Sunday, February 26, 2006

An open letter to the Citizens of Phoenix: Why I oppose the bonds

This little datum actually tells you all you need to know about the bond campaign: In large measure, it is welfare for the rich.

I'm not playing a class-envy card. I despise welfare in all its forms. I can sympathize with the plight of the poor, and I can even volunteer my time and my money to help them. But I think it is vile to use force to steal wealth from honest, innocent producers in order to confer it upon people who have not earned it. But if this is vicious and wrong when done for benefit of the poor, how much worse is it when the recipients are among the wealthiest of the city's residents?

The actual purpose of the bond issue - and of the Trolley and of the recidivist reconstruction of the Civic Center and of all the other so-called 'investments' downtown - is to provide free upscale amenities for the use and enjoyment of rich Phoenicians and their out-of-town visitors. There are miserly little bribes to other constituencies beneath the vast Christmas tree of bond programs, but the overwhelming amount of money will be spent to amuse and enrich people who are already laughing all the way to the bank.

Almost a year ago, I wrote about how these corrupt 'investments' are carefully target-marketed to the most corruptible kind of investors. And this is the first and biggest benefit to the rich of the bond issues: The bonds themselves. They will be underwritten by a politically-connected investment firm, and they will be purchased by politically-wired investors. Even though the city's property tax receipts will surge this year, making it possible to pay for any improvements that are actually needed out of the general budget, we will still issue bonds, paying massive amounts of interest over the years to people who are already very, very wealthy.

But Christmas will come twice for prosperous Phoenicians. Take a drive by the Herberger Theater some night. It's a colossal failure as a theatre, but it's an excellent place for rich matrons to show off their thousand-dollar gowns. When you look at your property tax bill - which is probably up 25% or more - take solace that you'll be subsidizing the Herberger to the tune of $16.7 million - plus tens of millions more in interest.

There's money for the Arizona Opera, another outrageous failure, and for the zoo and the art museum and for Phoenix Theatre - because you can't have too many under-attended taxpayer-subsidized theater companies.

Add to this all the money to be blown building downtown campuses for Arizona State University and the University of Arizona. These are completely redundant facilities, of course. What's worse, the state's universities are actually the responsibility of the state government - which is running a billion-dollar surplus. But why should the state pay when the city of Phoenix is willing to milk its own taxpayers in the state's behalf?

But why should the taxpayers of Phoenix strap themselves with $878.5 million in debt, plus as much as $2 billion more in interest over the years, to build these campuses? For the same reason the taxpayers were saddled with the costs of every other 'investment' downtown: In order to provide free upscale amenities for the rich.

It gets better, though: The city hopes that, this time, it will achieve critical mass downtown. It is hoped that by coercing thousands of students to live in downtown Phoenix - won't their parents love that? - the central core of the city will finally come to life, an ungainly, undead Frankenstein stuffed full of tax dollars.

Incidentally, this is why the Trolley runs to ASU. The greatest concentrations of adult bus passengers in the city are in Sunnyslope and South Phoenix. A transit system designed to move the greatest number of passengers would run straight down Central Avenue from Dunlap Road to Baseline Road. But we can't have that. For one thing, that would run the Trolley right past all those gorgeous multi-million-dollar homes, each one sporting a "Support the Bonds" sign. For another, by forcing ASU students to come downtown, then sending them back to Tempe at least once a day for their core-curriculum classes, the Trolley will seem to be working, even though, by Valley Metro's own estimates, it will be yet another colossal failure, with the taxpayers paying huge subsidies for each rider - and even bigger subsidies for each ASU student on the train. But those students will be young, attractive and nice-smelling, which will be very pleasing to all the wealthy residents and their guests, who may ride the Trolley on a lark, but who will never use it for day-to-day transportation.

Incidentally yet again, the Trolley and everything that goes with it are buttressed by a Transit-Oriented Development zoning overlay. Small business-people all along the route of the Trolley are slowly discovering that one of the purposes of Trolley construction is to kill their businesses. As profitable as those businesses might have been, and as popular with their clients, they are not pretty enough to appeal to the sensibilities of Yuppies, the Bohemian Bourgeoisie and the avidly-courted Creative Class. The Trolley's construction will bankrupt the small firms that had done business along its route, and the Transit-Oriented Development zoning overlay will forbid anything similar from replacing them. This is in essence a hidden tax enacted by these so-called 'investments', the deliberate destruction of profit-making businesses - along with an epidemic confiscation of taxable commercial real estate.

