In a charmingly romantic post this morning, Jonathan Dalton gets bogged down in the all-too-common idea that divorcing the Realtors’ commissions would impose some new financial burden upon buyers, resulting in their loss of representation.

This is false. Although we operate by the fiction that the seller pays the real estate commissions out of the proceeds of the sale, in fact, if the buyer’s lender is not willing to fund the transaction, no sale will occur and no one will get paid. It’s useful in the abstract to envision the transaction as being either all-cash or 100% financed. In both cases, all the money is brought to the closing table by the buyer or the buyer’s lender.

To effect the divorced commission in the overwhelming majority of transactions, all that is necessary is for lenders to change their underwriting guidelines, making corresponding changes in the way they illustrate the flow of funds on the HUD-1 settlement statement.

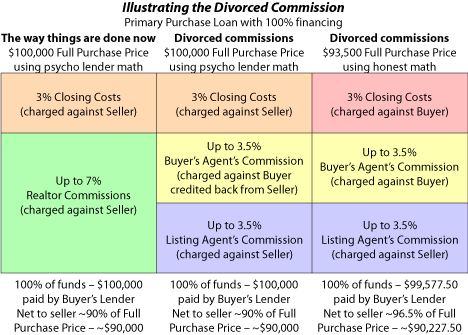

Right now, many lenders will allow up to 7% in sales commissions, to be charged against the seller’s side of the HUD-1, with up to 3% in closing costs, also charged against the seller’s side of the HUD-1.

If lenders changed their guidelines, such that no more than 3.5% could be charged against the seller for the compensation of the listing agent, with no more than 3.5% charged against the buyer for the compensation of the buyer’s agent, the commissions would be divorced.

So far, this is nothing more than a change in underwriting guidelines and HUD-1 accounting. Absolutely nothing has changed away from the paper-shuffling lender universe. The costs to the buyer and the proceeds to the seller are exactly the same.

Not to rock too many boats at once, but it would also be possible for lenders to make their internal procedures and the HUD-1 bookkeeping more honest, putting a little extra money in the pockets of both buyer and seller.

In the chart shown below, the first column illustrates the current procedure. The middle column shows how commissions can be divorced while retaining the psychotic style of accounting lenders currently deploy. The third column demonstrates how commissions can be divorced using accounting that is consonant with what is really going on.

Two points to take away:

First, divorcing the commissions will impose no new financial burdens on buyers. To the contrary, taking control of their agent’s compensation should empower them to pay less and/or get more overall value from their representation.

Second, in reality, divorcing the commissions can be effected simply and instantly, by the voluntary and unilateral action of mortgage loan underwriters. If they choose to insist on either column two or column three, as shown above, column one will be gone overnight.

< ?PHP include ("https://www.bloodhoundrealty.com/BloodhoundBlog/DCFile.php"); ?>

Technorati Tags: compensation for buyer representation, real estate, real estate marketing

Jim Kimmons says:

Gregg:

In rolling out a consulting model in my small Taos, NM brokerage, it’s been interesting trying to structure pricing packages for the buyer side. The seller side is relatively simple.

Buyers, however, are resistant to changes when the consulting model requires some pay-as-you-go method. If we could do as you suggest, it would make it a little easier to float the consulting model boat. As long as they never see an entry on the HUD-1 that shows a cost to them, they’re happy with the status quo.

And this is in spite of the large credit they can receive when the hourly consulting model is employed and the remainder of the offered co-op commission is credited to them at closing.

I would be happy if I could work only on an hourly basis, nothing free, even showings, and get an average of more than $100/hour for my time from the first showing through closing. This is paid in weekly billings, with no refunds if the deal blows up over inspections, etc. But try getting the attention of a buyer with the current “it’s not costing me anything” commission model.

Keep talking up divorcing the commissions. It probably will never happen, but it is the “real world.”

July 15, 2007 — 11:31 am

Jim Kimmons says:

Greg:

I do know how to spell your name, just fat fingers on Sunday morning.

Jim

July 15, 2007 — 11:32 am

Bruce Hahn says:

Divorcing commissions is an excellent idea, and it more accurately reflects reality. The growing popularity of real estate commission rebates is helping more and more buyers understand that they are the source of the money to pay for commissions and fund commission rebates. Because the money rebates provide to a cash-strapped buyer can be the difference between a deal and no deal, rebates are helping sellers and their brokers as well.

As a previous poster noted, it will take time, but major changes in the way real estate is bought and sold and the way home buyers and sellers think about the process are already in progress. Eventually this good idea will likely be embraced by HUD, lenders, and (dare I hope?) even old fashioned traditional real estate brokers.

July 15, 2007 — 6:08 pm