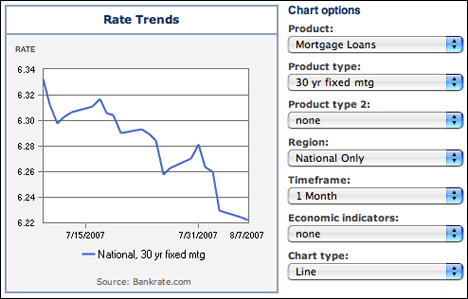

Source: Bankrate.com. The rain it raineth every day, but it’s not the same rain everywhere.

Technorati Tags: real estate, real estate marketing

Michael Cook says:

It is also important to note that jumbo loans are on the rise. An interesting divergent trends has currently been taking place. Good for those looking at conventional loans, not good for people trying to find a condo in NYC.

August 8, 2007 — 10:41 am

Dan Green says:

Not to poke a hole in the theory, but rates dropping 0.125% over the course of a month is not really a big deal. The graph only looks dramatic because the major ticks on the y-axis are 0.02% apart.

Here’s the same chart over three months.

And here it is again over a year.

August 8, 2007 — 12:03 pm

Greg Swann says:

Check. And here’s five years, and I wish I could do 15. Ants are always carrying their very last meal. We are victims of central banking, surely, because markets can’t self-correct quickly enough with a monopolized money supply, but it remains that the bread-and-butter mortgage product is going down in price at the same time that Chicken Little has a hit show on CNBC. The big picture is not good, but it’s much better than the ant’s-eye-view would seem to imply.

August 8, 2007 — 12:33 pm

Steve Berg says:

Silly Boys with your charts – Add to the mix that last Friday (Aug. 3) the Wall Street Journal reported that Wells Fargo is “charging 8% for a prime 30-yr. fixed rate loan that carried a 6 7/8% rate” the week before. A classic overeaction? Probably.

There also appears to be a disconnect between the 10-year Treasury and mortgage rates, at least for the moment as the 10-year has dropped from a recent high of 5.30% to 4.84%. That’s a pretty big swing in a relatively short timeframe that one would expect mortgage rates to follow. Except that’s not happening. I’m not the mortgage expert, but it seems to me that Wall Street, the guys who buy the mortgages, are (finally) perceiving risk and are not buying mortgages right now unless, of course, the risk is mitigated by, you guessed it – higher rates. Mortgage-backed securities have been temporarily banned from the dance. Of course, I could be wrong. After all, I’m just a silly real estate agent.

August 8, 2007 — 6:51 pm