Should we say goodbye to the half-assed listing? Mike Price:

Today Buyside has announced an ABA, (affiliated business arrangement) whereby any homeowner can list a home in the MLS free of charge. It’s called IggysHouse.Com. Interesting branding, I couldn’t find anything on their site that explained the moniker. Could be they just got tired of searching for decent real estate domains, there aren’t too many left out there.

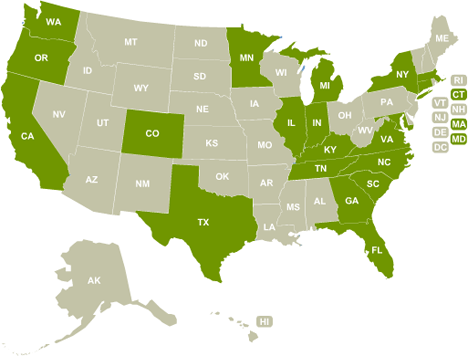

I went and looked for myself. Here is the Iggy coverage area:

Dark green states: Now. Light green states: Soon.

The site sells yard signs, lock boxes and forms, but not at huge premiums. I’m not going to fill out a listing to find out what happens, but my guess is that the end-user is doing every bit of the work for the MLS entry and the supplemental Do-It-Yourself web page with additional photos.

The Iggy people are promising listings on Realtor.com as well. As we have learned, Realtor.com listings do a lot better when they have virtual tours, so Mike might offer to make a video podcast at an extra cost, using PBS-style pan and scan video from the user-supplied photos.

Does this matter? In the age of the $99 listing, probably not so much. I truly don’t understand why there are any FSBOs left in the marketplace. If this doesn’t eat up the few holdouts, I’ll be amazed.

Interestingly, IggysHouse is evidently owned by BuySideRealty.com, which, apparently, hopes that, by giving away 100% of the listing commission it can cling to a whopping 25% of the buyer’s agent’s commission.

Are they daft?! No — they’re lenders. BuySideRealty is a lead-generation scheme that uses the real estate side of the transaction to rope in mortgage borrowers. And how much do lenders make? Just as much as they want to…

This is really quite a bit smarter than Redfin.com. They exploit the de facto “commons” in the traditional commission split, taking the buyer’s agent’s fee without doing the buyer’s agent’s job. BuySide is operating real estate brokerages as a loss-leader, to generate mortgage business.

Of the two, BuySide’s is the business model more likely to make a profit, if only because it has the means to eat Redfin’s lunch along with everyone else’s. In this respect, Redfin has done us a further injustice: By sucking up all the sleazoid attention, it may be that even worse offenders have slipped in under the radar.

I would be interested to hear from the mortgage boys, here and elsewhere, about Yield Spread Premiums at BuySide. After all, they can’t be giving away the whole store…

Technorati Tags: blogging, disintermediation, real estate, real estate marketing

Todd Carpenter says:

This business plan is actually somewhat established at the local level. I know a mortgage broker who used to do the listing for free, refer the purchase to a buyers agent and did loans at the same competitive rates as anyone else. He marketed to FSBO’s and made an honest killing. It was a lot of extra work for him, but it paid off. He retired last summer, and can’t be more than 50.

I don’t know how much BuySide is making on it’s mortgages, but it doesn’t have to be out of the market. Believe me, there are enough shady real estate agents asking for kick backs to encourage many mortgage professionals to find a way to bypass the need to work with them. For many it’s worth the extra work.

March 22, 2007 — 10:29 pm

Brian Brady says:

I agree with Todd that its a lot of work but the model can work charging market rate terms for the mortgage.

I’ve tried this twice but have found that consumers are more interested in the value a full-time Realtor gives them.

There IS a market if we’ve learned anything from the Redfin model. It may not be huge but it may not have to be to make a killing.

March 23, 2007 — 8:36 am

JeffX says:

I generally agree w/ both Todd and Brian…especially if they’re geared for and producing high volume.

Its an interesting model and speaks to the fact of how much a mortgage company can make…usually without looking like it publically…you don’t run loss leaders if you don’t have a cash-cow rolling somewhere else…

More than likely they’re hiding YSP…making the whole experience look real ‘cheap’. They’re subject to some considerable risk if the mortgage model they run is forced to become more transparent.

Problem I see with them is that they’re circumventing industry professionals in a way that compromises service. Although I don’t care for the cliche’, you get what you pay for, I do beleive it’s very likely to apply here…

…not to mention that their typical client is probably paying alot more than that client perceives…

March 25, 2007 — 11:58 am

Andrew Reichek says:

The internet is so easy to use. And with the ability to upload videos, picture, and floor plans users can access pretty much anything. However, a full service realtor can provide expertise throughout the entire process. There is probably a market for both the internet savy individual and the full service realtor. In the end though; a buyer wants advice; and a full service realtor will always be available to assist the consumer.

July 21, 2008 — 8:51 pm

Robert says:

Even if you have to post your own photos,descriptions, and videos tours it is not that difficult. Its very easy to do these days. Its just a few clicks and computer users today are much more savy than they were 5 or 10 years ago.

September 20, 2008 — 9:25 am