And incidentally one more time, downtown Phoenix will never work. It will always be a colossal failure, soaking up tax dollars to subsidize the existing 'investments' and to fund ever-newer boondoggles, each one of which will be promoted as the final answer to all the problems downtown, each one of which will fail in its turn, soaking up tax subsidies forever. The downtowns of the cities we think of as having a downtown - cities like New York or San Francisco, London or Rome - the central cores of those cities developed when transportation was very costly. A city like Phoenix, which developed when transportation was cheap and progressively cheaper, can never have that kind of throbbing, vibrant, population-packed downtown. Never. No matter how much money we throw away on the Trolley or the Civic Center or the chimerical bio-medical bonanza.

Here are some secrets you will never see reported anywhere: Every city in America with a chip on its shoulder is building that paragon of 19th century technology, a Trolley system. Every city with something to prove is building and rebuilding and rebuilding a vast, empty convention center. Every city with an inferiority complex plans to buy its way to greatness by throwing billions of dollars in corporate welfare at the biotech industry - since, as we all know, the most consistently successful venture capitalists are politicians and newspaper columnists. Phoenix is not innovative in any way, not even in its choices of doomed downtown 'investments'.

A self-selected minority of people may long for life in a make-believe-Manhattan, but, in reality, there will never be a dense-enough concentration of them to yield even a chintz-Cincinnati. The closest thing there is in Phoenix to an actual downtown - a walkable concentration of high-commerce, retail and residential skyscrapers - is the area around the Biltmore Fashion Square. The city is doing what it can to destroy this, to protect its futile vision downtown. But even more urban than the Biltmore is downtown Tempe, a pretend-Paris the Phoenix City Council is having a harder time trying to vanquish - although it is trying.

And there's more. All of this, the giveaways to the very wealthy, the redundant college campuses, the destruction of existing businesses, the war on non-taxpayer-subsidized vertical development in other locations - even the improvements to the sewers and fire stations, the true business of city government - all of it will entail the letting of thousands of lucrative contracts to politically-favored developers, vendors, attorneys, consultants - an endless soup-line of mendicants in $900 suits. Where do those folks live? Amazingly enough, they live in the same neighborhoods where you see all the little "Support the Bonds" signs. The neighborhoods where the Trolley will never run. The neighborhoods where the bus-stops - if any - have no overhead shelters.

Bond supporters are ready with talking points for every objection an opponent might raise. No tax increase, 700 participants, the sacred deity that is public education, blah, blah, blah. None of that matters. Every proper function of city government can be more than adequately funded from the impending property tax windfall. The city has no business building colleges or subsidizing the diversions of millionaires. Of course, if the bonds fail, this will be offered as the reason why downtown failed. Take heart: Downtown will fail anyway, and the downtown boondogglers will never admit it. Why should they? It's making them rich.

"Cui bono?," the Roman poet Juvenal asks? Who benefits? As Thoreau reminds us: "That government is best which governs least." The absolute best thing the City Council can do for you and for the city is to get out of your way - and out of your wallet. But who will benefit from this billion-dollar bond boondoggle? If you have to look at your bank balance before you write a check, it isn't you.

I voted by mail, so I've already voted "No" on all seven bond proposals. I encourage you to do the same.

posted by Greg Swann | 10:20 AM | 0 comments | links

Saturday, February 25, 2006

One year of experience eleven times...?

Bad news for the many homeowners trying to sell: It's likely only going to get tougher.The source for this is probably an article by Betty Beard, who is actually a responsible journalist. Witness:

The number of home listings in metro Phoenix is at an all-time high. In January, there were 30,113 houses for sale across the Valley. A year ago, there were 3,402.

The last time the Southeast Valley had listings in the 10,000 range was in late 2002 and early 2003, according to the Arizona Regional Multiple Listing Service Inc.You see, like seemingly no one else at the Republic, Betty Beard is aware that there were years prior to the completely anomalous 2005. Here's more from Ms. Beard:

Robert Rucker, the multiple listing service's chief executive officer, said he couldn't determine that 11,512 is a record because the records are not set up easily to compute that.It may be that Ms. Reagor has a source for her claim that the current inventory is a record, but she doesn't say who it might be. In any case, since a normal inventory prior to the completely anomalous 2005 was around 25,000 homes, and since we've built tens of thousands of new homes since then, it would be very difficult to say what is by now a normal market. The NAR's standard for normal, a six-month absorption rate, is substantially longer than what we're seeing locally.

More from Ms. Reagor:

Some sellers still don't realize the housing market has deflated from last year's peak. Not only are the bidding wars gone but so, too, are many of the buyers. Most of the speculators who sparked multiple offers on homes early last year are long gone, and there aren't as many regular buyers because fewer can afford today's higher home prices. The typical house costs 50 percent more, and the typical income climbed less than 5 percent in the past year.In January 2004, 5,103 MLS-listed properties sold in an average of 67 days on market at 97.7% of the list price, on average. In January 2006, 5,252 properties sold in an average of 50 days on market at 97.7% of the list price, on average. The paragraph is mostly editorializing, but the claims about the market are easily demonstrated to be false to fact.

Want a reality check? Go to zillow.com, a new Web site with a program that calculates a home's value for free. It values several Valley homes for tens of thousands less than the price listed on them.If you want to know what your house is worth, do not go to a zillow.com, which delivers completely useless estimates of value for free. Even Net Value Central, a tool used by professionals, lags the market by a month or more. The only way to price a house is to work as rigorously as possible from current and recently-sold listings for extremely similar properties. If you price your house to sell from sources like zillow.com, you will give thousands of dollars away. If you rely on zillow.com to tell you how much to offer on a home, you will see it sold to someone else.

(You can prove all this to your own satisfaction, if you like. Most of Ms. Reagor's mistakes seem to come from falling in love with ideas she doesn't check out. Here she tells us that she ran zillow.com on live listings and found it came in much lower than the listed prices. How did it do against sold listings? She didn't check, but you can. Run zillow.com on the sold homes documented in your local section of the Republic. You'll see that, time after time, zillow.com is substantially under real-life market results. It's a useless toy, which Ms. Reagor might have discovered on her own had she bothered to test it properly.)

It gets better, believe it or not:

Any Valley homeowner with a good crystal ball would have sold last summer and rented until now to be able to take advantage of all the deals out there.It's no kindness to lie to a fool: This is stupid. The average suburban home that you might have sold for $252,000 last July would have cost you more than $263,000 in January, not counting transaction and closing costs and the costs of renting a home and moving twice. The home prices are all rigorously documented, and I've pointed Ms. Reagor to the source data more than once.

I didn't, but I wish I had.It's because she's bad at arithmetic.

Who would have guessed home prices would climb 50 percent in a year?I did. I actually predicted higher and longer, but events haven't borne me out so far.

And who knows where they are headed?In the long run, up. It's not a lead-pipe cinch, but it's a great bet for the Phoenix market. We are an excellent fit for many, many monied demographic segments.

Analyst forecasts run the gamut from prices dipping 10 percent this year to climbing 10 percent.I have not heard a single prediction about values dropping for the year. If Ms. Reagor has a source for this claim, she should name it.

Everything Catherine Reagor said in the matter I quoted is dumb. In the next segment of her column, she wonders why homeowners aren't facing foreclosure. Seemingly, the question "Who would have guessed home prices would climb 50 percent in a year?" doesn't connect in her mind to the idea that even the most financially-troubled of homeowners is sitting on a ton of equity. Because the Republic has become such a cesspit of corruption, it's hard to distinguish stupidity from calculation. With a writer as oily as Jon Talton, the malice is palpable and you know the man is lying in pursuit of propaganda goals. But I don't like to think the worst of people where a more innocent explanation will suffice. In email to me, Ms. Reagor has bragged that she has eleven years' experience "covering real estate in metro [P]hoenix". I'm thinking maybe she's had one year of experience eleven times.

posted by Greg Swann | 11:30 PM | 0 comments | links

Monday, February 20, 2006

posted by Greg Swann | 4:30 PM | 0 comments | links

An open letter to Catherine Reagor and Glen Creno of the Arizona Republic

Second, I would dearly love it if both of you would bring some perspective to your writing. For example, from Catherine's new column:

What this year holds is the multibillion-dollar question. A 10 percent drop in home building or sales would cost the Valley's economy at least $1 billion.There are two important caveats missing from this conjecture. First, we are more likely to gain 10% in value this year than to lose it. Las Vegas had a 50% upswing in 2004, very much like our year last year. Their appreciation in 2005? An incredible 19.2%, four times their normal appreciation.

I doubt Phoenix will do this well, especially since the year has started down, with a serious dearth of buyers. But Catherine's worst-case scenario seems even less likely. But even if we entertain it, what are the consequences?

If I bought a home for $300,000 in January of 2005 (which I actually did do), and if that home is worth $450,000 in January of 2006, and if the market now suffers a "ten percent drop," what happens? My home would then be worth $405,000, $105,000 more than I paid for it. I put 5% down, so my cash-on-cash return after what Catherine seems to regard as a financial cataclysm would be--how much? Jeepers, it's only 700%. A ten percent drop in values would not be good, but after the surge we've had over the last 18 months, it would hardly be tragic, and most people would still be far head of where they were before this boom began.

The "would cost the Valley's economy" argument is also specious except as a bookkeeping analysis. A homeowner's equity isn't actually gained or lost until it is liquidated. If values drop by 10% this year and gain 6% a year for the next three years, none of it matters until the homeowner either sells or refinances. A drop in values might matter to builders' shareholders, and it would matter to homeowners if their notes were to be called by their lenders, but otherwise it's all academic. Without doubt, someone will claim that because his home lost 10% of its value, he now eats oatmeal for every meal, but this will not be true--not the whole truth in any case. A paper loss against paper profits will have few if any measurable real-world consequences, sob stories notwithstanding.

In the same respect, Glen, I've chided you for reacting to the market like Austin Powers with The Mole. Both of you are persistently guilty of this, and I think you are being less than forthcoming in not putting your reports into perspective. Yes, 2006 isn't starting like 2005 did. But if we acknowledge that 2005 was an anomaly--which is what makes the stories newsworthy--then what is actually important is that 2006 seems to be off to a better start than 2004.

Omitting this essential fact is either tendentious or puerile, I can't decide which.

I really can't decide which. The Republic has become such a translucent propaganda organ, it is by now hard to tell when the paper is actively campaigning for some covert purpose of its own, and when it is merely badly informed or poorly thought out.

Your Saturday article was actually funny, and not just because we caught another sighting of The Mole:

The number of existing homes for sale has shot up from a year ago. Home prices are flat or down slightly in most areas. And in January, used-home sales were half of what they were in August, a record month.Again, January 2006 was a much better month than January 2004. And we all can see the mole on The Mole.

As a side note, I'd love to hear how it could be that investors "snatched up three or four new homes at time a year ago" when they were forbidden to buy any new homes. The Republic printed the builders' propaganda line when they trotted it out, and I told you at the time that it was propaganda. I don't believe in proof by isolated anecdote, but can you name even one investor who successfully reserved an unbuilt home last year and has walked away from it now? As R.L. Brown points out to you, the return on investment would be huge--a $2,000 deposit turns into maybe ten or twenty times that in instant equity. Why would an investor leave that kind of money on the table?

But I'm more interested in this remark by the estimable Dr. Jay Butler:

Just look at all the ads.Indeed. Look at the ads, the other white meat in the newspaper.

An incentive is not a fire sale, it's an enticement to induce the buyer to do what he otherwise might not do. In many cases, the incentive is just icing on the cake, since the buyer was already committed. Are builder incentives working? Call and ask. But in fact, incentives are not news. I started hearing about them in September of 2005. This is also when builders resumed courting Realtors--and boosting commissions by double or triple what they had been paying.

Note, however, that investors are still excluded from most new home subdivisions, as least as a matter of stated policy. What this suggests is that the builders themselves do not regard the current market as being as soft as it was in 2004, when the investor policy was all-you-can-eat. In other words, the no-investors rule argues that builders believe they can sell all the inventory they intend to build as high-profit, highly-upgraded owner-occupied housing. They do not need to sell excess to-be-built inventory as low-profit, upgrade-free models to investors.

All of which brings me to my own little bit of news: I had a very busy weekend, which is good for me. But I saw more showing activity among other parties than I've seen so far this year. My joke last year was, if you lingered in a doorway you'd be trampled by the next party of buyers. Saturday was the first day this year when I have seen anything like that. Quite a few Realtors' business cards in newly-listed properties, too, which is also a good sign.

This is nothing more than the kind of isolated anecdote I hate to see reported as real estate news, but it is one data point of actual on-the-ground evidence. If next weekend is just as hot, it will be a strong sign that the drought of buyers is over.

And, all that by the way, I encourage you both to call upon me if you have questions about how real estate works in real life. Someone once told me that I am "rather glaring on the receiving end," which I thought was an exceptionally polite way of putting things, but it remains that I can give you a perspective on what is really going on, short- and long-term, that you are not getting anywhere else. At a minimum, if you let me do your math problems for you, I won't make fun of you for getting them wrong.

Very best,

Greg Swann

posted by Greg Swann | 6:10 AM | 0 comments | links

Wednesday, February 08, 2006

How to make headlines by ignoring the news...

An example:

The number of houses for sale in metro Phoenix has nearly tripled in the past year, based on December data from the Arizona Regional Multiple Listing Service.This is simply irresponsible. The inventory of available homes last year was abnormally low. There are about 30,000 active listings right now. Two years ago, I would have said that 25,000 listings is a normal market. We've built 120,000 new houses since then, plus we went through last year's boom. I don't know what a normal market is now, and I may not have a clear idea for months. But to say "tripled" without saying anything about "normal" is just sensationalism.

Creno offers some loose conjectural reasons why inventories are up, but he fails to cite the incessant scare-mongering of the Arizona Republic.

However, "Mortgage rates have nudged higher," he says, another reckless claim the media never tires of making. Every time you read something about rising mortgage rates, click on this link. I wish I had a chart for ten or twenty years instead of just five. Mortgage rates are amazingly low and mortgage lenders make their money by writing loans. They have an incentive to keep new-loan-origination activity high. Other factors influence rates--but not so much, as Alan Greenspan discovered in 13 failed tries to influence them--but it is not unreasonable to expect them to stay low and possibly go even lower. That nothwithstanding, if you saw a chart of mortgage rates over the last 35 years, you'd gape in horror. Even so, people continued to buy and sell houses even when rates were over 20%.

Dr. Jay Butler, who apparently keeps his head where he can best monitor his gut feelings, weighs in with this profound scientific observation: "If prices and rates move up, we're in deep trouble." Oh, my.

Here's the real truth, which Dr. Butler could have given Creno were he not so devoted to undefended off-the-cuff remarks:

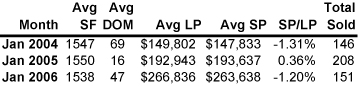

Those are the numbers for the last three Januaries from the BloodhoundRealty.com Market-Basket of Homes. January of 2005 was a banner month, to be sure. But compare January of 2006 to January of 2004. January of 2004 was worse by every measure: Fewer homes sold at a higher rate of discounting with 22 more days on market, on average.

Whether we are really back to normal is a question I'm not prepared to answer until March or April, but our current real estate market is better than it was at a time when the Republic was not running scary stories about how bad everything is.

This is the actual news.

posted by Greg Swann | 7:35 AM | 0 comments | links

Friday, February 03, 2006

Despite not even being among the 10 most populated areas in the country, metropolitan Phoenix led the nation in absolute job gains from December 2004 to December 2005.

The seasonally unadjusted figures from the federal Bureau of Labor Statistics confirm the Valley's status as a growth market not only for new residents but for new jobs as well.

The region added 83,200 jobs to its economy over the year, topping the Washington, D.C., metropolitan area's 81,600 jobs.

Somewhat remarkably, the Census Bureau reported last year that metropolitan Phoenix was only the 14th most populous metropolitan area in 2003, while metropolitan D.C. was the 7th-largest region.

That means the Phoenix region created more new jobs than even such metropolitan goliaths as Los Angeles, New York and Chicago.

"We've actually done incredibly well since the end of the last recession," said Tracy Clark, an economist at Arizona State University. "In percentage terms, we tend to be behind only Las Vegas, but they have a much smaller base."

posted by Greg Swann | 6:24 AM | 0 comments | links

Selling | Buying | Investing | Relocation | Current listings | About us

Find your ideal new home | Get a Market Analysis of your home

Search MLS listings | Make an appointment | Our offices

Tell your friends about us | Email Bloodhound | Home

![]()

![]()

![]()

|

Voted |

|

BloodhoundRealty.com, LLC | Designated Broker: Greg Swann

Webmaster: Greg Swann | © 2005 BloodhoundRealty.com